(Brien Lundin, Money Metals News Service) Gold has not only held the lofty $3,000 line, it’s advanced well beyond. This raises the question…why?

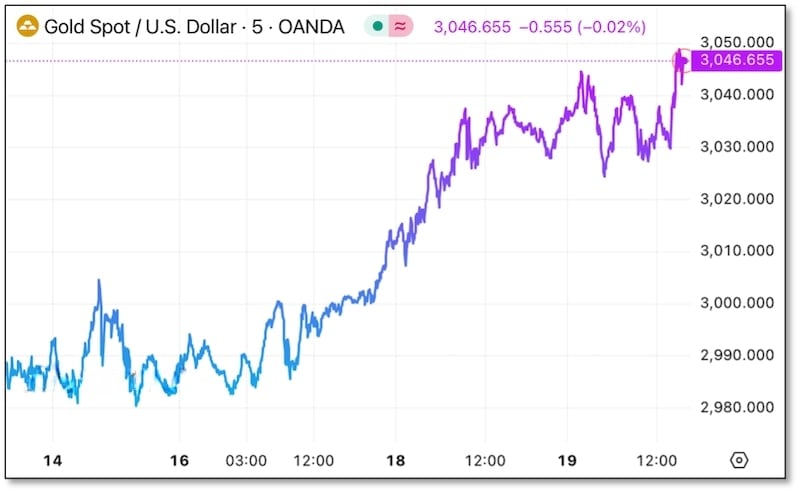

After a dizzying run to $3,000 that has stunned even the most ardent gold bulls, the yellow metal has continued to climb.

Count me among the dumbfounded bulls. I stood in awe at how easily gold had achieved the latest millennium number, even as it was hesitating at $3,000. But since then, the run has continued, punctuated by a $34 jump yesterday even as other asset classes were diving.

Today, gold gained once again in the wake of the Fed’s policy statement and during Chairman Powell’s press conference. The reason, I believe, is because there were no big surprises in anything from the Fed today.

Thus, the rationale for higher gold prices remaining the same, and the uptrend quickly reset.

That rationale is multi-faceted, ranging from recognition of the necessity to lower rates in the face of untenable debt service costs at current levels, the inflationary implications of the new tariff policies, and the increasing likelihood of a recession as the economic uncertainty works its way through the economy.

More generally, I believe the tremendous rally we’ve seen in gold over the past two months, and even over the past year, is telling us something about the future. The markets are predictive mechanisms, and none are more sensitive than gold. Just as gold rose post-Covid as it discounted the eventual inflationary reaction to the Fed’s easy-money rescue efforts, it’s predicting something ahead today.

That “something” is likely some combination of easier money and higher inflation.

Being gold bugs and natural contrarians, a move like we’re seeing tends to set our Spidey senses tingling, wondering if gold is getting ahead of itself…and whether the market is about to slap us upside the head with a figurative 2 x 4.

I’m comforted, however, by the fact that we’re starting to see Western investors coming into the metals and miners in force…and those money flows could soon increase substantially.

Consider that gold has far outpaced every other asset class this quarter. Not only has the bloom come off the roses in tech equities, AI stocks, and Bitcoin — all of which have robbed gold of very significant speculative funds — but gold has risen relentlessly even as those assets have fallen.

In the trend-following world of managed money, that outperformance is going to attract ever greater fund allocations like moths to a flame. The trend, already in place, will accelerate after first quarter reporting.

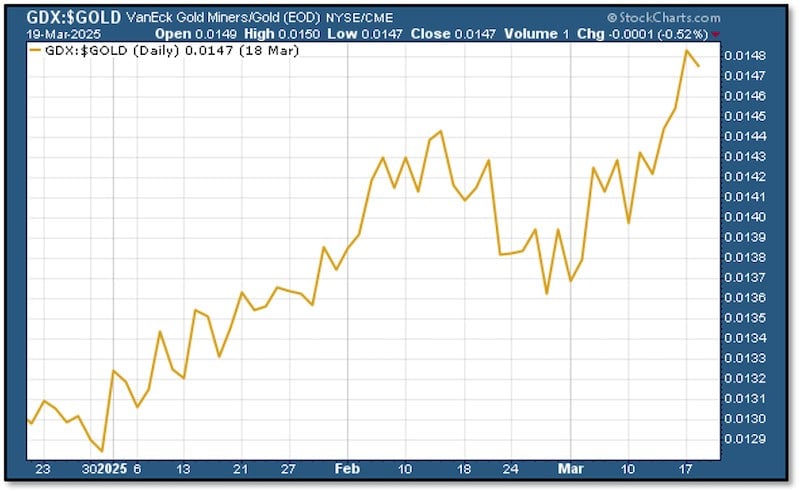

The news will get even better for gold and silver stock investors, as the hot money will look for ways to leverage gold’s move…and they will discover that mining equities remain dramatically undervalued.

It’s already happening to some extent, as the chart below of the GDX/gold ratio shows how mining stocks have been generally outperforming the metal since the beginning of the year. In short, investors have been aggressively moving into gold equities.

This outperformance is especially remarkable when you consider how steeply gold has been rising. For mining stocks to do even better is quite something.

There’s even better news for readers of our Gold Newsletter and Gold Newsletter Alert service, as the junior mining stocks in our portfolio are leading the charge upward.

I’ve come up with a number of exciting new stock picks over the past few weeks, some of which are already taking off, while others remain on the launch pad.

I cannot emphasize enough how special this opportunity is. The gold equities, and the juniors in particular, remain tremendously undervalued — especially with respect to where gold and silver are now trading.

This is easily the most compelling market environment that I’ve seen in four decades in this sector.

You should view my presentation at the recent Metals Investor Forum to see more details on why…but most importantly, you should click on the link below to subscribe to the Gold Newsletter or our alert service.

Believe me, you’ll be kicking yourself if you miss this opportunity.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.