(Jacob Bruns, Headline USA) Big-government apologists at the Los Angeles Times recently declared that the elite-caused Silicon Valley Bank crisis and its fallout is really a “blessing in disguise,” Legal Insurrection reported.

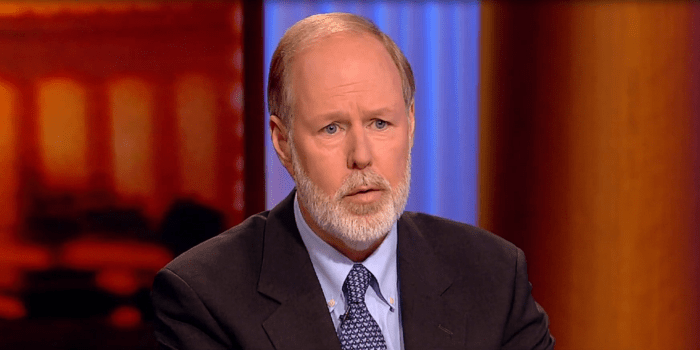

Times columnist Doyle McManus penned the op-ed, suggesting that the banking crisis might be a blessing because it will allow for further state intrusion into the banking industry, without the widespread disaster caused by the 2008 crisis.

“In the brief but spectacular collapse of Silicon Valley Bank, we may just have witnessed the best banking crisis ever,” McManus began.

McManus targeted libertarians in particular, noting that because they generally wish to avoid bank regulation by the federal government, it is fitting that many of them were victims of the crisis.

“Those Silicon Valley libertarians who spent years demanding that government get out of the way earned their comeuppance when they begged the Federal Reserve to save them,” he claimed.

However, there is no evidence that libertarians comprise a significant portion of SVB’s clients given the bank’s popularity with wealthy technocrats, many of whom had deposits that exceeded the FDIC’s insurance limit.

McManus’s strawman screed went on to attack Republicans, as well, for noticing that wokeness and banking—despite the best efforts of our elites—do not mix as well as they would like.

“Republican politicians provided a dose of comedy, blaming SVB’s financial blunders on the imaginary menace of ‘woke banking,'” he wrote. “There’s no evidence that the bankers’ political leanings, ‘woke’ or otherwise, affected their balance sheet.”

Analysts have pointed to the fact that SVB had no high-level executive overseeing risk, even while it was making rookie mistakes in it investment strategy, but that it did have a high-level “diversity” executive who seemed to influence many of its major policy decisions while devoting an inordinate amount of time to virtue-signaling over identity politics.

The “blessings” of the crisis, however, seem to have mostly made things worse for middle-class Americans, considering that they will foot most of the bill for the bailouts.

The crisis has seen the downfall of other banks besides SVB. The Swiss bank, Credit Suisse, as well as New York’s Signature Bank have both collapsed dramatically as well.

Credit Suisse gets a €54 BILLION bailout printed by Swiss Central Bank!

Head of Global Markets Philip Bunce said to be delighted.

Also known as Pippa as it is a 'trans woman' and is a key player in LGBTQ policy and sits as a woman on the board. pic.twitter.com/gxqTAMIvEy

— Warren Davis (@wdavis_OpRP) March 16, 2023

All three banks are expected to be bailed out or bought out by larger banks as the industry consolidates.

McManus echoed the sentiments of President Joe Biden and his administration, who, with Democrats in Congress, plans to use the crisis to magnify the federal government’s power.

“I’m firmly committed to accountability for those responsible for this mess,” Biden claimed last week. “No one is above the law—and strengthening accountability is an important deterrent to prevent mismanagement in the future.”

McManus concluded his piece by offering a word of thanks to federal regulators, who he believes saved the nation from financial disaster.

“If all financial crises could be resolved as quickly as this one, capitalism would be a little less scary.”