(Mike Maharrey, Money Metals News Service) The Federal Reserve cranked up the inflation machine, despite acknowledging “inflation has moved up and remains somewhat elevated.”

The FOMC voted 11-1 to cut the federal funds rate by a quarter percent, setting the interest rate between 4 and 4.25 percent.

The committee projected two more cuts before the end of the year.

In the official FOMC statement, the committee expressed concern about the softening economy, noting that “economic activity moderated in the first half of the year,” and that “job gains have slowed.”

However, Federal Reserve Chairman Jerome Powell characterized the rate cut as a move to mitigate risk, not to rescue the economy.

“You can think of this, in a way, as a risk management cut,” Powell said during his post-meeting conference.

Many market observers took this as a more hawkish sign, assuming the cutting program will be limited.

Although he didn’t use the word, Powell described a stagflationary setup.

“While the unemployment rate remains low, it has edged up, job gains have slowed, and downside risks to employment have risen at the same time, inflation has risen recently and remains somewhat elevated.”

The only no vote was recent President Trump appointee Governor Stephen Miran, who advocated for a half-point cut.

Powell said there wasn’t widespread support for a bigger 50-basis point cut.

“I think we’ve done very large rate hikes and very large rate cuts in the last five years, and we tend to do those at a time when you feel that policy is out of place and needs to move quickly to a new place. That’s not at all what I feel certainly now, I feel like our policy has been doing the right thing so far this year.”

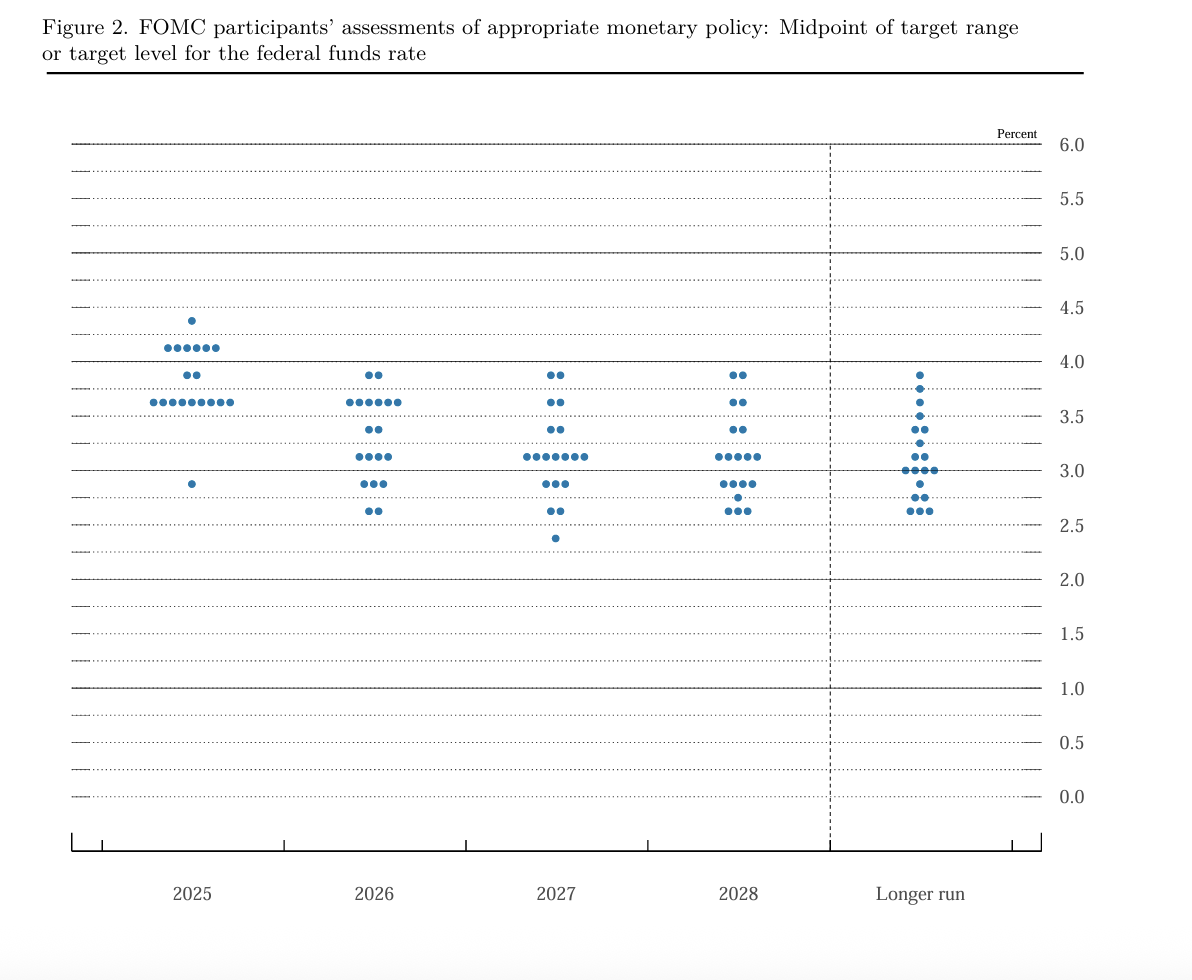

The Dot Plots

The FOMC released its dot plot, indicating two more rate cuts this year. However, the committee now only anticipates one cut in 2026. At the June meeting, the members projected three cuts next year.

