(Mike Maharrey, Money Metals News Service) Those golden bulls have grabbed some attention.

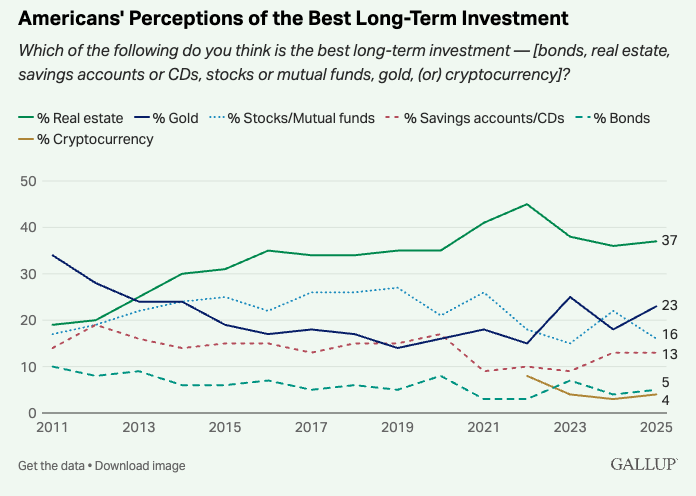

According to the latest Gallup poll, gold has overtaken stocks and is now viewed as the second-best long-term investment in America, trailing only real estate.

In the latest survey, 23 percent of the respondents chose gold as the best long-term investment. That was up five points from last year’s poll.

Thirty-seven percent of the respondents chose real estate as the best investment. That was virtually unchanged from a year ago.

Real estate has ranked as the top investment for Americans each year since 2014, with between 30 percent and 45 percent selecting it.

The number of Americans choosing stocks as the top investment fell 6 percentage points to 16 percent.

Thirteen percent of Americans chose savings accounts or CDs as the best option for long-term returns, 5 percent picked bonds, and 4 percent said they prefer cryptocurrency. Those numbers were all in line with last year’s readings.

Gallup said the poll was mostly conducted after President Trump announced sweeping tariffs last month, sparking a sharp stock market selloff. Even with a pause on some tariffs and apparent progress in negotiating trade deals, stock market volatility has remained high.

Gold’s appeal still hasn’t reached the popularity it enjoyed in 2011 at the height of the Great Recession and aggressive quantitative easing (money creation) by the Federal Reserve, when 34 percent of Americans polled chose it as the top asset.

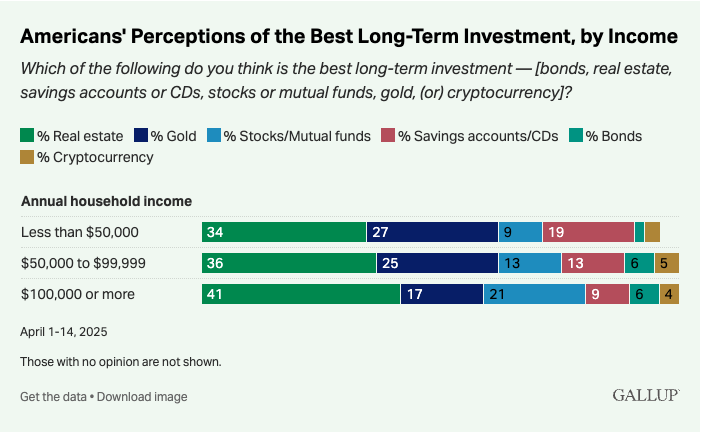

According to Gallup, there is a notable difference in investment preferences between income groups, with higher earners preferring riskier investments such as stocks, and lower-income groups choosing the perceived safer options such as gold and cash.

Twenty-seven percent of respondents making less than $50,000 chose gold. That percentage fell to 17 percent for those earning $100,000 or more.

This could explain why, despite the professed preference for gold, American investors have largely been absent from the recent gold rally. Investors in the East – particularly China – have primarily driven this gold bull run.

China reported the second strongest quarter for gold coin and bar demand on record in Q1. Demand for gold is so strong in China that the government recently allocated additional gold import quotas for commercial banks last month.

Meanwhile, in the U.S., gold coin and bar demand dropped to the lowest level in almost five years.

According to a survey by Retirement Living, just over 10 percent of Americans own gold. According to the Gallup survey, 62 percent of Americans report owning stocks, either separately or through a mutual fund or 401(k).

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.