America faces a retirement crisis.

The chairman of the world’s largest asset management firm is sounding the alarm.

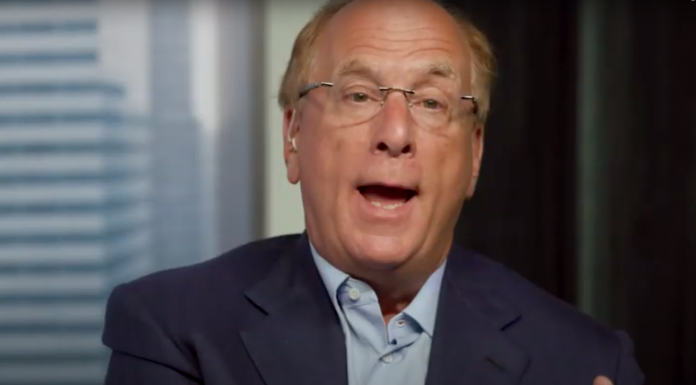

BlackRock CEO Larry Fink told CNBC last week that he sees a “silent crisis of retirement.”

Fink cited ultra-low interest rates, combining with elevated inflation rates, as steadily diminishing the real value of retirement savings.

“People are going to have to, unfortunately, whether they like it or not…work longer because they’re not earning the same returns on their savings,” he said.

Of course, they could increase their allocation to equity markets and hope they outperform low-yielding bonds and cash instruments. But then they would be exposing themselves to heightened volatility as they head into their golden years.

For decades, the conventional retirement planning advice has been to reduce exposure to the stock market and increase fixed-income allocations as retirement approaches. The thinking is that retirees may not have enough time to see their stock portfolios recover from a severe bear market.

In decades past, income instruments such as government bonds and bank certificates of deposits provided decent yields. Today, with a 10-year Treasury note yielding just 1.3%, that is not the case.

As for Social Security, that supposed safety net for retirees, annual cost of living adjustments (COLAs) in recent years have been about as pitiful as returns on savings accounts.

If you’re a retiree who depends on Social Security for monthly income, you’ve likely been falling further and further behind your costs of living.

Social Security beneficiaries did receive some apparent good news recently from the Senior Citizens League. The advocacy group for seniors projects they will get a 6.1% benefit increase next year – which would be the biggest since 1983.

That sounds like good news for beneficiaries. But the jump merely reflects the surge in government-induced inflation that is occurring now, while current Social Security payments are offering no relief.

Social Security COLAs will always be behind the inflation curve. In fact, the system would quickly go broke if its payouts kept pace with inflation.

A study published by the Senior Citizens League found that since 2000, Social Security COLAs have lifted benefits by a total of 55%. But typical senior’s expenses, according to the study, rose by 102% (through March 2021).

That gap represents a massive purchasing power loss – and the lie of the Consumer Price Index to which Social Security benefit increases are tied.

What if those Social Security benefits had been paid in or immediately converted into gold? In that scenario, retirees would have seen sizeable purchasing power gains.

Since 2000, the price of gold has gone up a cumulative 525%.

Along the way, there have been setbacks – including the lull in place since last year’s peak. But the major trends couldn’t be clearer: gold rises over time to keep up with inflation while dollar-denominated IOUs (including Social Security benefits) steadily lose value over time.

Precious metals are often overlooked in retirement planning, even though gold and silver are clearly superior forms of “cash” savings during periods of negative real interest rates like we have now.

Of the two metals, gold tends to be less volatile while silver offers more potential upside during rallies. It’s therefore likely that conservative-oriented retirement savers would want to favor gold over silver.

One key to surviving the government’s policy of high inflation, though, is to be well diversified into a broad array of assets since price increases can hit different markets at different times. Since inflation never rests, there is never a bad time or a wrong age to begin diversifying into physical bullion…Original Source…

Stefan Gleason is President of Money Metals Exchange, the company recently named “Best Overall Online Precious Metals Dealer” by Investopedia. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, TheStreet, and Seeking Alpha.

Stefan Gleason is President of Money Metals Exchange, the company recently named “Best Overall Online Precious Metals Dealer” by Investopedia. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, TheStreet, and Seeking Alpha.