(Brien Lundin, Money Metals News Service) Gold’s back in the mode of setting a new record high (almost) every day.

Sure, it’s taking a break today, down a few dollars after a torrid run over the past week.

In fact, just last week, we were ecstatic that gold was barreling toward $2,800. Now the metal has $2,900 directly in its sights.

I think it’s going much higher on this run. Frankly, it seems to me that gold is now aiming for the magical $3,000 level.

As to why gold is rocketing higher while other markets are falling or teetering, that’s an even more interesting and compelling story.

Gold “Wants” To Go Higher

A powerful sign of a bull market is when seemingly bearish news or data is instead interpreted bullishly by investors.

As I’ve said numerous times over the years, and particularly over the course of this one-year-old gold rally, it’s instances like these when gold seemingly “wants” to go higher.

That’s just where we are now — at a time when even a strong dollar or rising Treasury yields can’t deter gold’s upward trajectory.

So what’s really behind this latest move in the metal?

Well, that tariff kerfuffle, which seemed to be the rationale behind gold’s price jumps earlier this week, came and went in a flash. So, we’ll need to dig a bit deeper to see what’s truly worrying investors.

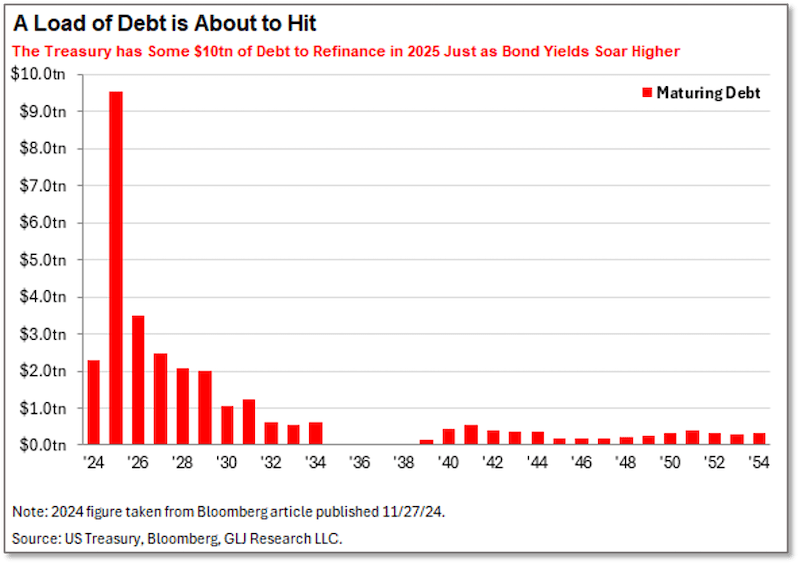

Frankly, I think this chart has a lot to do with it:

As you can see, there’s a veritable tsunami of Treasury debt that’s about to hit — nearly $10 trillion in Treasury securities that will have to be rolled over in 2025 — a total far exceeding any other in history.

This is a time bomb that Janet Yellen gleefully left for President Trump’s new Treasury Secretary Scott Bessent. Good luck to him…and good luck to investors everywhere when this bomb goes off over the weeks and months ahead.

The bottom line is that the Fed and the U.S. Treasury are mired in a classic debt trap, with the federal debt simply far too large to be managed at current interest rates.

Bond investors realize this, see the massive flood of Treasury issuance looming ahead, and are bidding rates up even higher in anticipation.

There’s simply no way out. And now, after 45 years of ever-easier money and ever-greater debts, the reckoning is coming due.

Again, investors around the world are realizing this. As a result, we’re seeing an unprecedented flood of demand for physical gold in London and New York — the vaults of the London Bullion Market Association and the Bank of England, as well as the Comex, are being drained.

The wait time for delivery from the Bank of England has gone from days to weeks, putting the staid institution in technical default on its obligations.

These are the reasons why gold is soaring right now and why the metal wants to go much higher.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.