(Mike Maharrey, Money Metals News Service) After moderating in November and December, the price of gold has surged to new all-time highs in India to kick off 2025. Higher prices have weighed on gold jewelry demand but continue to support investment demand.

India ranks as the world’s second-largest gold market.

Despite falling around 6 percent in rupee terms through the last two months of 2024, gold still emerged as India’s top-performing asset class, posting a 21 percent annual gain. This compares to a 26 percent return in dollars.

Beginning in January, gold rallied in rupee terms and is up 10 percent ($286 in dollar terms) so far in 2025. The gold price has set several new records along the way, peaking at ₹86,831/10g.

According to World Gold Council analysts, a combination of geopolitical risks, growing concerns about inflation, and increased investment flows have driven gold prices in India higher.

Gold Jewelry Demand Slumps; Investment Demand Remains Robust

According to the World Gold Council, the rising gold price has “taken the shine” off gold jewelry demand in India. Anecdotal reports indicate retail sales slumped in January, and slow demand persisted through the first few weeks of February.

Gold jewelry is viewed differently in India than in the West. It is seen as not only an adornment but also an investment. Much Indian jewelry is made from pure 24-carat gold, as opposed to the 14- and 18-karat pieces more common in the U.S. and Europe. Many Indian families use gold jewelry as savings.

Indian demand is also heavily influenced by cultural and religious traditions that inform the best times for purchases and gift-giving. Some individuals may avoid making major purchases during certain phases of the lunar calendar, believing that these times bring bad luck.

January 15 marked the end of an inauspicious buying period on the Hindu calendar, but demand weakness appears to have persisted into the current month.

World Gold Council analysts said wedding purchases have also slowed “suggesting that many consumers had front-loaded their purchases when prices dipped in November.”

Sagging demand has resulted in a price spread between domestic and international prices as sellers offer discounts to spur sales.

In addition to slowing sales, many Indian jewelers also report increased jewelry selling as people rush to lock in profits at higher prices.

According to the World Gold Council, many retailers are not restocking due to the high prices because they face challenges in making payments to wholesalers, creating a liquidity crunch in the industry.

Even as jewelry sales dipped, demand for gold coins and bars has remained strong with many investors anticipating further price increases.

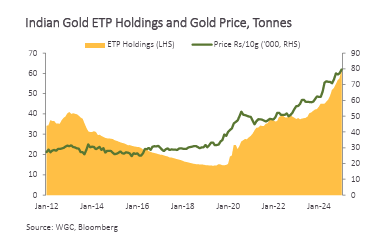

We also see investor interest reflected in India gold ETFs. Gold-backed funds reported “unprecedented” inflows of gold in January of $435 million. Over the previous 12 months, inflows had averaged around $112 million.

In tonnage terms, Indian ETFs increased their gold stocks by 4.6 tonnes, bringing total holdings to 62.4 tonnes.

According to the World Gold Council, investors are directing free cash flows into gold for “diversification amid ongoing global and domestic economic and policy uncertainty.”

Weakness in Indian equities is also pushing investors toward safe havens such as gold.

Gold Imports Dip

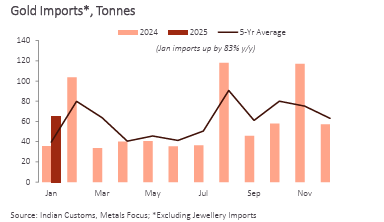

Gold imports in India slowed in January due to the high prices and pullback in demand. Imports are estimated to have run between 30 and 35 tonnes. That was the lowest level since July, but still about 40 percent higher than a year earlier.

Good Government Policy News for Gold Investors

In a bit of good news for Indian gold and silver investors, the new Union Budget maintained the import duty on gold at 6 percent, while reducing the customs tariff on gold jewelry imports from 25 percent to 20 percent.

There had been some speculation that the government might raise the import duty after slashing it significantly last July. The move initially pushed prices down by about 6 percent and drove record gold imports in August.

According to the World Gold Council, the reduction in the jewelry tariff won’t likely have a significant impact on domestic jewelry production because imports aren’t significant and are limited to high-end pieces.

Gold Plays an Important Role in the Indian Economy

India ranks as the world’s second-largest gold-consuming country.

Indians historically have an affinity for gold. While it’s hard to know for sure exactly how much gold Indians hold because of the amount of metal circulating in the underground economy, the best estimate is that Indian households own more than 25,000 tons of gold.

Gold is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item. Not in India. Even poor Indians buy gold. According to a 2018 ICE 360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.