(Mike Maharrey, Money Metals News Service) Have you ever gone to a movie everybody raved about and thought, ‘Meh. I don’t get all the hype?’

That’s how I felt reading the December Consumer Price Index (CPI) report.

I mean, it wasn’t awful.

But it wasn’t good either.

On balance, the CPI has been telling the same story for several months: price inflation is stubbornly sticky.

But since some of the data was better than expected, the mainstream threw a party. As CNBC put it, “U.S. stocks popped on Wednesday for their best day since November, on the back of the cooler-than-expected inflation reading.”

The not-so-bad CPI revived hope that the Federal Reserve might be able to keep the easy money flowing. In other words, people are giddy about a “cooler” inflation report because it will allow the central bank to start creating more inflation.

The December CPI Numbers

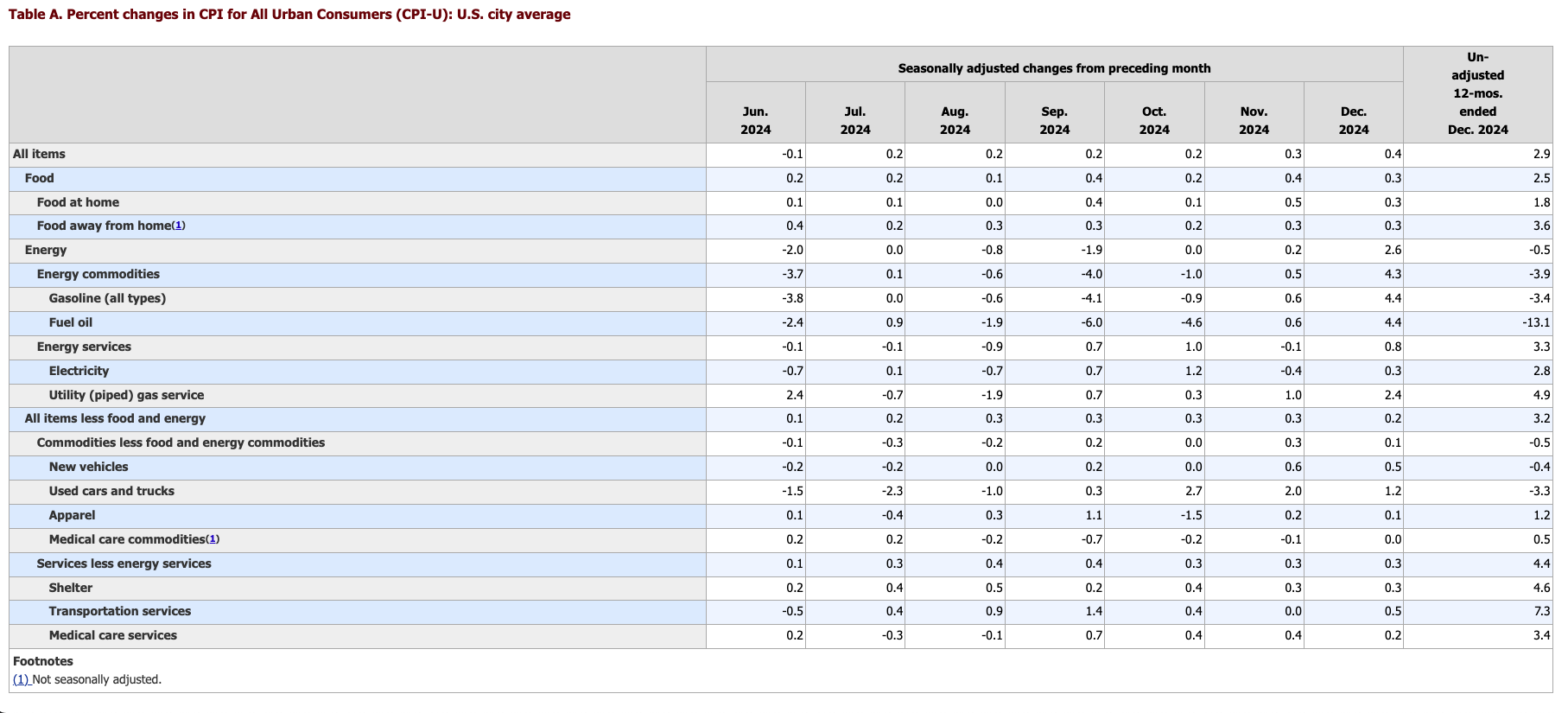

On a monthly basis, prices rose 0.4 percent, according to the BLS report. That comes on the tail of a 0.3 percent increase the previous month. On an annual basis, the CPI rose by 2.9 percent.

The CPI has gone up for the last three months, from 2.4 percent in September, 2.6 percent in October, and 2.7 percent in November. The last time we saw a 2.9 percent handle was in July. In fact, the annual CPI was only 3.1 percent in June 2023.

It’s also worth noting that a 0.4 percent monthly CPI increase annualizes to 4.8 percent.

The “good” news was on the core inflation front. Stripping out more volatile food and energy prices, core CPI rose 0.2 percent in December. The expectation was for a 0.3 percent rise.

This dropped the annual core CPI to 3.2 percent, a dip from the 3.3 percent level in November.

