(Jan Nieuwenhuijs, Money Metals News Service) The U.S. Treasury can draw up to $700 billion in new funding from its gold revaluation account at the Federal Reserve. And the Treasury could invest this “new money” in a sovereign wealth fund (increasing the money supply by an equal amount).

Using its gold revaluation account would emphasize gold’s strength versus the dollar, something the United States government has been trying to downplay for decades. This turn of events would be bullish for gold and weaken the dollar.

Introduction

I started writing about central bank gold revaluation accounts (GRAs) in 2022, to show how they can use a trick to write-off assets, such as government bonds, from their balance sheet with new money from their GRAs. The German central bank even wrote me in an email that it doesn’t rule out this possibility for the future.

Then I discovered how central banks have been using their GRAs to absorb losses, like the Central Bank of Curaçao and Saint Martin did in 2021. Coincidentally, as interest rates went up in 2022 and central banks globally experienced shortfalls, officials from the Dutch and German central banks commented that their massive GRAs underline the soundness of their balance sheets. Providing a solvency backstop, if you will.

Because of how modern central bank balance sheets are structured, GRAs can also be used to fund their respective Treasuries. Even the World Bank noted my writings, as it referenced my research on GRAs in a handbook for asset managers on why to invest in gold.

What Is a Gold Revaluation Account, and How Can It Be Used?

A gold revaluation account (GRA) is an accounting item on the liability side of a central bank balance sheet that records unrealized gains of gold assets.

When the price of gold denominated in fiat currency rises, as it inevitably does in the long run, gold assets increase in value, and concurrently, the GRA swells.

As a formula:

GRA = present gold market value – gold purchasing cost

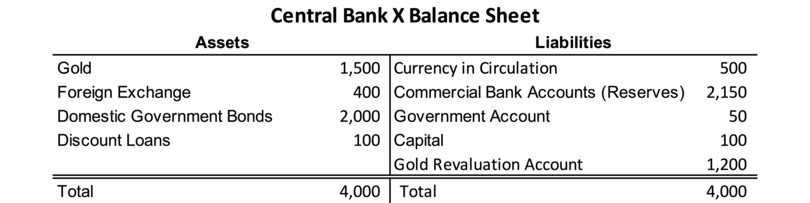

In this example, central bank X once bought gold for $300, and the present value of that gold has gone up to $1,500, creating a GRA of $1,200. Capital and the Gold Revaluation Account is the central bank’s equity.

In many textbooks you will read GRAs are meant to cushion a decline in the price of gold, but because gold is scarce and the denominator (fiat) on central banks’ balance sheets is not—visible in large GRAs of banks that own gold for a long time—there are far more creative possibilities for it.

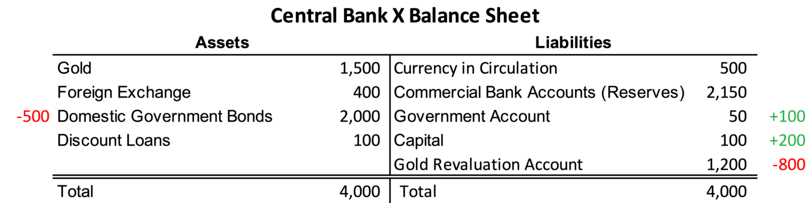

In the example below, I have illustrated that a central bank can transfer entries from its GRA to its own capital position and absorb losses (+200); to the government’s checking account held at the central bank (+100); or to write-off assets (-500).

It’s just numbers.

If central bank X draws $800 from its GRA, there is still (1200 – 800) $400 left to cushion a potential decline in the price of gold.

The American Setup

Take notice that the central bank of the United States owns not one ounce of gold. With the Gold Reserve Act of 1934, the Federal Reserve transferred all its monetary gold to the Treasury in return for a special series of gold certificates valued at $35 an ounce. These gold certificates are purely an accounting item and can’t be redeemed for gold.

Because the U.S. has always been reluctant to raise the statutory price of the gold in its books to downplay the strength of gold versus the dollar, the Fed’s gold certificates today are still valued at 42.22 dollars an ounce, a price approved by Congress during the demise of Bretton Woods in the early 1970s.

On February 3, 2025, President Trump signed an executive order for the creation of a sovereign wealth fund within one year. Standing next to him when he signed the order was Treasury Secretary Scott Bessent, who told reporters, “We’re going to monetize the asset side of the U.S. balance sheet for the American people.”

What asset can that be? He could be referring to selling off federal lands or vacant government office buildings, but the Financial Times speculated on February 7 that it’s a reference to gold:

Some hedge fund contemporaries of Scott Bessent, the hedgie-turned-US Treasury secretary, are speculating about a revaluation of America’s gold stocks.

This week, such chatter intensified after Bessent both pledged to “monetise the asset side of the US balance sheet” — in other words, to focus on assets as much as liabilities — while also promising to lower 10-year Treasury yields.

Perhaps the Trump administration does want to draw on the Treasury’s gold revaluation account at the Fed, as happened in 1972 when the official gold price was raised from $35 to $38, and in 1973 from $38 to $42.22 an ounce.

