(Jesse Colombo, Money Metals News Service) JPMorgan and Goldman Sachs’s $4,000 price targets are not only realistic but could even be achieved sooner than they expect.

Despite gold’s strong price gains over the past fifteen months, Goldman Sachs on Monday reaffirmed its forecast for gold to reach $3,700 per ounce by the end of 2025 and $4,000 by mid-2026. If they’re correct—and I believe this projection is quite realistic—that would represent additional gains of approximately 11% and 20% from the current price of $3,331.

This is especially impressive given that gold has historically been a relatively low-volatility, slow-moving asset compared to stocks, cryptocurrencies, and other commodities.

Goldman’s main bullish case for gold centers on continued strong central bank and institutional buying. Between January and May 2025, central banks and institutions purchased an average of 77 tonnes of gold per month — just slightly below Goldman’s earlier projection of 80 tonnes per month by mid-2026 in the London OTC market. In May alone, total purchases reached 31 tonnes (excluding the U.S.), with China standing out as the most prominent buyer, adding 15 tonnes. Additionally, Goldman notes that fund net positions in gold have eased from their April highs, creating more room for sustained buying from ETFs and central banks going forward.

JPMorgan agrees with Goldman and last week predicted that gold will average $3,675 an ounce in the fourth quarter of this year, rising to $4,000 in the third quarter of 2026.

Previously, the firm didn’t expect gold to reach $4,000 at all next year. Natasha Kaneva, head of global commodities strategy at JPMorgan, explained that the risk of a recession and global trade tensions make the $4,000 target even more achievable. “We remain deeply convinced of a continued structural bull case for gold and raise our price targets accordingly,” Kaneva said.

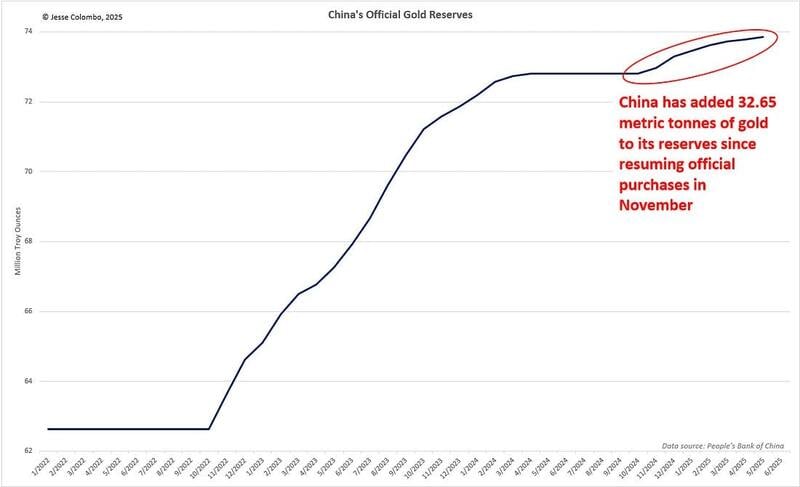

As I have written before, China has been one of the most prominent buyers of gold in recent years, adding 32.65 metric tonnes to its official reserves since November. In reality, China is likely purchasing even more gold than it officially reports, using various discreet channels.

The fact that it has been openly reporting increased purchases is likely intended to signal to its citizens and institutions to continue steadily accumulating gold — a sharp contrast to the West, which remains largely indifferent to gold despite its strong gains since early 2024.

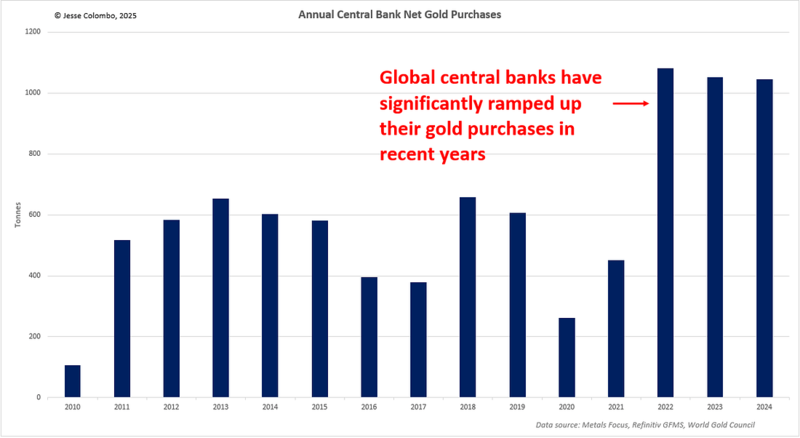

Since the pandemic and the ensuing surge in global debt, money supply, and inflation, central banks around the world have significantly ramped up their gold purchases, averaging just over 1,000 tonnes per year in 2022, 2023, and 2024.

This marks a dramatic increase — roughly double the annual average of about 500 tonnes in the preceding decade.

This trend is expected to continue, supporting higher gold prices as central banks increasingly diversify their reserves into hard assets to safeguard against inflation and the growing economic risks posed by massive global debt levels.

