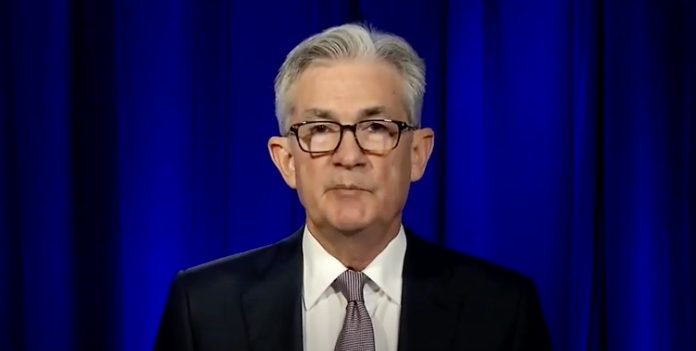

(Mike Gleason, Money Metals News Service) Precious metals markets are rallying on some early Friday remarks from Jerome Powell.

The Federal Reserve chairman is speaking at the Jackson Hole virtual gathering of central bankers Friday and Saturday, and he started off by emphasizing the view that high inflation readings will come down soon.

There is still a question of whether anything has changed since the last Fed policy meeting. There, Fed officials had suggested they may soon begin tapering their asset purchases.

Something that could give the Fed’s money masters an excuse to back down on tapering is the recent global surge in COVID cases linked to the Delta variant.

Some countries including Australia are back in full lockdown mode. In the United States, mask mandates are back in many of the more authoritarian jurisdictions and vaccine requirements are increasingly being imposed by businesses and local governments.

Just a few weeks ago, President Joe Biden had touted the vaccine as a ticket to freedom from mask mandates. Now his team of government health bureaucrats is telling everyone to wear masks, calling for more contact tracing, and warning that additional vaccine booster shots will be necessary.

The risk is that the virus keeps mutating to thwart every effort aimed at achieving herd immunity. But optimists on Wall Street are pricing in a robust economic recovery to continue in spite of the threats from the virus and Fed tapering.

It’s unlikely the central bank will get very far into tapering if Wall Street decides to throw a tantrum. The Fed may also face pressure from the big-spending Biden administration to reverse course and ramp up its bond purchases.

Given the political realities, capitalist and commentator Steve Forbes argued in his latest “What’s Ahead” commentary that tapering will likely be short lived.

Steve Forbes: Now, concerning tapering, every month, the Fed has been buying $120 billion of government bonds and mortgages. Thanks to COVID-19 stimulus bills passed by Congress and money previously created by the Federal Reserve out of thin air, the financial system today is awash in liquidity. Corporations hold trillions in cash, banks are loaded with lendable funds, consumer checking accounts are at record levels.

Given all this, the continuation of the scale of the Fed’s bond-buying should be fueling far worse inflation than what we’ve been experiencing. This gets to the fact that the Fed will not be in control of its destiny if Congress passes President Biden’s humongous spending bills. The central bank will face irresistible pressure to buy bonds to help finance this extravagance.

If investors are overestimating the Fed’s ability to rein in liquidity, then they may be underestimating inflation risk and undervaluing precious metals. Gold and silver markets have lagged this year but are showing signs of gathering strength in recent days.

This week gold prices are up 1.5% to trade at $1,814 an ounce. Silver shows a weekly gain of 3.8% to bring spot prices to $23.97 per ounce. Platinum is up by 0.7% since last Friday’s close to come in at $1,015. And finally, palladium is putting in a weekly advance of 6.9% to command $2,471 an ounce as of this Friday morning recording.

Precious metals markets have been basing out during these summer months. While the price action has been frustrating for bulls, it may ultimately be healthy for the long-term bull market outlook. The bigger the base, the bigger the directional move that can follow.

An investor rush into gold and silver for protection from inflation, negative real interest rates, and systemic risks in financial markets remains to fully play out.

There have certainly been many great gold rushes and spectacular booms and busts throughout history. One of the most famous gold manias occurred during the late 1890s in the Klondike region of Canada.

Many prospectors made their way there through a grueling journey on foot from the Alaska panhandle. They risked everything for a chance to strike it rich. A few did. Most didn’t. Many lost everything, including their lives, in pursuit of hitting paydirt.

2021 marks the 125th anniversary of the discovery that inspired gold fever in the Yukon territory. Skookum Jim Mason, his nephew Dawson Charlie, Kate Carmack, and her husband George Carmack made the famous find. Word spread and the rush was on the following summer.

The Klondike gold rush lasted just three short years. But its legacy has been memorialized in special release one ounce gold coins from the Royal Canadian Mint. The 2021 Klondike Gold Rush Series “Panning for Gold” coins are struck in .99999 fine gold. That’s “five nines” – making them the purest gold coins in the world.

The unique design is of a gold pan, with a rich find of nuggets. Each single coin comes attractively packaged in a certified assay card holder. It will make a fine addition to any collection without entailing a high collectible’s premium when purchased from Money Metals Exchange.

Investors who want to participate in the next great gold rush or silver rush need not risk it all like earlier prospectors did. They simply need to convert their depreciating currency and their at-risk financial assets into physical bullion – ideally before the next buying rush begins.

For now, bullion market conditions are favorable to buyers. Spot prices are depressed, premiums have come down, and availability is plentiful for most products…Original Source…

Mike Gleason is a Director with Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. Gleason is a hard money advocate and a strong proponent of personal liberty, limited government and the Austrian School of Economics. A graduate of the University of Florida, Gleason has extensive experience in management, sales and logistics as well as precious metals investing. He also puts his longtime broadcasting background to good use, hosting a weekly precious metals podcast since 2011, a program listened to by tens of thousands each week.