(Mike Maharrey, Money Metals News Service) Nobody in their right mind would hold their reserves in dollars.

That’s the conclusion of Catalyst Funds CIO David Miller.

And he’s right.

Gold is up over 87 percent since January 2024 and is knocking on the door of $4,000 an ounce. But even with the rapid price surge, Miller said gold is not overpriced.

“It is just keeping up with how fast the money supply has grown.”

The appreciation of gold is the flip side of the dollar’s depreciation.

In other words, gold is tracking inflation.

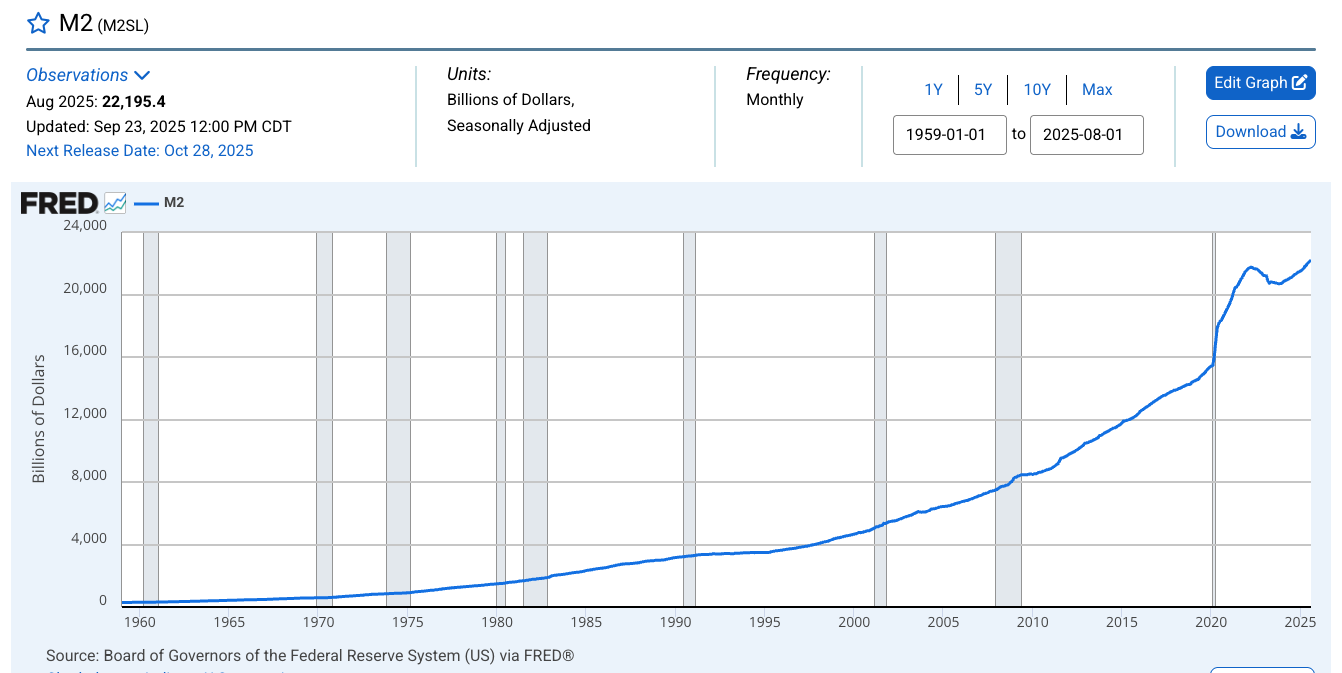

After contracting during the hiking cycle, the money supply has been expanding for well over a year.

This is, by definition, inflation.

As of the end of August, the money supply had expanded by more than $1.5 trillion since its low point in mid-2023 and stood at nearly $22.2 trillion, above the peak reached during the pandemic.

Miller said this relentless monetary inflation is inevitable given the massive government debt.

And there is no sign the federal government is going to address its spending problem any time soon.

With one month left in fiscal 2025, the federal government had spent $6.73 trillion, a 5.9 percent increase over the same period in fiscal ’24. The Trump administration has already spent more this fiscal year than it did last.

Make no mistake, the 2026 spending bill will raise spending even higher. Oh, they may trim the speed of some of the spending increases. They’ll call that a “cut,” and partisans will cheer. But spending will increase on an absolute level.

It always does. As Miller pointed out, political incentives make this inevitable.

“If you owed $37 trillion, like the U.S. government does, and were running a $1.9 trillion annual deficit—spending that much more than you bring in through taxes—and also had a printing press, you’d likely use it. Politicians face major pushback for austerity or aggressive tax hikes, so the easiest path is to gradually debase the currency. It’s not just the U.S.—governments globally have learned this.”

Miller said that he wouldn’t be surprised if price inflation ran at 5 percent annually.

So, what can you do, because this isn’t something you can just vote away.

“One way to protect against this as a consumer or investor is to denominate your assets in hard currency—like gold—instead of the dollar, euro, or yen.”

There are other factors driving de-dollarization as well, including the weaponization of the dollar and aggressive trade policy.

The U.S. and other Western countries aggressively sanctioned Russia in the wake of its invasion of Ukraine. America and its allies locked Russia out of the SWIFT financial system and froze around $300 billion in Russian central bank assets.

The rest of the world was watching.

Consider this – if something makes you vulnerable, what do you do?

You take the necessary steps to eliminate that vulnerability.

So, if you’re worried that the U.S. and its allies might cut off your access to dollars, what would you do?

Minimize your dependence on dollars.

In other words, if you are concerned that the U.S. could pull the “dollar rug” out from under you, why not pull out from the dollar system first?

Miller said when you combine all these factors, it’s no wonder gold is surging through the roof.

“ When you combine that trifecta of tariffs, weaponization of SWIFT, and enormous quantitative easing, no one in their right mind should want to keep their reserve, the money they don’t intend to spend in dollars.”

While there is no question that de-dollarization is happening, Miller thinks it’s unlikely the U.S. currency will lose its standing as the global reserve overnight.

“This will be a multi-decade process, which will keep an elevated floor in gold for the foreseeable future.”

However, even a modest de-dollarization spells trouble.

Because the global financial system runs on dollars, the world needs a lot of them, and the United States depends on this global demand to underpin its bloated government. The only reason the U.S. can borrow, spend, and run massive budget deficits to the extent that it does is the dollar’s role as the world reserve currency. It creates a built-in global demand for dollars and dollar-denominated assets. This absorbs the Federal Reserve’s money creation and helps maintain dollar strength despite the Federal Reserve’s inflationary policies.

But what happens if that demand drops? What happens if the world decides it doesn’t need as many dollars?

A de-dollarization of the world economy would cause a dollar glut. The value of the U.S. currency would further depreciate. At the extreme, global de-dollarization could spark a currency crisis. You and I would feel the impact through more price inflation, eating away at the purchasing power of the dollar. In the worst-case scenario, it could lead to hyperinflation.

Again – the world doesn’t have to completely abandon the dollar to create negative impacts. Even a modest drop in the demand for the greenback will ripple through the U.S. economy.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.