(Mike Maharrey, Money Metals News Service) Physical silver investment has become a significant driver of overall global silver demand, and four countries dominate the market.

Between 50 and 60 percent of silver demand comes from industrial and tech sectors, with the remaining half split between investment and jewelry demand. Industrial demand set a record in 2024, but investment demand lagged. However, with silver up more than 80 percent on the year, investment demand has grown.

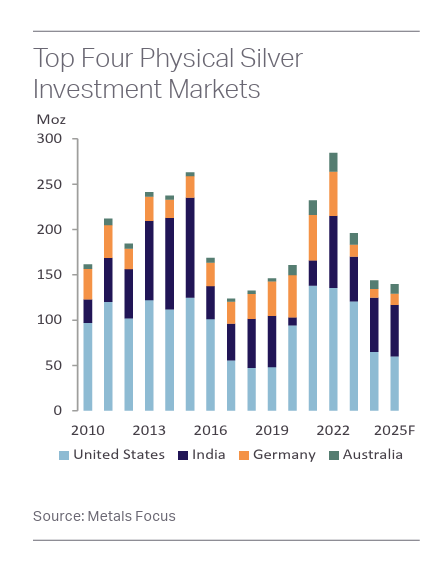

Physical investment is the most volatile source of silver demand. It has ranged from a low of 157.2 million ounces in 2017 to a record high of 337.6 million ounces in 2022.

Physical investment accounted for around 20 percent of total silver demand in 2010. It jumped to 28 percent in 2015 but fell to around 16 percent last year.

Four Countries Dominate the Silver Investment Market

Silver investment demand is concentrated in four countries – the United States, India, Germany, and Australia. These four nations account for 80 percent of physical silver investment. That compares with a 60 percent market share between the top four gold investment countries.

USA

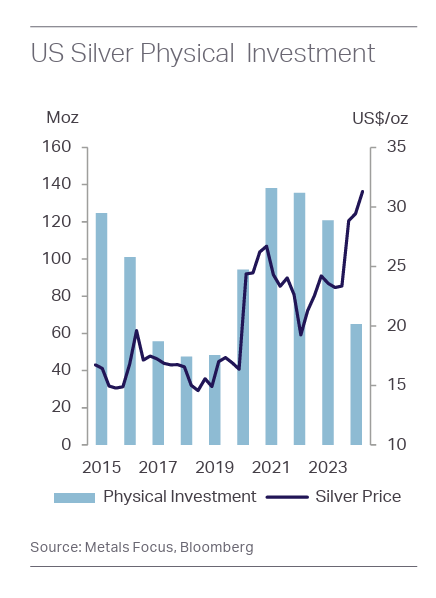

Historically, the United States has ranked as the top country for silver investment, although India surpassed the U.S. in 2018 and 2019, and it may do so again this year.

According to Metals Focus, the U.S. investors bought 1.5 billion ounces of silver between 2010 and 2024. That’s an average of 3,077 tonnes per year.

Up until the last few years, American investors weren’t selling. That means much of those 1.5 billion ounces remained in investors’ hands. As the price began to rise in 2023, investors seeking profits began selling, and that trend has accelerated this year. According to Metals Focus, selling drove a sharp drop in demand for newly struck coins and bars so far this year, with total U.S. retail investment likely to hit a seven-year low in 2025 (Investment demand is the net of buying and selling).

India

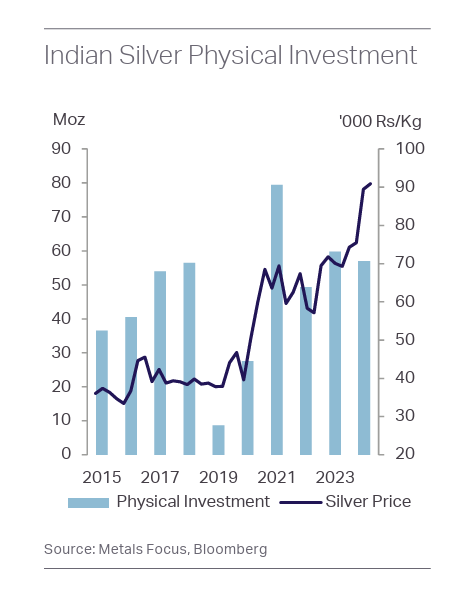

India has typically ranked second in physical investment silver demand, but occasionally jumps to the top.

Traditionally, Indian investors have held silver in bar form.

Between 2010 and 2024, cumulative Indian bar and coin demand stood at 840 million ounces (26,100 tonnes). According to Metals Focus, “In a broadly similar fashion to the U.S., these holdings have generally been quite sticky, reflecting Indian investors’ typically bullish price expectations.”

Silver prices hit records in rupee terms before they did so in the U.S. and have pushed through the psychologically important ₹100,000/kg level. Nevertheless, Metals Focus reports sales have been “surprisingly modest.”

