(Jesse Colombo, Money Metals News Service) Today marks a historic milestone as the spot price of gold has officially closed above $3,000 an ounce for the first time! While gold futures—typically priced higher than spot gold—briefly tested this level last week, they failed to hold above it.

However, yesterday’s close confirms a true breakout, solidifying this critical psychological threshold.

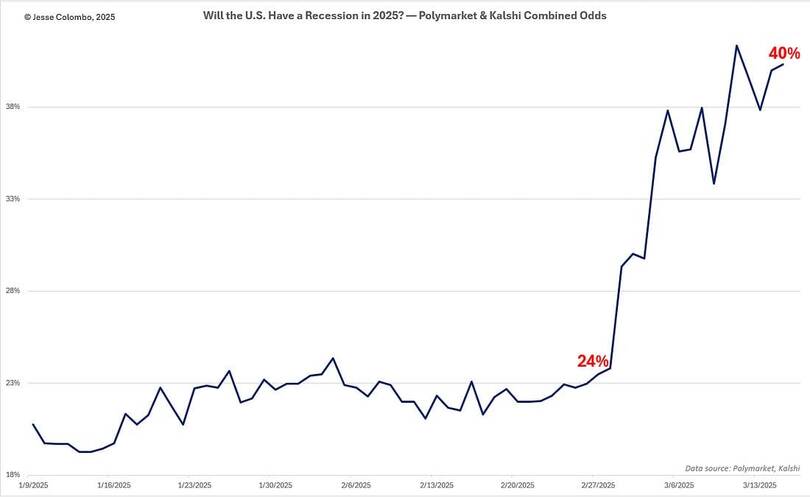

The primary driver behind gold’s recent surge is mounting economic uncertainty and the increasing risk of a recession—something I’ve been warning about for months.

Yesterday’s developments further validate these concerns, including U.S. Treasury Secretary Scott Bessent acknowledging the possibility of a recession, a weaker-than-expected retail sales report, and a sharp decline in New York State factory activity.

Now, let’s dive into the technicals, starting with COMEX gold futures, which I find more useful for analysis than the spot price since $100 increments in COMEX gold often serve as key support and resistance levels.

As shown in the chart below, gold futures repeatedly tested the $2,900 support level before rebounding, signaling strength.

Now, with COMEX gold futures officially breaking above the critical $3,000 mark, we’ve entered blue sky territory—meaning no clear resistance levels overhead, suggesting a smoother path forward. That said, I’d keep an eye on $3,100 as the next potential target and hurdle.

China’s gold benchmark, the Shanghai Futures Exchange (SHFE) gold futures, broke out of the 590–640 trading range in late January—a strong bullish signal.

More recently, it confirmed this momentum by breaking out of a bull flag pattern, reinforcing the uptrend. As the world’s largest producer of gold—producing 370 metric tons in 2023—and one of its largest consumers, China plays a pivotal role in the global gold market.

For months, I’ve theorized that a resurgence of Chinese gold futures traders—who were instrumental in driving gold’s surge in March and April—could be the catalyst to propel prices toward $3,000 and beyond. I believe that the recent bullish breakouts will turn that forecast into reality.

While gold mining stocks have largely lagged behind gold’s surge over the past year, I’ve predicted that they would finally gain momentum once gold surpassed $3,000 and sentiment in the precious metals sector—especially in the West—heated up.

Sure enough, this shift appears to be underway, as evidenced by the action in the large-cap VanEck Gold Miners ETF (GDX), which recently broke out of a long-term triangle pattern dating back to 2011—a highly bullish development.

For confirmation, I’m watching for GDX to close decisively above the key $42–$46 resistance zone, and it looks like that moment is approaching. I’ll be keeping a close eye on it.

Likewise, the VanEck Junior Gold Miners ETF (GDXJ) broke out of a long-term triangle pattern in early 2024, signaling the start of a new bull market.

For full confirmation, I’m now watching for a decisive close above the key $50–$60 resistance zone, which would solidify the bullish trend and open the door for much further upside.

The rising risk of a recession is a key driver behind the recent surge in the precious metals market:

The gold and silver bull market is still in its early stages for several reasons, including the breakdown of the Dow-to-Gold ratio—signaling that capital is currently rotating from stocks into gold.

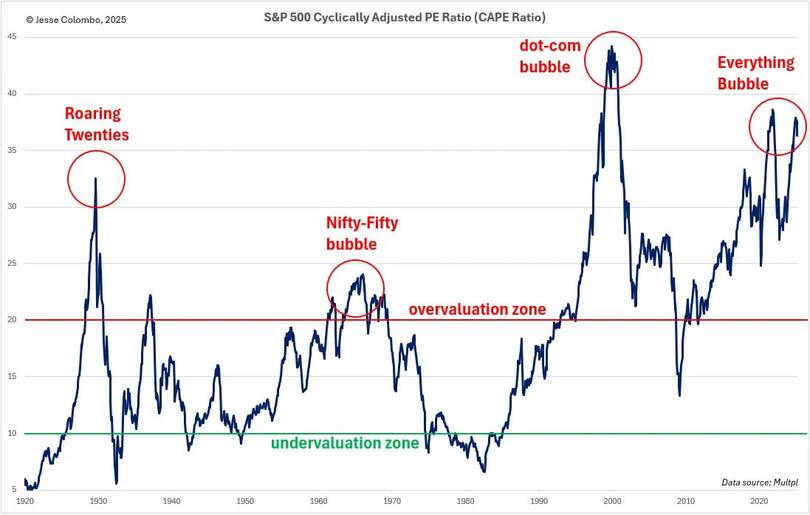

This shift will accelerate as the stock market bubble bursts.

There are numerous signs that the U.S. stock market is in a massive bubble, one that will end disastrously—triggering a significant capital shift into gold, silver, and mining stocks.

For example, the chart of the S&P 500’s cyclically adjusted PE ratio reveals that stocks are currently more overvalued than they were in 1929, just before the stock market crash and the Great Depression!

In summary, no matter how you look at it, gold is in blue sky territory—it’s gold’s time to shine. With no clear resistance overhead and the trend decisively upward, the best approach is to align with the momentum rather than fight it.

This is the moment we gold bulls have been waiting for, so enjoy it! I believe gold still has plenty of upside potential, fueled by the rising risk of a recession and an overinflated stock market that has barely begun to unravel.

As gold thrives, I expect mining stocks and silver to follow suit. These are exciting times, and we’ve earned this moment for staying true to gold when it was overlooked in favor of high-tech, speculative assets. Now, as those gimmicks fall out of favor, people are waking up to the true value of precious metals.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.