(Jon Forrest Little, Money Metals News Service) An old Sunday school story may be the best metaphor for the risks of today’s high paper-to-silver ratio.

Let me take you back to the Old West, New Mexico specifically.

There are over 15,000 abandoned mining sites in New Mexico, a state which boasts vast mineral resources such as copper, gold, silver, and uranium (but is small in comparison to States like Colorado, Idaho, Nevada, Oregon, and Arizona.)

As a native New Mexican, one of my favorite parts of state history is connected with Billy the Kid, who was raised around Lincoln County, two hours South of Albuquerque and 1.5 hours north of El Paso.

Silver Shenanigans in Santa Fe

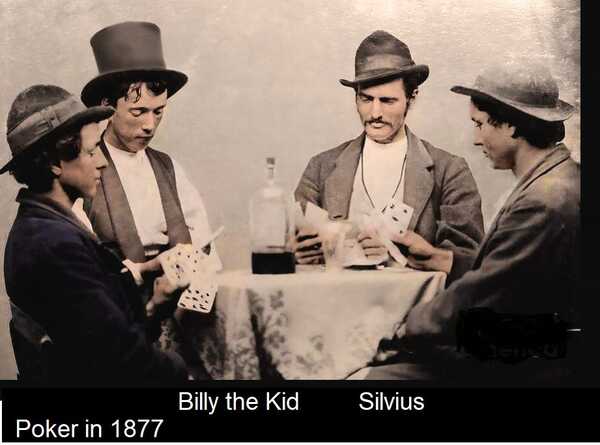

In the dusty saloons of Santa Fe, New Mexico, a clever merchant named Silvius often rubbed elbows with the infamous Billy the Kid and his gang of horse bandits.

One fateful evening, as Billy bought a round of drinks for his outlaws, the sharp ping of a silver coin hitting the bar counter caught Silvius’s ear.

Later that night, he watched intently as Billy and his gang engaged in a lively poker match, using paper slips and chips to represent silver ounces, dividing the precious metal into betting increments.

This scene sparked an idea in Silvius’s mind — a scheme to resell the same silver over and over again.

He took his show on the road and traveled on horse 65 miles south to Albuquerque. In the “old town” market square, Silvius put his plan into action.

He owned a single, gleaming silver coin that caught everyone’s eye. Seeing an opportunity, Silvius devised a plan.

He created 400 paper tickets, each claiming to represent his silver coin. He approached his marks individually. “Buy a ticket, and you’ll own a share of my precious silver! “

The townspeople, enticed by the low price of the tickets, eagerly bought them. Soon, all 400 tickets were sold, and Silvius’s pockets were full of money.

One day, a wise old woman approached Silvius. “May I see the silver coin my ticket represents?” she asked.

Silvius smiled nervously. “Of course, but you see, there are 399 other ticket holders. You’ll have to wait your turn.”

The woman frowned. “But how can one coin be in 400 places at once?”

Word spread quickly. Soon, a crowd gathered, all demanding to see the silver coin they believed they owned a piece of. Panic ensued as people realized the absurdity of the situation.

In the chaos, Silvius slipped away, leaving behind a valuable lesson: just because something is written on paper doesn’t make it real.

The Moral

This parable illustrates the disconnect between paper representations and physical assets in the silver market. Just as Silvius created 400 tickets for one coin, the paper silver market often trades at ratios far exceeding the available physical silver.

The lesson here is twofold:

- The power of perception: Silvius, like modern financial institutions, created value from thin air by leveraging people’s trust and desire for profit.

- The fragility of paper promises: When everyone tried to claim their share simultaneously, the illusion collapsed, much like how a run on paper silver could expose the market’s vulnerabilities.

In the real world, this situation allows for price manipulation and creates a disconnect between paper and physical silver prices.

It’s a stark reminder that in financial markets, as in the parable, those who set the rules can create realities that may not align with physical constraints.

Jon Forrest Little graduated from the University of New Mexico and attended Georgetown University’s Institute for Comparative Political and Economic Systems. Jon began his career in mining industry and now publishes “The PickAxe” which covers topics surrounding precious metals, energy, history, and politics.