(Money Metals News Service) In this week’s Money Metals Midweek Memo, host Mike Maharrey tackled two major themes: the Federal Reserve’s latest policy pivot and his firsthand look inside the Money Metals Exchange headquarters and depository in Eagle, Idaho.

The episode highlighted the ongoing challenges of monetary policy, the bullish outlook for precious metals, and the robust systems in place at America’s leading sound money company – Money Metals.

Federal Reserve Cuts Rates Despite Inflation Pressures

The Federal Open Market Committee voted 11–1 last week to cut the federal funds rate by a quarter point, setting the target between 4 and 4.25 percent. This came even as the official statement admitted that “inflation has moved up and remains somewhat elevated.”

Chair Jerome Powell tried to calm markets by framing the move as “risk management” rather than a desperate rescue, but the Fed has clearly chosen to stimulate a weakening economy at the expense of price stability.

The lone dissenter, Trump appointee Steven Myron, actually wanted a larger half-point cut, underscoring how little appetite there was within the committee for holding the line.

The Fed’s dot plot projections showed two more cuts this year and only one in 2026, down from three projected just a few months ago. That shift was read as hawkish messaging, though the Fed’s record on forecasting interest rates is abysmal.

Analyst David Haye found they’ve only been right 37 percent of the time—worse than flipping a coin.

Inflationary Policy and the Money Supply

Mike Maharrey pointed out that rate cuts are inflationary by definition in a fractional reserve banking system. Expanding credit expands the money supply.

As of July 2024, M2 had risen by more than $600 billion from its mid-2023 low, climbing to $22.12 trillion and surpassing pandemic-era peaks. Inflationary pressure is baked in, even if official numbers understate it.

Using today’s CPI, the real interest rate hovers between 1.25 and 1.6 percent. If you apply the 1970s formula, real inflation looks closer to 6 or 7 percent, which means true real rates are barely above zero and sometimes negative.

Thomas Sowell’s old line that “there are no solutions, only trade-offs” sums up the Fed’s dilemma. Policymakers are trading off persistently high inflation for a chance to keep a fragile economy propped up.

Maharrey argued that stagflation—weak growth alongside stubborn price pressures—is no longer a theoretical risk but a present reality.

Precious Metals Rally

Loose monetary policy and negative real rates are ideal conditions for gold and silver. Both metals surged following the Fed’s decision. Gold nearly touched $3,800 an ounce this week, while silver climbed to around $45.

With inflationary policy locked in, Maharrey sees plenty of upside left, particularly for silver. The opportunity cost of holding non-yielding assets like precious metals has virtually disappeared, making them more attractive as safe-haven stores of wealth.

Inside Money Metals: A Field Trip to Idaho

Maharrey also offered listeners a behind-the-scenes look at Money Metals Exchange headquarters and its depository in Eagle, Idaho.

For him, it was a first chance to meet coworkers in person after more than a year of remote work.

What stood out most was the caliber of the team. Employees were engaged, enthusiastic, and genuinely interested in helping customers preserve wealth. Precious metals specialists demonstrated deep knowledge and a willingness to guide newcomers through the complexities of gold and silver investing.

The depository itself left a strong impression. Metals are handled with multiple layers of redundancy, strict auditing, and segregation.

Every customer’s holdings are boxed, tracked, and never mixed with others.

The security is formidable, from advanced technology to a staff of well-armed employees—Idaho being a Second Amendment-friendly state. Maharrey joked that trying to rob the facility would be a fool’s errand.

At one point, he found himself standing beside a pallet of seventy-pound silver bars worth over a million dollars, a vivid reminder of the scale of operations.

Storing metals at home provides physical possession and eliminates counterparty risk, but it also comes with the obvious vulnerability of theft. Using a professional depository, such as the Money Metals Depository, introduces some fees and an element of counterparty risk, yet provides unmatched security.

As Sowell might say, the choice is all about trade-offs.

Maharrey came away convinced that Money Metals’ systems and safeguards put it well above the industry’s many questionable operators.

Special Tribute Product: Charlie Kirk Silver Round

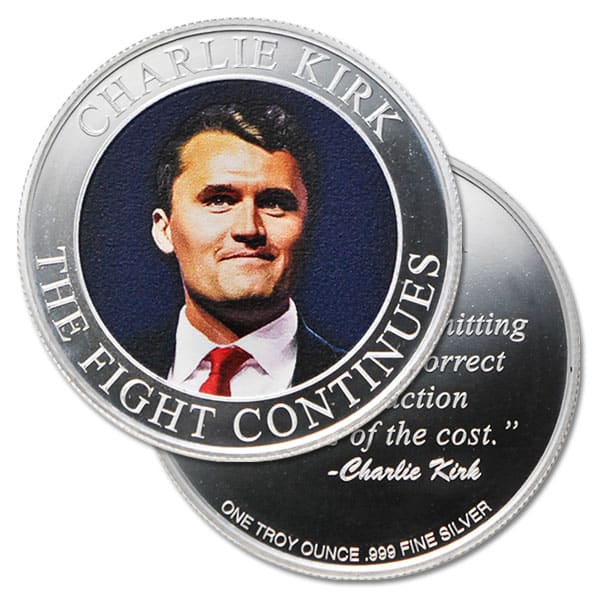

The episode also highlighted a new offering from Money Metals: a colorized one-ounce silver round honoring Charlie Kirk.

The round features a colorized portrait on one side and the Turning Point USA logo with one of Kirk’s quotes on the other: “Courage is committing yourself to the correct course of action regardless of the cost.”

Proceeds go directly to Turning Point USA!

Maharrey praised the silver round as a beautiful way to honor Kirk while supporting an organization he built.

Conclusion

The Midweek Memo closed with a reminder that the Fed has once again chosen inflation over restraint, a decision that continues to strengthen the case for owning gold and silver.

Maharrey left Idaho impressed with Money Metals’ operations and more convinced than ever of the importance of sound money in an age of easy money policies.

For investors willing to weigh their own trade-offs, the lesson was clear: precious metals remain one of the few assets positioned to endure whatever the Fed chooses to unleash next.