(Mike Maharrey, Money Metals News Service) India is swapping U.S. Treasuries for gold, providing a concrete example of de-dollarization.

As a Times of India report put it, U.S. Treasuries “seem to be losing favor.”

Meanwhile, the Indian central bank has been rapidly increasing its gold reserves.

“India’s central bank has shown a preference for increasing gold reserves instead of U.S. Treasury bills to strengthen its foreign exchange holdings. This is part of a broader global shift towards diversifying national reserves beyond dollar-based assets.”

As of the end of June, the Reserve Bank of India held 879.98 tonnes of gold, a 4.7 percent, 39.22-tonne increase in 12 months.

This reflects a longer trend. The RBI has been buying gold since 2017. Over that period, it has increased its gold reserves by over 270 tons.

In the midst of this buying spree, an Indian economist told the Times of India that the push to accumulate gold was based on both political and economic reasons. He said that the “reliability” of the U.S. dollar has “diminished, and noted the “noticeable decline” in confidence in U.S. dollar assets.

Another economist told the Times, “It makes a lot of sense (to invest in gold), given the increased volatility in the FX market, elevated interest rates in the U.S., and, of course, also as the central banks in each economy would like to diversify the asset classes in which they are parking their reserves.”

Meanwhile, India’s share of U.S. Treasuries has dipped. In June 2024, the U.S. Treasury reported that the Indian central bank held $241.9 billion in U.S. Treasury holdings. By June of this year, the level had dipped to $227.4 billion, a 6 percent decrease.

India ranks as the 14th largest foreign holder of U.S. debt.

An economist at IDFC First Bank told The Times of India that it’s clear the Indian central bank has been diversifying its reserve holdings away from U.S. Treasuries.

“Over the same period, there has been a rise in gold reserve holdings. This shift reflects and effort to diversify forex reserves and reduce the risk of revaluation loss due to U.S.-specific factors. For instance, worsening fiscal metrics of the U.S. government have kept yields elevated.”

The Times of India notes that this is part of a broader global trend.

“The declining share of dollar holdings indicates a widespread international trend towards diversifying foreign exchange reserves, driven by geopolitical tensions and trade disputes.”

The data bears this out.

