(Mike Maharrey, Money Metals News Service) Federal Reserve Chairman Jerome Powell gave the clearest indication yet that more inflation is in the pipeline during his Jackson Hole Speech on Friday.

Powell indicated rate cuts are on the horizon, saying, “The time has come for policy to adjust, adding that “the direction of travel is clear.”

But Powell stopped short of saying exactly when and how quickly the central bank would trim interest rates.

“The timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Nevertheless, Powell all but declared victory over price inflation, saying, “My confidence has grown that inflation is on a sustainable path back to 2 percent.”

He also insisted that a soft landing remains in play, saying, “There is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market.”

A Return to Inflationary Policies

While virtually nobody will say it out loud, this so-called victory over price inflation sets the stage for a return to inflationary policies.

While it didn’t create much of a stir in the mainstream financial media, the Federal Reserve already eased monetary policy when it began slowing balance sheet reduction in June. Instead of allowing $60 billion in U.S. Treasuries to come off the balance sheet each month, it capped the runoff at $25 billion.

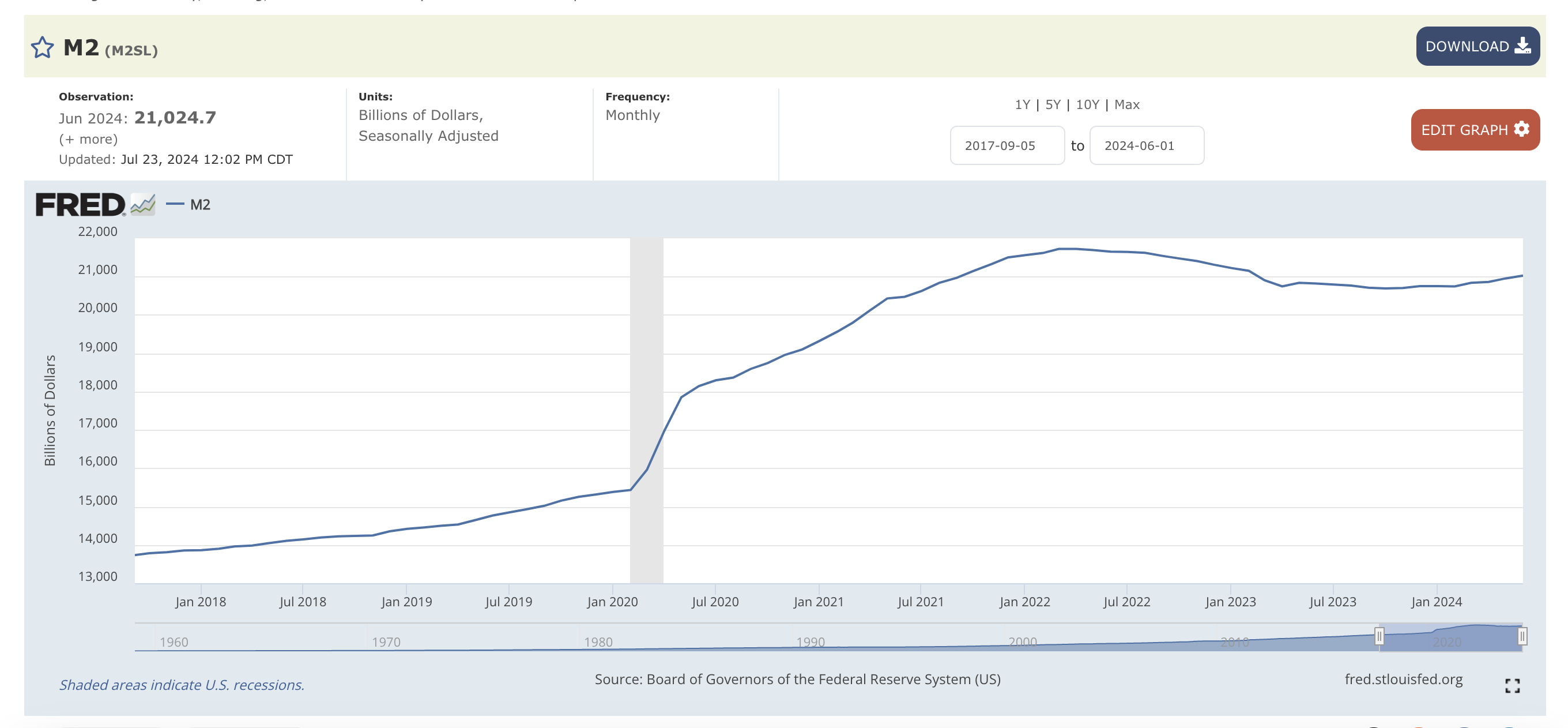

Slowing and ultimately ending balance sheet reduction and lowering interest rates will increase the money supply, and the expansion of the money supply is, by definition, inflation.

Inflation is an expansion of money and credit. Price inflation is one symptom of inflationary policy.

The Fed has tightened things up just enough to slow rising prices, but it hasn’t come close to running wringing the pandemic-era inflation out of the economy. The central bank pumped nearly $5 trillion into the economy through quantitative easing alone. That was on top of the credit expansion incentivized by artificially low interest rates. It has only shrunk the balance sheet by about $1.8 trillion.

In fact, the Fed never substantively shrank the balance sheet after the 2008 financial crisis despite Ben Bernanke saying, “Ultimately, at the right time, the Federal Reserve will normalize its balance sheet,” in February of 2011.

Apparently, that time has yet to come.

Meanwhile, interest rates are higher than they were, but from a historical perspective, the current rate environment is close to normal.

Today, most of the inflation created during the pandemic and the Great Recession is still sloshing around in the economy.

And now, by slowing balance sheet reduction and signaling interest rate cuts, the Fed is telling you it plans to ramp up the inflation machine.

As you can see from this chart, the money supply is already starting to increase.

Powell Dodges the Real Cause of Inflation

During his Jackson Hole talk, Powell confessed that the stickiness of price inflation took him by surprise. You might remember that during the 2021 Jackson Hole speech, Powell doubled down on the “inflation is transitory” narrative.

Powell pinned the inflation problem on “supply chain issues” and said policymakers at the Fed were surprised they didn’t clear up sooner. Powell said they expected the problems to fade “fairly quickly without the need for a monetary policy response” — in short, that “the inflation would be transitory.’’

Powell has never acknowledged that pumping trillions of dollars into the economy and handing out trillions in stimulus to people who weren’t producing anything were at least two factors in the post-pandemic inflation surge.

This might explain why nobody seems to grasp the fact that this monetary policy pivot is, in fact, a return to inflationary policies, albeit at a much more modest pace than during the last two economic crises.

But of course, there is no guarantee an economic crisis isn’t still on the horizon. Despite Powell’s victory lap and mainstream optimism about a soft landing, it is highly likely this higher interest rate environment has already broken things in the economy. In fact, it has already precipitated a financial crisis that the central bank managed to bury under the surface with a bailout.

History tells us that it takes quite a while for the impacts of interest rate changes to manifest in the economy. The Federal Reserve began cutting interest rates in the fall of 2007, a full year before the 2008 financial crisis.

If the Fed is already committing to a return to inflationary policies when the economy is supposedly strong and robust, what is going to happen when the next crisis unfolds?

If history is any indicator, it will slash interest rates to zero and launch quantitative easing.

It’s also important to remember when you hear Jerome Powell and other policymakers talking about “controlling” inflation, they don’t mean getting rid of it. Inflation is the Fed’s stated policy.

It would be wise to brace yourself for more inflation – from now to eternity.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.