Doing so would allow the Treasury to spend hundreds of billions of dollars without increasing the national debt.

Step one would be for Congress to approve an increase in the official price of gold. Step two is for the Treasury to issue new gold certificates for the Federal Reserve.

Once the value of the Fed’s gold certificates on its balance sheet goes up, the Treasury’s checking account at the Fed, commonly referred to as the Treasury General Account (TGA), increases by the same amount.

As the Fed doesn’t own any gold, a windfall from the revaluation of its gold certificates is for the owner of the physical gold, which is the Treasury. Note that when GRAs are used for spending, it creates new money and thus has to be done through central banks. Welcome to the wonderful world of accounting!

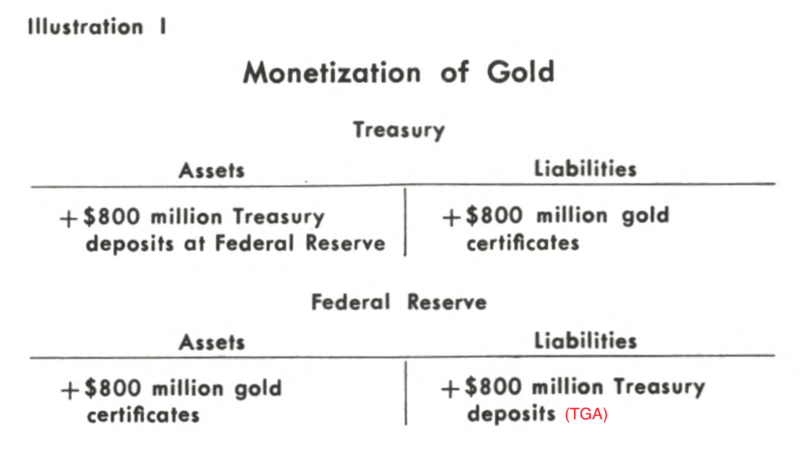

The below illustration is from a paper by Albert E. Burger, published by the Federal Reserve Bank of St. Louis in 1974: “The Monetary Economics of Gold.” When, in 1972, the statutory price of gold was revalued to $38 from $35 an ounce, the TGA increased by roughly $800 million.

H/t John Paul Koning. The same procedure is described in the Financial Accounting Manual for Federal Reserve Banks, published in April 2024 (page 12).

From A. E. Burger:

On May 15, 1972, the Treasury took steps to monetize the increased value of the gold stock. This occurred as follows: the Treasury issued to the Federal Reserve Banks gold certificates equal to the increased official dollar value of the gold stock and, in return, the Treasury received from the Federal Reserve an increase of an equal amount in its deposits at the Federal Reserve Banks [TGA].

Following the revaluation of the U.S. monetary gold in 1972, the Treasury spent $800 million at the private sector—without selling an ounce of gold—increasing the monetary base (reserves) and broad money supply (deposits) by an equal amount.

How Much Can Trump Spend?

Currently, the Treasury owns 8,133 tonnes of gold valued at $42.22 an ounce, which equals $11 billion, while the prevailing market value of the gold is roughly $750 billion.

Treasury can deplete its gold revaluation account via the Fed in full but then runs the risk that the free market price of gold falls below the new U.S. statutory price, which would undercollateralize America’s balance sheet.

So, either Trump draws less than $750 billion from this trick, or he takes it all and puts a floor under the free market price of gold, which brings us one step closer to a gold standard. Either scenario would be bullish for gold, highlighting its role in the monetary system.

The Federal Reserve could counter the Treasury’s expansion of the monetary base by selling bonds, but this would drive up interest rates, which is not what Trump wants. Trump, firmly in charge since in office, is thought to want a weaker dollar to boost exports.

Expanding the monetary base by drawing on the United States’ GRA would do just that and allow him to invest in a sovereign fund. Two birds with one stone.

Sources:

Board of Governors of the Federal Reserve System (2024): Financial Accounting Manual for Federal Reserve Banks

Federal Reserve Bank of St. Louis (1974): The Monetary Economics of Gold

Financial Times (2025): Gold glitters as the unimaginable becomes imaginable

Myrmikan Capital, LLC (2025): Gold Revaluation

Nieuwenhuijs, Jan (2022-2024): German Central Bank Doesn’t Rule Out Gold Revaluation, Governor Dutch Central Bank States Gold Revaluation Account Is Solvency Backstop, How a Central Bank in the Caribbean Recently Used Its Gold Revaluation Account to Cover Losses, German Central Bank: Gold Revaluation Account Underlines Soundness of Balance Sheet, How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress, World Bank Report Highlights Advantage of Central Bank Gold Revaluation Accounts

Reuters (2025): Trump orders creation of US sovereign wealth fund, says it could buy TikTok

Originally a sound engineer in the Dutch movie industry, Jan Nieuwenhuijs has devoted the last decade to in-depth gold market research. His commentary and analysis has earned him international recognition as a top expert on the Chinese gold market, the COMEX futures market, the London Bullion Market, and the Turkish gold market. At Money Metals, he writes about the international monetary system, central bank gold policies, the mechanics of the global gold market, the gold price, and economics in general.