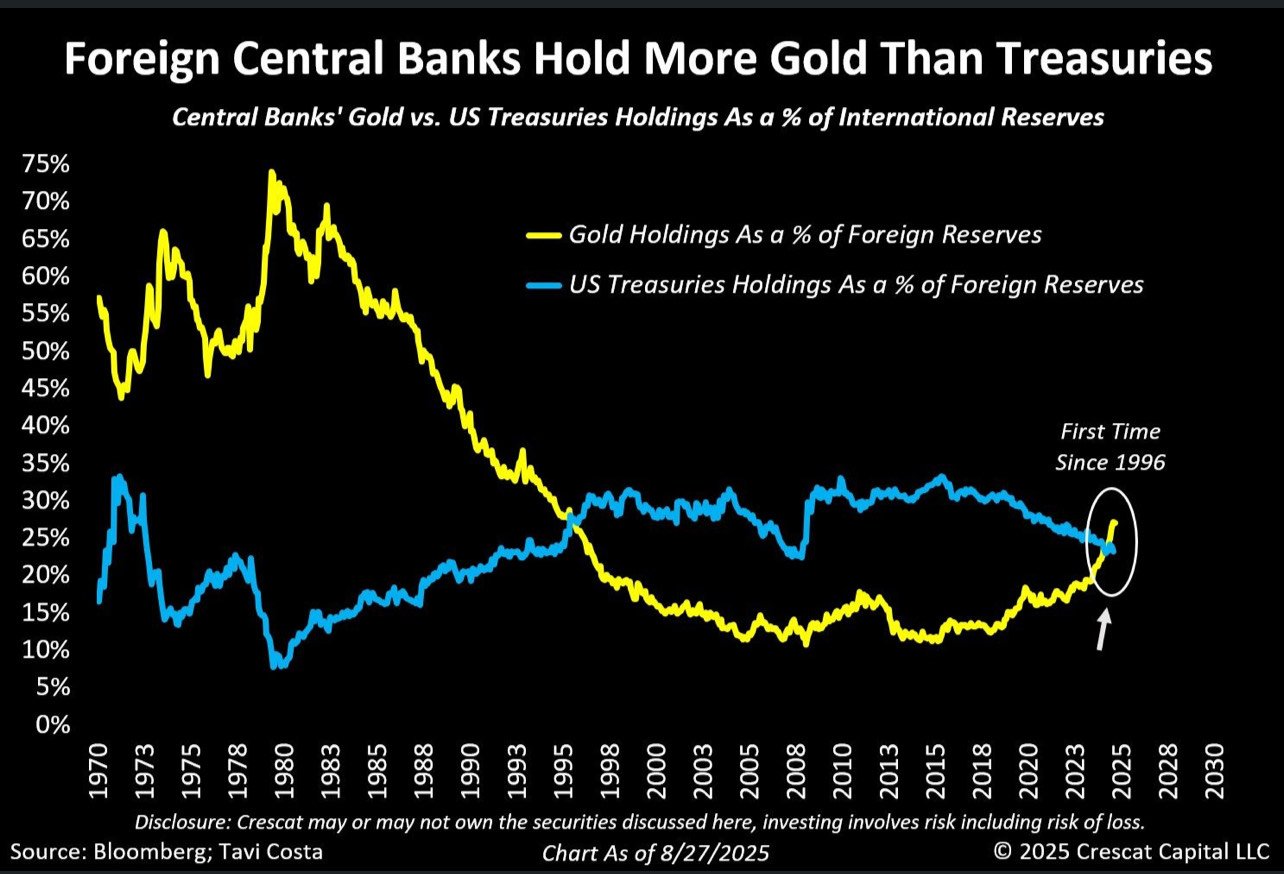

For the first time in nearly 30 years, foreign central banks hold more gold than U.S. Treasuries.

Why are so many countries spurning the dollar?

Many are concerned about the weaponization of the U.S. currency. In an article published by the Atlantic Council, Kimberly Donovan and Maia Nikoladze point out that “central banks that are worried about getting sanctioned, want to protect themselves from a potential global financial crisis, or both have been stacking up gold at record levels.”

There are also growing worries about the U.S. government’s fiscal irresponsibility. Earlier this month, the national debt surpassed $37 trillion, and there is no indication that borrowing and spending will slow down anytime soon.

As analyst Artis Shepherd explained, “The bond market is sending a message to the U.S. government that its spending is out of control and the reserve currency ‘privilege’ it has abused for the last 80 years is running out.”

So What?

The dollar isn’t in danger of collapsing or even losing its reserve status – at least not yet. However, even a modest de-dollarization spells trouble for the federal government and the U.S. economy.

In a nutshell, the United States needs the world to need dollars.

The U.S. depends on this global demand for dollars supported by its reserve status to underpin its massive government. The only reason Uncle Sam can borrow, spend, and run massive budget deficits to the extent that it does is the dollar’s role as the world’s reserve currency. It creates a built-in global demand for dollars and dollar-denominated assets. This absorbs the Federal Reserve’s money creation and helps maintain dollar strength despite the Federal Reserve’s inflationary policies.

WolfStreet summed up the risk the U.S. faces as the dollar’s status continues to erode.

“The status of the U.S. dollar as the dominant global reserve currency has helped the U.S. fund its twin deficits and thereby has enabled them: the huge fiscal deficit every year and the massive trade deficit every year. The reserve currency status comes from other central banks (not the Fed) having purchased trillions of USD-denominated assets such as Treasury securities, other government securities, corporate bonds, and even stocks. The dollar’s status as the dominant reserve currency has been crucial for the U.S., and as that dominance declines ever so slowly, risks pile up ever so slowly.”

While the threat isn’t immediate, a slowly growing pile eventually turns into a giant pile.

But again, even a modest de-dollarization will have significant impacts. If the world needs fewer dollars, they will begin to return to the U.S., causing a dollar glut. This will increase inflationary pressure domestically as the value of the U.S. currency further depreciates. In the worst-case scenario, the dollar could collapse completely, leading to hyperinflation.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.