But core CPI has been mired around this level for months. Core inflation was also 3.2 percent in July.

It’s also important to note that all these numbers are far higher than the mythical 2 percent target.

Keep in mind that the CPI doesn’t tell the entire story of inflation. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Looking more closely at the data, we find that rising energy prices drove the overall CPI higher. Gasoline prices rose 4.3 percent in December, pushing the energy index up by 2.6 percent. Even so, that index is still down -0.5 percent from a year ago.

Food prices both at home and in restaurants were up in December, rising by 0.3 percent on a monthly basis.

In fact, prices were up in every single category.

How Was This CPI Report Good News?

This CPI report was good news basically just because it wasn’t bad news.

The numbers weren’t great, but the annual CPI data hit projections, and the core CPI data was better than expected.

But it wasn’t good by any objective measure.

When you dissect the data on its own merits, there’s not much to celebrate other than it could have been worse. Price inflation has been running at the same level for nearly a year and that level is far above the Fed’s stated target.

Even so, the Federal Reserve has cut interest rates by a full percentage point over the last four months, starting with a supersized rate cut in September.

In fact, the central bank started loosening monetary policy when it quietly announced that it would begin to taper balance sheet reduction in June.

Keep in mind what this pivot to rate cuts and the wind-down of balance sheet reduction actually means – the Federal Reserve is ramping up the inflation machine even as it declares victory over inflation. It means more credit expansion and more money flowing into the economy.

In other words, by declaring victory over price inflation and easing its monetary policy, the Fed is effectively committing to creating more inflation.

The data reflects this.

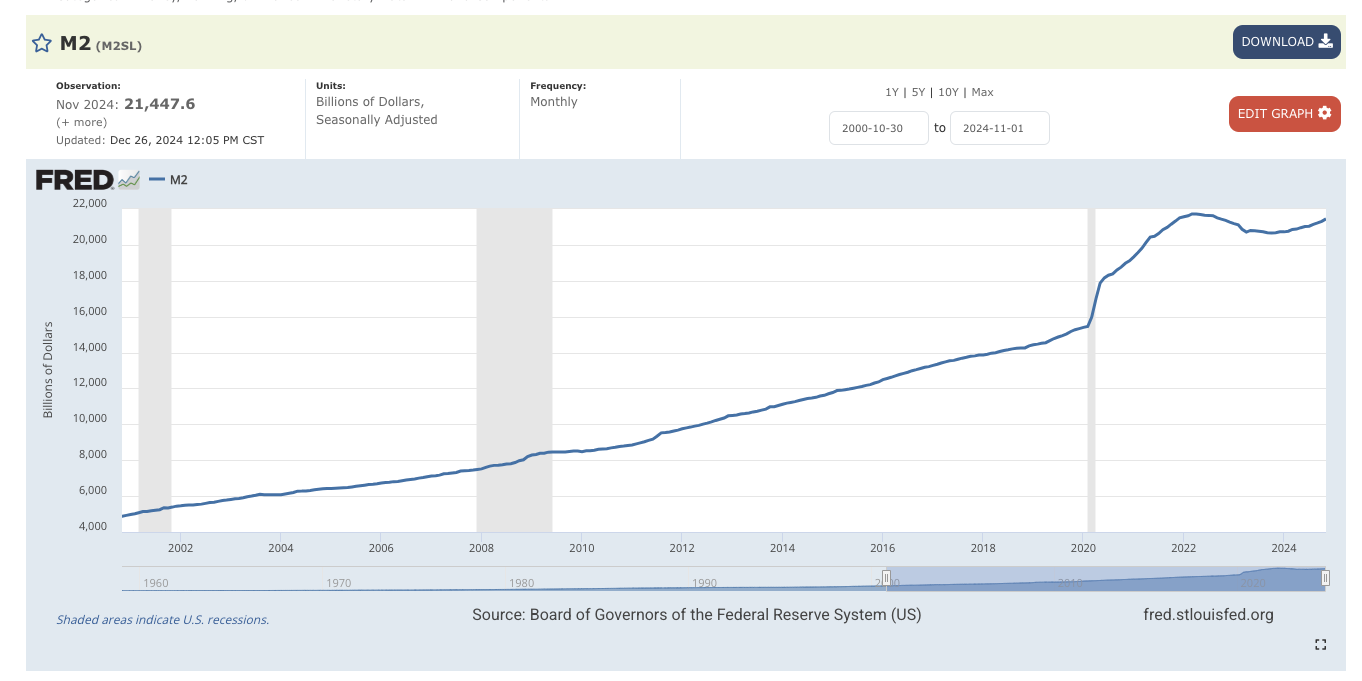

Even as CPI has been mired at the same level for the last several months, the money supply is increasing. This is – by definition – inflation.

The M2 money supply bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of November, it was at 21.4 trillion. That’s the highest level since October 2022.

The bottom line is the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

Meanwhile, the Fed is in a Catch-22. It needs to keep interest rates higher for longer to finish the job on inflation. (I would argue it needs to raise rates.) At the same time, it needs to cut rates to keep the debt-riddled bubble economy from cracking.

Powell & Company are walking a tightrope. The question is how long can they keep their balance?

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.