(Jesse Colombo, Money Metals News Service) The past two months following the U.S. presidential election have been challenging for gold bulls as the yellow metal pulled back and settled into a choppy trading range.

However, as I’ve consistently stated, this consolidation phase is just a healthy pause— allowing gold to catch its breath before continuing its upward trend.

Over the past year, gold has displayed a steady, orderly growth pattern, advancing through a series of consolidation phases in a stair-step fashion. The encouraging news is that this current consolidation period may be nearing its end, positioning gold to resume its climb toward all-time highs.

COMEX gold futures are currently trading within a range of $2,550 to $2,800, forming a triangle pattern within this range.

For confirmation that gold’s bull market has resumed, a decisive, high-volume close above both the triangle pattern and the $2,800 resistance level is necessary. A successful breakout should propel gold to $3,000 and beyond in short order.

I closely monitor gold priced in other currencies, as it removes the impact of U.S. dollar fluctuations and offers a clearer picture of gold’s underlying strength. Over the past two months, gold priced in other currencies has outperformed gold priced in U.S. dollars, largely due to the powerful dollar rally, which has made gold appear weaker than it truly is.

The chart below shows gold priced in euros, British pounds, and Swiss francs. I find that this particular mix shows gold’s movements very clearly. Gold priced in this mix of currencies is currently in a trading range between 6,700 and 7,200.

Gold priced in Canadian dollars is currently trading within a range between 3,550 and 3,900. A triangle pattern has formed within this range, mirroring a similar setup in gold priced in U.S. dollars. This chart holds particular significance as Canada ranks among the world’s top gold producers, claiming the fourth spot globally with 200 metric tons of gold produced in 2023.

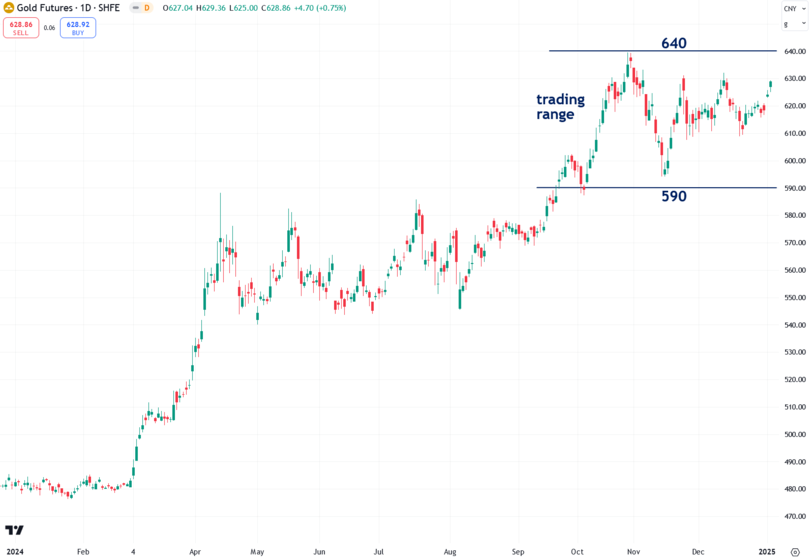

China’s gold benchmark, the Shanghai Futures Exchange (SHFE) gold futures, is currently trading within a range of 590 to 640. As the world’s largest producer of gold—producing 370 metric tons in 2023—and one of its largest consumers, China plays a pivotal role in the global gold market.

For months, I’ve theorized that a resurgence of Chinese gold futures traders—who were instrumental in driving gold’s surge in March and April—could be the catalyst to propel prices toward $3,000 and beyond. A bullish breakout from this trading range should turn that forecast into reality.

