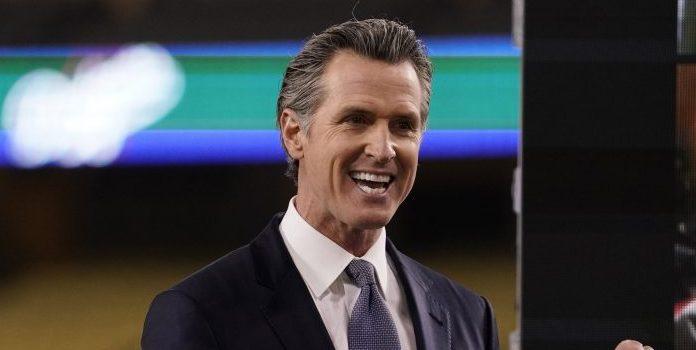

(Dmytro “Henry” Aleksandrov, Headline USA) California Democrat Gov. Gavin Newsom praised the federal government for bailing out the failed Silicon Valley Bank without mentioning that he is one the bank’s depositors.

On Sunday, Newsom cheered the Biden administration after the federal government announced that the Federal Deposit Insurance Corporation would cover all depositor losses from the SVB collapse through taxpayers’ dollars, according to the Daily Wire. SVB’s largest depositors were surprised about the bailout because FDIC insurance is guaranteed to cover only up to $250,000 per account.

He also added that the FDIC’s decision would have “profoundly positive impacts” on California businesses. Unsurprisingly, the reason why he thinks like that is because his own wineries may stand to benefit from the FDIC’s unusual action. CADE, Odette and PlumpJack — Newsom-owned wineries — all banked with SVB and each of these wineries was at risk of losing its deposit if it held over the $250,000 threshold in a single account.

Newsom also had personal accounts at SVB.

“Governor Newsom’s business and financial holdings are held and managed by a blind trust, as they have been since he was first elected governor in 2018,” a Newsom spokesman said.

The blind trust didn’t have anything to do, however, with Newsom calling top government officials — including the ones from the White House — to repeatedly and urgently encourage the bank be saved.

“Over the last 48 hours, I have been in touch with the highest levels of leadership at the White House and Treasury,” Newsom said.

“Everyone is working with FDIC to stabilize the situation as quickly as possible, to protect jobs, people’s livelihoods, and the entire innovation ecosystem that has served as a tent pole for our economy.”

Newsom is not the only one in his family who has ties to SVB. His wife, Jennifer Siebel, founded the California Partners Project, a charity that received a $100,000 donation from the bank in 2021.