“This mostly reflects how deeply held positive price expectations are in India, with many investors looking for the international price to revisit its record high in dollar terms.”

In 2022, Indian silver investment hit the highest level since 2015 as the pandemic era wound down. Silver purchases contracted significantly in 2023 but were still high in absolute terms. Indian silver demand was resurgent last year, especially after the Indian government cut the import duty on both gold and silver.

While Indian investors have historically favored physical metal, there is also a growing interest in silver ETFs. The first silver-backed fund launched in 2022. Over the past 18 months, ETF silver holdings have surged to 58 million ounces (1,800 tonnes), a jump of 51 percent since end-2024.

A silver ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical metal. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the silver market, but owning ETF shares is not the same as holding physical silver.

According to Metals Focus, ETFs seem to be attracting investors already active in the equities market, who typically might not have bought physical metal.

Germany

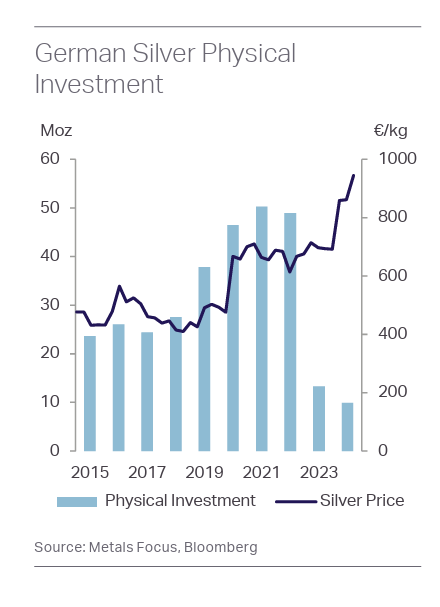

Germany ranks as the third-largest market for silver bar and coin investment.

Between 2012 and 2018, German retail silver purchases averaged a relatively modest 24.6 million ounces (764 tonnes) annually. The market was already showing signs of heating up with the pandemic, and Russia’s invasion of Ukraine spiked demand.

German physical silver investment doubled, averaging 48.5 million ounces (1,510 tonnes) in the period of 2020-22.

A tax change in 2023, along with inflation and a return to positive real rates, tanked silver demand, with sales plunging to 13.3 million ounces. These headwinds continued into 2024.

According to Metals Focus, a rise in selling occurred as investors sought to lock in profits and access cash to cover growing expenses in an inflationary environment.

“To put this into perspective, in just two years, German net silver demand had slumped by 80 percent or roughly 39 million ounces (1,200 tonnes).

There has been a modest recovery in demand this year, in part because selling has eased. Metals Focus projects a 25 percent year-on-year increase in physical investment silver demand in 2025.

Australia

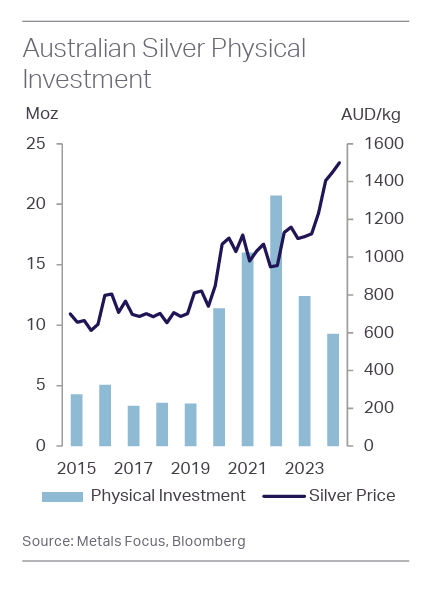

Silver demand in Australia has increased over the last five years, making the country the fourth-largest physical silver investment market.

As recently as 2019, Australian silver demand was a paltry 3.5 million ounces. By 2022, it had surged to 20.7 million ounces. According to Metals Focus, along with the general macro fundamentals underpinning the precious metals markets, two factors specific to Australia drove this increase – the growing popularity of investing silver in superannuation, or retirement accounts, and the favorable tax structure applicable to physical silver investment products.

As for the favorable tax treatment, investment-grade silver in Australia is sales tax-free, although it is subject to capital gains tax (CGT). Silver invested in retirement accounts attracts different CGT rates if the investor sells before retirement, but after that point, it becomes capital gains tax-free.

As with other markets, silver demand sagged in the post-COVID era, in part due to profit-taking. However, demand remained well above pre-2020 levels.

Metals Focus forecasts an 11 percent increase in investment silver demand this year as cost-of-living pressures ease.

“There also appears a growing perception that silver is undervalued compared with gold, which is therefore attracting renewed interest in silver.”

For a more detailed breakdown of physical investment silver demand, download the full Metals Focus report HERE.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.