(Mike Maharrey, Money Metals News Service) Despite the significant increase in tariff revenue, the U.S. continues to run massive budget deficits. The budget shortfall for fiscal 2025 has already exceeded last year’s deficit.

So much for import duties paying for the government.

That’s because Uncle Sam doesn’t have a revenue problem. He has a spending problem.

The Trump administration ran a $344.79 billion budget deficit in August. That was about $35 billion lower than last August. However, it was still the second-highest budget deficit charted this year.

The August deficit pushed the fiscal 2025 shortfall to $1.97 trillion with one month left. In fiscal 2024, the federal deficit was $1.82 trillion.

The U.S. pulled in $29.5 billion in customs duties in August, a staggering 321.4 percent increase. That pushed August receipts to $344.32 billion, a 12.3 percent increase year-over-year.

Through the first 11 months of fiscal 2025, the U.S. government brought in $165.2 billion in customs duties. That’s up $95.5 billion from the same period in fiscal ’24.

In total, the federal government has collected $4.69 trillion so far in fiscal 2025. That’s 6.8 percent higher than through the same period last year.

That’s a healthy revenue increase for any organization.

Unless that organization spends without restraint.

That’s exactly what the federal government does, and spending is going up even faster than revenue.

A lot faster!

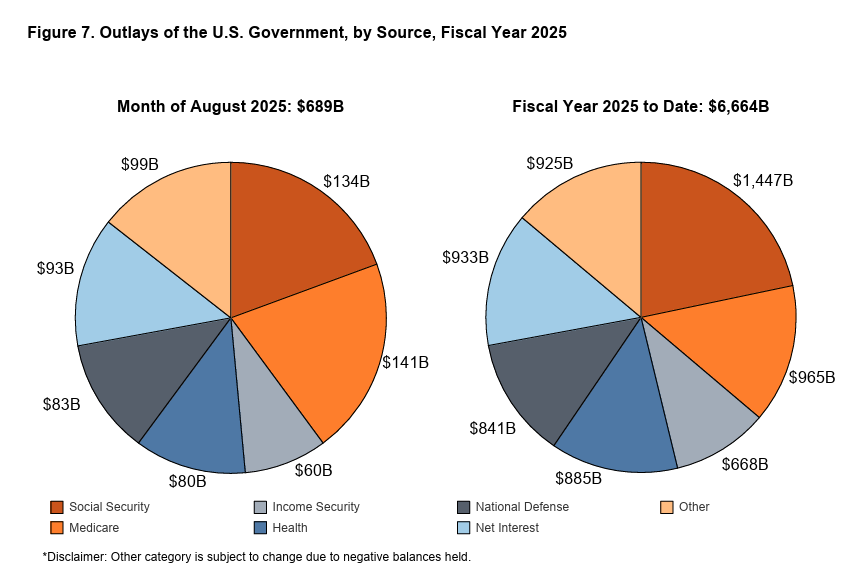

The Trump administration blew through $689.1 billion last month alone. That was 2.5 percent higher than August 2024.

With one month left, the federal government has spent $6.73 trillion, a 5.9 percent increase over the same period in fiscal ’24. The Trump administration has already spent more this fiscal year than it did last.

There is no indication that spending will slow down any time soon. The Big Beautiful Bill “cut” some spending but increased it in other areas. Furthermore, those “cuts” were from projected spending increases. Actual spending will still go up, just not as fast as originally planned. The bottom line is that even with the Big Beautiful Bill, spending will increase on an absolute basis.

This is par for the course.

You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

Supporters of the Big Beautiful Bill expect economic growth stimulated by tax cuts to boost revenue and narrow the deficit. However, history casts significant doubt on this claim.

The ugly truth is the government isn’t committed to cutting spending in any meaningful way, and it always finds new reasons to spend even more, whether for “crises” at home or wars overseas.

The Cost of Debt

The federal government is being increasingly burdened by its skyrocketing interest expense. This is one of the reasons President Trump and others in the administration are pressuring the Federal Reserve to slash interest rates.

Interest on the national debt cost $111.47 billion in July. That brought the total interest expense for the fiscal year to $1.12 trillion, up 6.7 percent over the same period in 2024.

Net interest (interest expense – interest receipts) stands at $933 billion through the first 11 months of this fiscal year.

So far, in fiscal 2025, the federal government has spent more on interest on the debt than it has on national defense ($841 billion) or Medicare ($965 billion). The only higher spending category is Social Security ($1.45 trillion).

Uncle Sam paid $1.13 trillion in interest expenses in fiscal 2024. It was the first time interest expense had ever eclipsed $1 trillion.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and must be replaced by bonds yielding much higher rates. And even after the Federal Reserve cut rates, Treasury yields have pushed upward as demand for U.S. debt sags.

The Bottom Line

The U.S. government has a spending problem it won’t address. No matter what the politicians in D.C. claim, there is no way to fix the budget problem by shoveling more money into the hole with tariffs, much less replacing the IRS.

The rest of the world is paying attention.

We’ve been watching Treasury yields inch upward for months. Even during times of geopolitical uncertainty, we’ve seen Treasuries sell off. In the past, U.S. notes and bonds were a safe haven go-to. No more.

This indicates sagging demand for U.S. debt.

That’s a big problem for a country that depends on the world to prop up its borrowing and spending habits.

We were warned.

The Bipartisan Policy Center warned that the growing national debt and the mounting fiscal irresponsibility are eroding the foundation of the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

Biden ran the debt higher at a dizzying pace, but to be fair, this isn’t just a Biden problem. Every president since Calvin Coolidge has left the U.S. with a bigger national debt than when he took office.

It’s going to take more than DOGE rooting out waste to get the borrowing and spending under control. Even if the Trump administration manages to slash discretionary outlays as promised, that only accounts for 27 percent of total spending. The vast majority is for entitlements, and there is little political will to take the scissors to Social Security or Medicare.

And the sad fact is that, given the political incentives, people in power will always kick the debt can down the road. It is a long-term problem that will require painful measures to fix. Politicians don’t want to create pain. That’s a quick path out of office. So, they will punt the debt problem and spend more to make constituents happy.

This is all well and good, but the problem with playing kick the can down the road is that you eventually run out of road.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.