There was significant divergence in the forecast. Two members projected as many as four cuts in 2026.

While analysts tend to get all excited about these dot-plot forecasts, they are virtually meaningless.

Fed members are notoriously bad at projecting the trajectory of interest rates, even though they’re the ones literally setting the rates.

How bad is their track record?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

The FOMC would probably get much better results by flipping coins or throwing darts at the wall.

Cranking Up the Inflation Machine

While the rate cut may provide some relief for an economy buried in debt, it will also ramp up inflation.

The cut will incentivize more borrowing. The downside is that in a fractional reserve banking system, an increase in lending grows the money supply.

Powell said the rate cut put monetary policy in “a more neutral” position. After the June meeting, the characterized police as “moderately restrictive.” In fact, policy is historically loose and wasn’t even tight at the height of the tightening cycle.

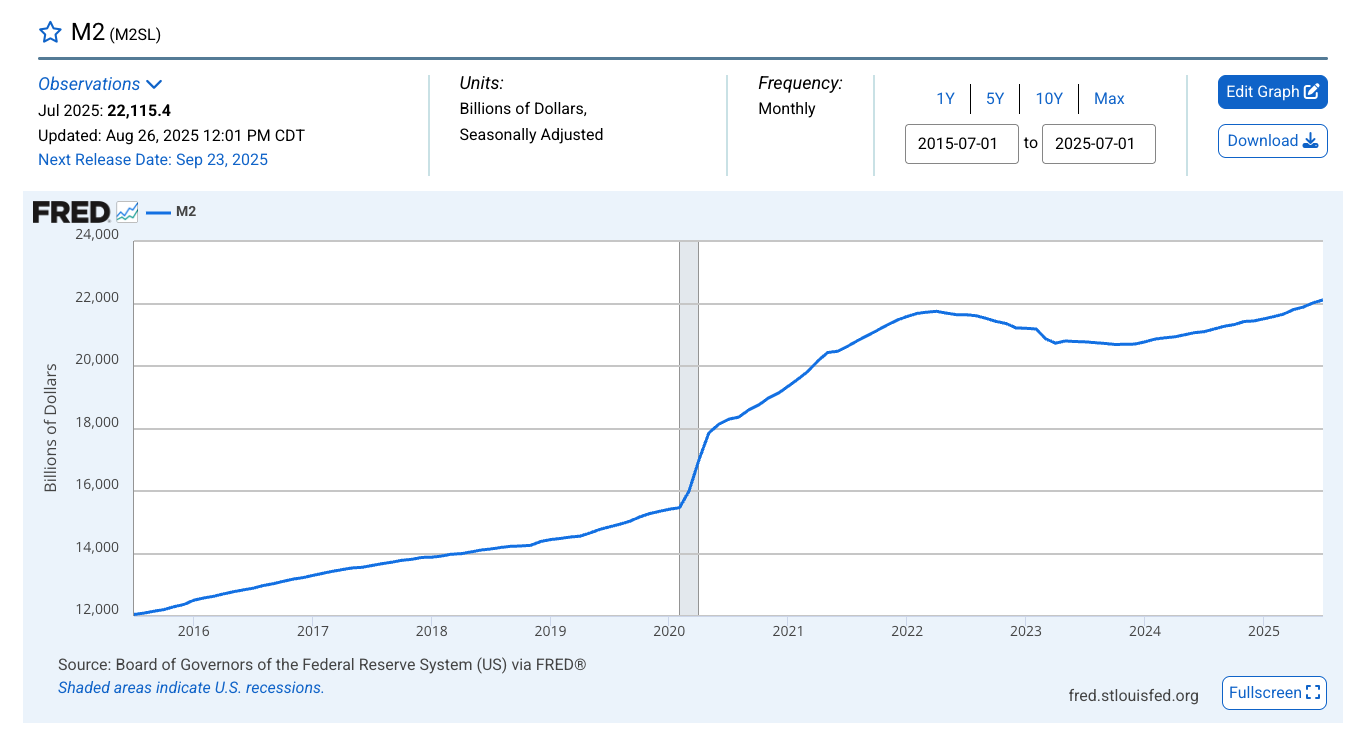

After contracting during the hiking cycle, the money supply has been expanding for well over a year.

