(Mike Maharrey, Money Metals News Service) Because we tend to look at gold’s performance in dollars, it’s easy to forget that it is also priced in other currencies.

We know that gold set records in dollar terms, but, how did it perform in other countries?

In most currencies, it did even better.

For instance, gold had a record-setting year in Australia as well, helping protect Australian investors from the rapid depreciation of their currency.

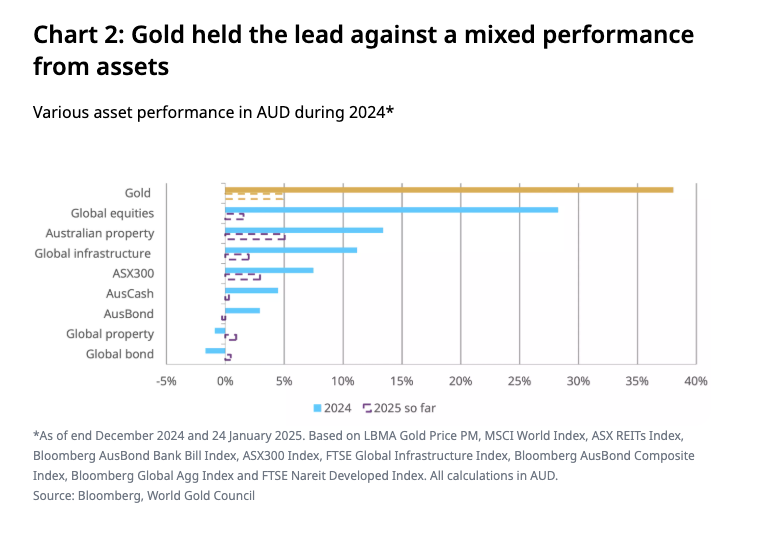

Priced in dollars, gold ranked as one of the best-performing assets in 2024. In Australia, it was far and away the best-performing asset.

The price of gold surged by 38 percent in Australian dollars (AUD) in 2024, surpassing global equities by about 10 percent.

According to the World Gold Council, “Strong investment demand, rising geopolitical risks, and a weaker AUD supported gold’s rally.”

The Dollar: The Cleanest Dirty Shirt in the Laundy

This big surge in the gold price primarily reflects the rapid devaluation of the Australian currency. The AUD fell by about 10 percent against the dollar.

As you’re reminded every time you go to the store, the value of the dollar is rapidly depreciating. Unfortunately for many, other fiat currencies around the world are devaluing even faster.

People often refer to the dollar as the cleanest dirty shirt in the laundry. It is devaluing, but not quite as quickly as many other global currencies. But do you really want to wear a dirty shirt?

Gold is the clean shirt in the drawer. It holds its value as fiat currencies, including both the U.S. and Australian dollars, decline. Gold is real money, as evidenced by its performance in the recent inflationary surge.

Analysts at the World Gold Council expect gold to continue to perform well for Austrailians in 2025. The yellow metal is already up another 4 percent in AUD terms.

The Australian central bank is expected to begin cutting interest rates. It has held its rates steady, even as the Fed has eased. Meanwhile, the Australian economy has been in a malaise. According to the WGC, “Restrictive financial conditions, declining real income, and cooling momentum in the housing sector all weighed on Australian growth in 2024. Even if markets are right about cuts, the absolute level of rates and their lagged impacts could continue to chip away at the economy’s resilience.”

“In conclusion, after an exceptionally strong year, we believe gold has the potential to continue to shine in 2025. Although the macro environment this year may bring some headwinds, the global geopolitical landscape and risks stemming from financial markets are certain to attract attention from official institutions and retail investors. Meanwhile, the potential risk of AUD weakness could make gold more attractive in local investors’ portfolios. And over the longer term, we anticipate that gold will deliver a stable return in line with global nominal GDP growth.”

The performance of gold in AUD underscores its role as an inflation hedge. While the dollar may be stronger, it’s not strong. American investors should consider this as they adjust their portfolios for the years ahead.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.