The husband of House Speaker Nancy Pelosi, D-Calif., reaped $5.3 million in profit by doubling down on Big Tech as several potentially trust-busting bills were winding their way through the House.

In May and June, a legislative package known as the Ending Platform Monopolies Act threatened to put the screws to several of Silicon Valley‘s so-called FAANG companies.

Yet, according to Fortune magazine, few on Wall Street were particularly rattled when it cleared the the House Judiciary Committee.

The series of six bipartisan bills, including antitrust legislation, sought to rein in four of the stock-market’s biggest blue-chips—Apple, Amazon, Google and Facebook—over their monopolistic practices.

Nonetheless, Forbes noted that shares in the Big Tech companies actually jumped after investors concluded the House’s bills were not a real threat to the platforms.

Among those who appeared to be placing his bets on Congress’s inherent inefficiency and/or corruption when it came to holding tech companies accountable was multimillionaire venture-capital investor Paul Pelosi.

Making matters worse was the fact that he not only remained confident in the companies holding their value, but was, in fact, banking on a substantial increase in value coming in the foreseeable future.

Just weeks before the bills cleared committee, he bought up to $11 million worth of Big Tech stocks—including $4.8 million worth of Google shares, $1 million worth of Amazon call options, $250,000 of Apple call options and $5 million of call options for Nvidia, according to a financial disclosure form filed last week.

A call option is a financial contract that allows a buyer to purchase stock shares at a set price within a certain time period. According to Forbes, a call option is great for investors who believe the stock price will go up in the future.

While some—recalling a pre-COVID scandal last year that ensnared fellow San Francisco liberal Sen. Dianne Feinstein and a handful of Republican senators—cried foul of insider trading, Nancy Pelosi claimed she was not aware in advance of her husband’s investments.

“The speaker has no involvement or prior knowledge of these transactions,” Pelosi spokesman Drew Hammill said in a statement to Bloomberg on Wednesday.

Nancy Pelosi endorsed the bipartisan bills and said they would be brought to the full House floor for a vote later this year.

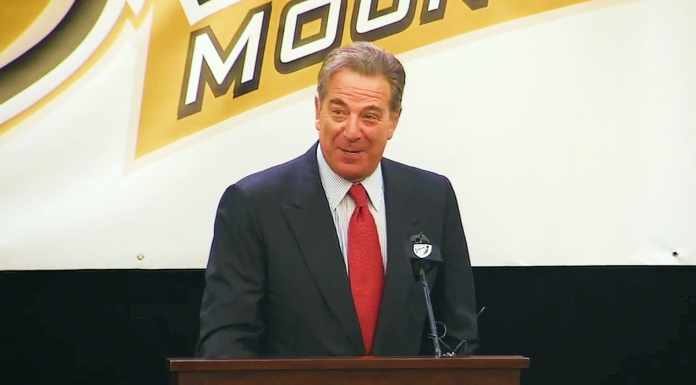

“There has been concern on both sides of the aisle about the consolidation of power of the tech companies, and this legislation is an attempt to address that,” Pelosi said during a press conference at the end of June, just weeks after her husband’s stock purchases.

Headline USA’s Ben Sellers contributed to this report.