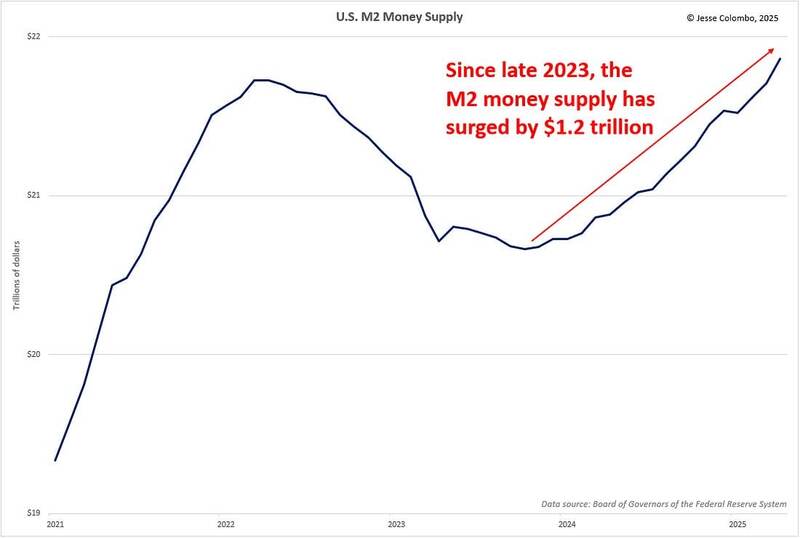

Speaking of rising money supply, the U.S. money supply began expanding again in late 2023 after a rare contraction in 2022 and 2023. This renewed growth is a major driver behind the precious metals bull market that kicked off just a few months later in March 2024. Since late 2023, the U.S. money supply has surged by $1.2 trillion.

A rising money supply is the fundamental cause of inflation — the erosion of a currency’s purchasing power — which is precisely why gold and silver tend to rise and serve as effective hedges during such periods. To learn more, read my recent report, “Gold Isn’t Going Up—Your Money is Just Losing Value.”

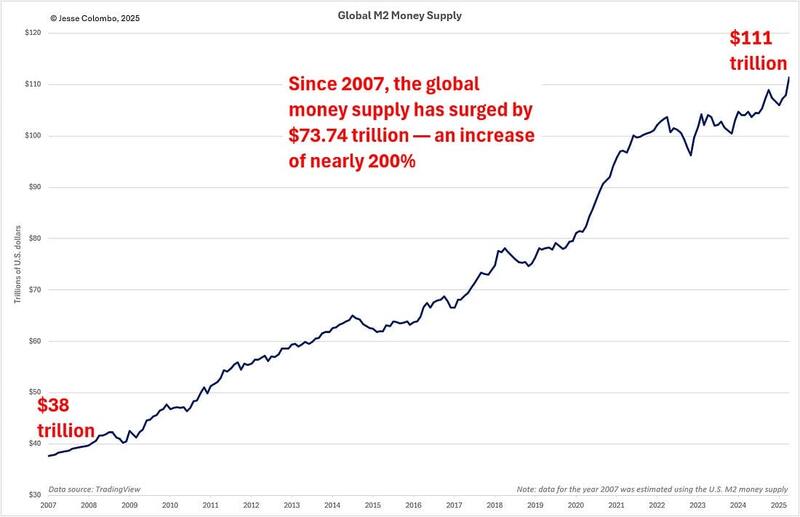

And lest you think this is just a U.S. issue — it’s not. This is a truly global problem, as the global M2 money supply has soared by an astonishing $73.74 trillion since 2007, representing an increase of nearly 200%:

Now, let’s delve into the technicals to assess how feasible Goldman and JPMorgan’s $4,000 gold price targets really are. As I’ve been explaining over the past couple of months, gold — in the form of COMEX futures — has been consolidating in a trading range between $3,200 and $3,500.

This is normal, healthy behavior and is typical during the summer months when news flow and trading volume decline as traders head off on vacation. You can clearly see this pattern of lower volume in the chart below.

The same thing happened last summer: gold peaked in mid-April, then moved sideways throughout the summer, before surging again when traders returned to their desks in September.

With gold currently in a trading range, I’m waiting for a decisive, high-volume breakout to confirm the next move. My bias remains to the upside, which would set the stage for a powerful rally toward $4,000:

The chart below shows COMEX gold futures, with a $4,000 price projection added. This target is just 20% above the current price and only 14% above the $3,500 breakout level — an outcome that is both realistic and attainable if/when gold breaks strongly out of its multi-month summer trading range.

Returning to the topic of trading volume, I also want to examine other gold proxies beyond COMEX futures to see if they’ve experienced similar seasonal declines — and sure enough, they have.

Take, for example, the popular SPDR Gold Trust ETF (GLD):

To summarize: although gold has been moving sideways for the past few months, this is perfectly normal — especially after such strong gains earlier this year and given the typical summer slowdown in trading volume and news flow.

However, assuming gold breaks out of its current trading range to the upside, I believe JPMorgan and Goldman Sachs’s $4,000 price targets are not only realistic but could even be achieved sooner than they expect — possibly by the end of this year, without having to wait until 2026.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.