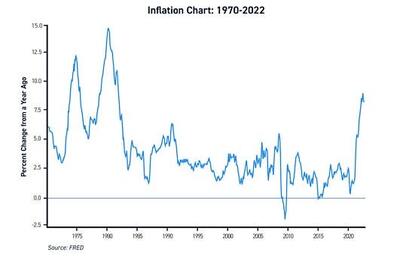

(Peter St Onge, Money Metals News Service) Bidenflation is over. But if you feel like prices still aren’t falling, you’re not alone.

Since Donald Trump took office, inflation has plunged from a Biden-era 5 percent to just 1.4%.

This is actually below the Fed’s target of 2%. Normally, at this point, the Fed would be trying to pump inflation since it’s “too low.”

Of course, for the American people, 1.4% is not “too low.” What they want is falling prices, as in take it back to pre-Biden prices.

Will that happen?

In short, no. Prices will never durably fall until we get rid of the Federal Reserve.

Because deflation — falling prices — is the #1 thing the Fed fears. Not unemployment. Not recession. Not nuclear war.

This comes from that core propaganda that created central banks: The false claim that deflation itself is bad.

Good Deflation

There are two very different kinds of deflation.

There’s the healthy — in fact, normal — deflation you automatically get from a growing economy. And the unhealthy deflation when a central-bank financial bubble collapses.

So, walking through, inflation is about how much money is chasing how much goods.

More money gives you inflation — too much money chasing goods.

More goods gives you deflation — more goods for money to chase.

So if your economy is growing, it means you’re producing more goods. So it takes fewer dollars to buy an apple — a dollar an apple when it used to be 2.

That deflation is good — it means you’re growing.

Central Bank Deflation

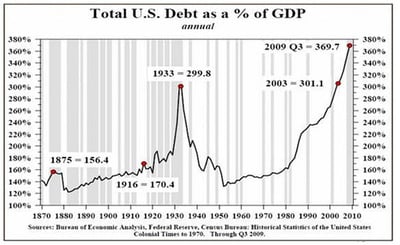

But there’s a second bad deflation called “debt deflation.”

This is where the amount of goods doesn’t change, the amount of money collapses. Specifically, mass defaults that collapse the money substitutes called debt.

That means the surviving dollars also buy more — a dollar buys an apple. Not because there’s more apples, but because there’s effectively less money.

This normally doesn’t happen — outside catastrophic war, you don’t get massive economy-wide defaults.

Unless there’s a financial crisis.

And what causes financial crises? Ironically enough, central banks. Who does it like clockwork?

They do this by making money artificially cheap with low interest rates and Quantitative Easing. And then slamming the brakes when the cheap money causes inflation.

The central bank boom-bust cycle.

Slamming the brakes causes widespread bankruptcies and defaults — less money. And it causes recession — less goods.

But in practice, the defaults far outrun the production. So less stuff, but a lot less money.

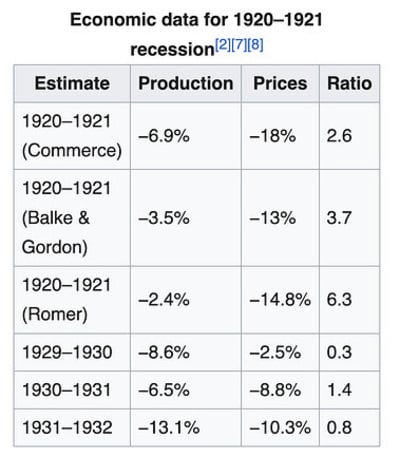

Sometimes this can be very big: in the 1919 and 1930’s depressions peak deflation was 30 to 40 percent — a dollar bought almost twice what it used to.

Which was catastrophic for borrowers: A farmer or small business suddenly had to pay effectively twice as much on their loans. All thanks to the Fed’s boom-bust.

Nowadays, debt deflation is much smaller — it peaked at 2% in the 2008 crisis.

Because nowadays, central banks immediately jump in to dump freshly printed money into markets.

So, setting aside the hilarious irony that the Fed fights good deflation specifically because it creates bad deflation, this means even after a catastrophic inflation like Biden or the 1970’s the Fed will never let prices come back down.

Peter St. Onge writes articles about Economics and Freedom. He’s an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University.