This is, by definition, inflation.

As of the end of July, the money supply had expanded by more than $600 billion since its low point in mid-2023.

As of July, the M2 money supply stood at $22.12 trillion and is above the peak reached during the pandemic.

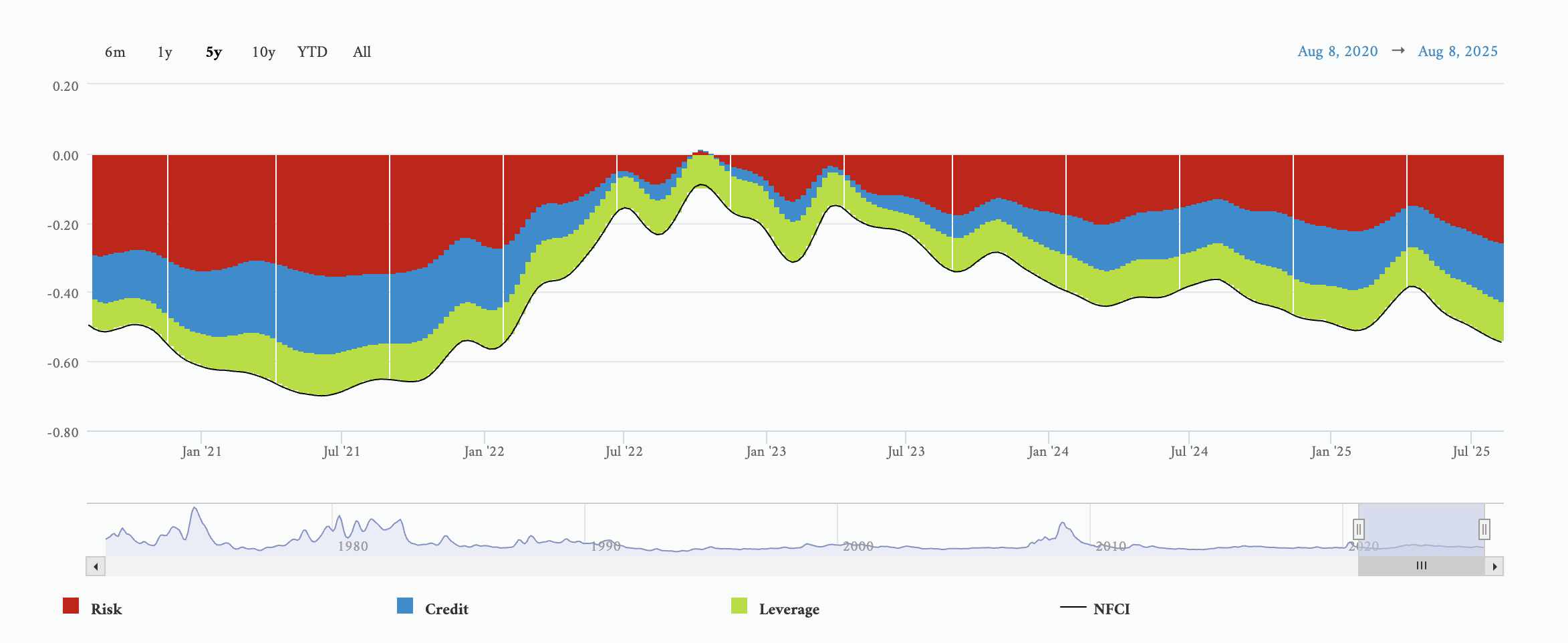

The Chicago Fed’s own metric indicates that monetary policy remains historically loose. As of the week ending September 12, the National Financial Conditions Index (NFCI) stood at -0.56. A negative number reflects historically loose financial conditions. The NFCI remained negative even as the Fed was raising rates in 2023.

Looking at the historical data also reveals that the current interest rate level isn’t high at all.

So, why cut rates? Especially given the CPI data, which indicates inflation is alive and well.

The economy is showing cracks, and Powell acknowledged that he didn’t want to see any further deterioration in the job market.

“The labor market is softening, and we don’t need it to soften anymore (and) don’t want it to.”

This underscores the Catch-22 facing the Fed.

Price inflation is clearly alive and well based on the CPI, and monetary inflation is expanding. This would indicate the need to hold rates higher for longer.

However, the debt-riddled bubble economy is addicted to easy money. It simply can’t function in a tighter monetary policy environment.

In other words, the Fed needs to cut rates and hold them higher at the same time.

It appears the central bankers have chosen to try to keep the air in the bubble economy at the risk of unleashing more inflation.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.