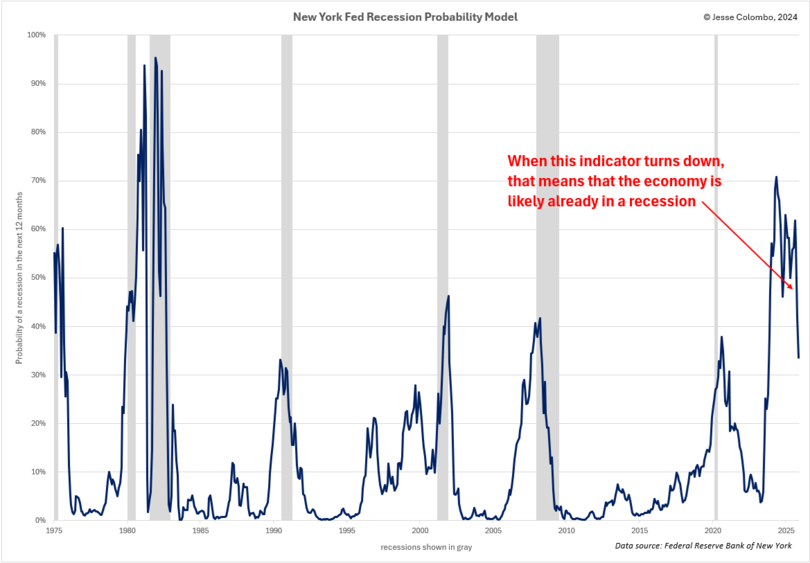

Adding weight to the idea that gold may be poised to resume its bull market is the likelihood that the U.S. economy is already in a recession. Recessions are typically bullish for gold, as they lead to interest rate cuts and quantitative easing (QE)— essentially digital money printing.

It’s not just the U.S. at risk of a recession—China faces similar challenges. Much like the U.S. during the 2008 financial crisis, China is grappling with a severe real estate and stock market bust, which has triggered a sharp economic downturn.

Government bond yields in China have plunged to all-time lows, signaling a deepening deflationary crisis. It’s inevitable that China will soon respond with a massive stimulus ‘bazooka’ to combat this deflation, a move that should be highly bullish for gold, silver, and other commodities.

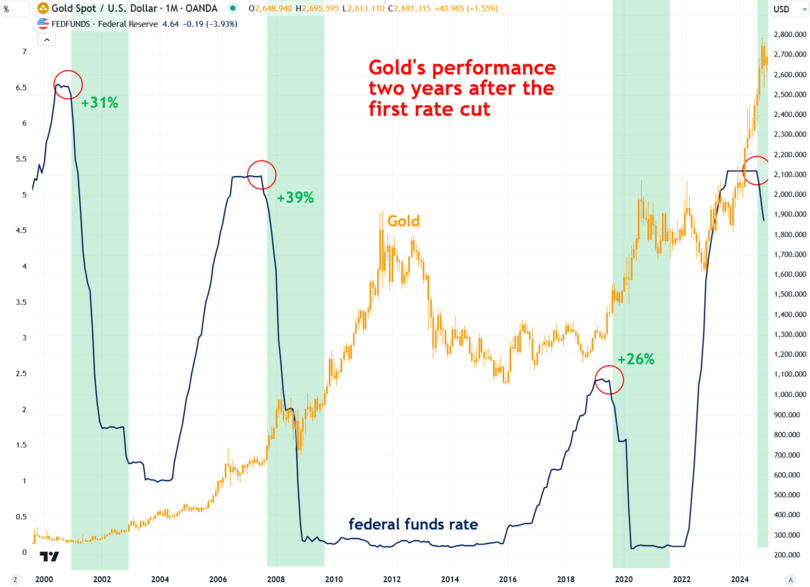

There are other reasons to believe that gold’s bull market still has plenty of gas left in the tank. For example, there is a strong tendency for gold to continue to rise strongly after the first Fed funds rate cut in a rate-cutting cycle.

As the In Gold We Trust report aptly stated, “rate cuts are like rocket fuel for gold.” The report showed that over the past three rate-cutting cycles, gold has risen an average of 32% within two years of the initial rate cut.

If gold follows a similar trajectory this time—following the Fed’s rate cut on September 18—it could rise to $3,380, representing a 27% increase from its current level of $2,658.

For now, I’m waiting for gold to decisively close above the key resistance levels I highlighted to confirm that the bull market is ready to resume.

Several catalysts could trigger this breakout, including a major Chinese stimulus announcement and worsening U.S. economic data as the recession unfolds. While the past couple of months have been frustrating for gold bulls—myself included—I firmly believe that our patience will be richly rewarded once gold climbs to $3,000 and much higher.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.