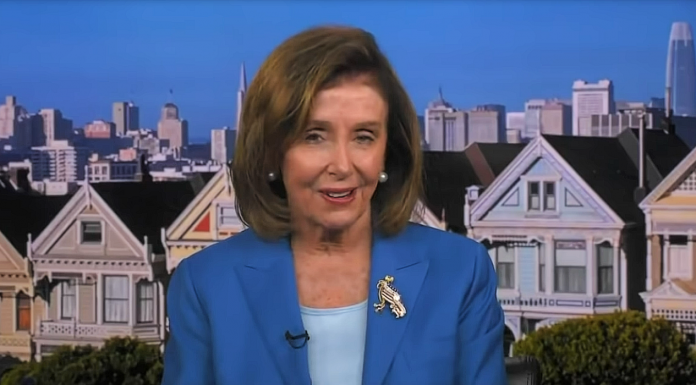

(Jacob Bruns, Headline USA) Once again, Paul Pelosi—the husband of House Speaker Nancy Pelosi, D-Calif.—has been caught up in an insider trading scheme, this time buying Tesla stock as Democrats wage war on gas, the Liberty Daily reported.

Business Insider reported that Paul, a successful venture capitalist and stock trader, purchased $2.2 million in Tesla stock earlier this month, according to the couple’s most recent financial disclosure.

The acquisition came as Nancy Pelosi led key votes on a massive omnibus spending bill that promoted electric vehicles and votes supporting the Biden administration’s sanctions against Russian oil, helping to drive up the already skyrocketing costs at the gas pump.

There is little to deter corrupt lawmakers from exploiting their advance knowledge of major economic impacts, some of which are the direct result of their policy dealings. Pelosi is one of only a handful of legislators in Congress who has access to regular intelligence briefings.

Members of Congress are legally expected to disclose individual stock trades, as well as those made by immediate family members, within one month of the purchase. But the loosely enforced rule requires only a $200 fine for violators.

Pelosi recently voiced her support for more regulations blocking congressional stock trades, but only after long opposing such legislation. Undoubtedly, such laws would involve loopholes for congressional spouses.

Nancy Pelosi’s spokesman, Drew Hammill, claimed earlier this month that “the speaker does not own any stocks,” despite the fact that Paul Pelosi invested nearly $3 million in Disney, American Express, Apple and PayPal earlier this year.

According to congressional records, the power-couple has made millions in the past few years from his shrewd stock-market bets. Some have pointed to blatant examples of insider trading.

Last spring, Paul Pelosi bought $10 million in Microsoft shares soon before they jumped 11% in value—based on an announcement that the Defense Department would begin using the company for cloud-hosting services.

Last summer, Paul Pelosi reaped $5.3 million in profit by doubling down on Big Tech as several potentially trust-busting bills were winding their way through the House. Among those companies was Amazon—a rival for Microsoft’s contract—after the Pentagon unexpectedly canceled the earlier deal.

“The speaker has no involvement or prior knowledge of these transactions,” Hammill said at the time.