(Jacob Bruns, Headline USA) Shareholders of the globalist bank corporation JPMorgan Chase called out the financial giant for aiding professional pedophile Jeffrey Epstein abuse children.

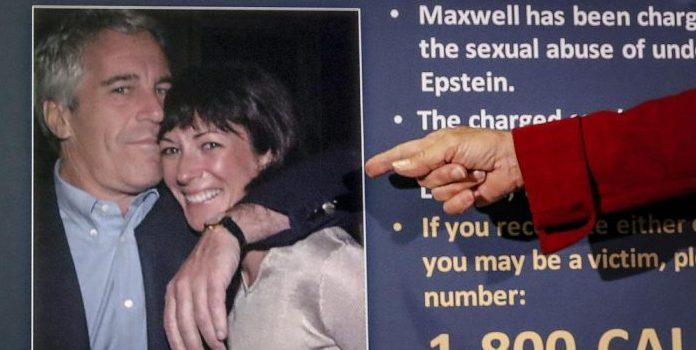

According to a new federal lawsuit filed by the Virgin Islands against the company, officials at JPMorgan kept Epstein’s bank accounts open despite expressing concerns internally as to his dealings, News Direct reported.

Specifically, he used accounts to distribute payments of up to $1 million to his rape victims in order to keep them quiet.

According to internal reports, the bank’s Global Corporate Security Division had noted as early as 2006 that Epstein was up to no good, and yet kept allowing him to maintain his accounts.

The bank had allegedly flagged “[s]everal newspaper articles . . . that detail the indictment of Jeffrey Epstein in Florida on felony charges of soliciting underage prostitutes.”

Four years later, Chase’s risk management division also questioned internal emails circulating regarding Epstein’s sexual exploits.

“See below new allegations of an investigation related to child trafficking – are you still comfortable with this client who is now a registered sex offender[?]”

The company allegedly dismissed the concerns, and is now attempting to exclude the Securities and Exchange Commission to drop the proposals of two watchdog groups to avoid being exposed in their support of a pedophile.

According to Paul Chesser, director of the National Legal and Policy Center’s Corporate Integrity Project–one of the watchdogs observing the situation closely–Chase has been both evil and deceptive.

“This is evil; Chase let the cash flow to aid and abet Jeffrey Epstein’s sick and disgusting global sex trafficking operation,” he said.

“But they shut down its services to a praiseworthy and respectable initiative by an upstanding public servant, and want to hide the reasons for it all from shareholders. The bank is obviously embarrassed and it should be.”

Scott Shepard, the Director of the National Center for Public Policy Research, echoed that sentiment.

“Chase is a too-big-to-fail bank, so it gets to keep its profits, while all taxpayers – not just leftwingers – backstop its losses,” he said. “Chairman and CEO Jamie Dimon talks a good game about recognizing the folly of woke corporate governance, apparently without realizing that that’s how his shop is run. After these Epstein revelations, it’s time for Congress and the states to investigate Chase and to bar it from doing business until it ends its petty partisan discrimination.”