(Brien Lundin, Money Metals News Service) Gold has set another record high as Jerome Powell confirmed the Fed pivot.

While gold has been driven to these heights by Eastern buying, we’re now seeing Western investors flocking to the metal as the shift to easier monetary policies begins.

And gold stocks are also now beginning to outperform gold itself.

This is what we’ve been waiting for: The next phase of the gold bull market has begun.

I’m talking about the long-anticipated entrance of Western investors into the gold and mining share market.

As you know, this new gold bull market was launched with furious buying from central banks and Chinese citizens.

Central banks want to reduce dependence from the U.S.-dominated global financial system, while Chinese savers and investors are not only culturally attached to gold, but have also been attracted to the metal’s performance relative to their stock and real estate markets.

These have been powerful drivers for gold, but they were nothing that Western investors/traders have been able to place much confidence in.

But Fed rate cutting? Well…that’s something they can sink their teeth into. It’s a trend they can project forward for years. And it’s the trend that will take gold to far, far higher levels.

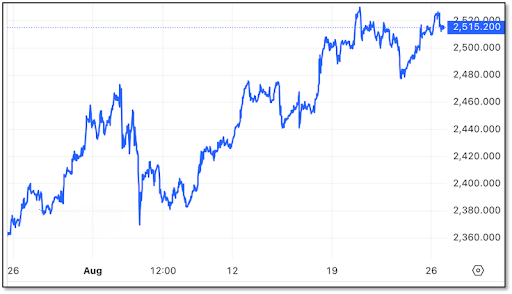

It’s already begun. As you can see, Western investors are starting to price-in the Fed pivot, and that has fueled the rise to new record levels.

You’ll also notice the latest run, one that was sparked by Fed Chairman Jerome Powell’s announcement in his Friday comments from Jackson Hole, that the first rate cut will come at its September 18th meeting.

This has also added more fuel to the fire that’s already growing in gold mining stocks:

The chart above shows the ratio of the GDX mining stock index to gold itself. As you can see, this ratio began to take off a couple of weeks ago as gold stocks began to outperform gold.

This is only the start of what’s to come. We are finally seeing investors recognizing how severely undervalued gold stocks are at these gold-price levels.

As I’ve been saying, gold at $2,500 changes everything for the gold stocks. When gold was at $2,000 just a few months ago, there were many companies with large gold resources that were trading for a quarter or less of where they would historically have been valued in just a normal gold market.

Now — at these gold prices — those companies could be 10-baggers or better.

In fact, I’ve found two of them that I’m about to unveil in a few days…

- The first company is developing a multi-million-ounce gold deposit where a pre-feasibility study has projected a net present value of about five times its current market valuation. But get this: That study is based on a $1,650 gold price!At today’s prices, the already stellar economics will explode off the page and attract hordes of investors…once they discover this hidden gem.

- My second new recommendation is a company that is about to reveal a resource estimate for its large project in Nevada. Looking at the data, I’m confident it will show about 1.5 million ounces of open-pittable gold at an eye-popping average grade above 2 g/t gold.Those would be amazing numbers for a project in Nevada. But the truly shocking number is this: The company’s market valuation is still under US$9 million!

I think you can see why I’m so excited about these two bargains and why I believe they could provide 10x returns as this gold bull market progresses. Learn more here.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.