(Mike Maharrey, Money Metals News Service) So, boss, about that pay raise… Do you feel like you’re taking two steps forward and three steps back?

Well, no matter what Paul Krugman or Joe Biden tries to tell you, it’s not your imagination.

Sure, you’re probably making more money than you were three years ago. But you can’t buy nearly as much stuff.

Price inflation has eaten up your paycheck.

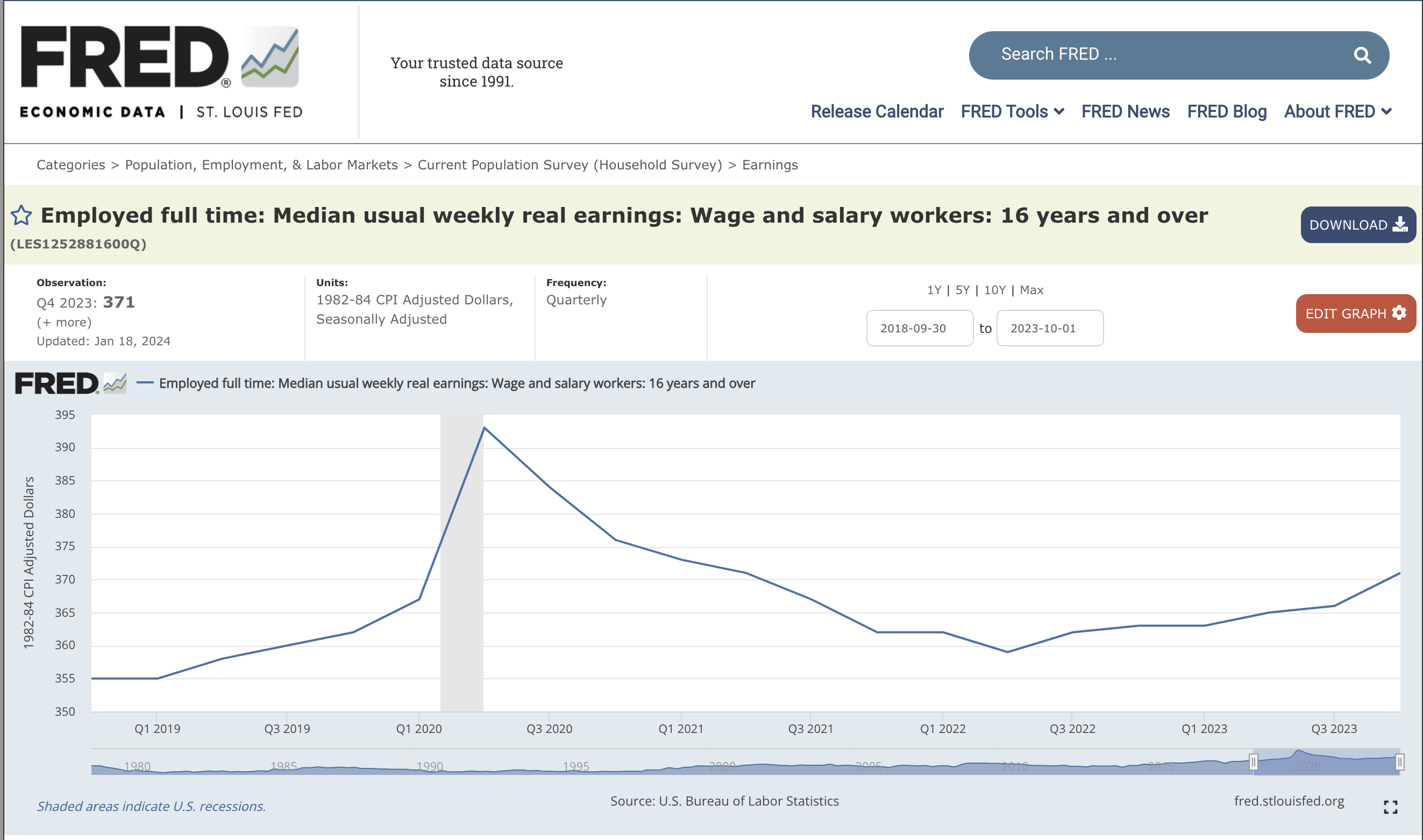

After a stimulus-fueled peak during the pandemic, real hourly wages adjusted for price inflation as calculated by the CPI plummeted. They fell month after month for nearly two straight years.

For instance, from September 2021 to September 2022, workers got a 5.2 percent raise as nominal wages increased. That sounds good, doesn’t it?

But when you factor in price inflation, real wages declined by 3 percent. In effect, you got a 3 percent pay during that 12-month period.

And the reality is even worse. These numbers are based on a government-rigged Consumer Price Index. Price inflation would be at least double the official rate if the Bureau of Labor Statistics used an honest CPI formula. That means the decline in real wages is close to double what they’re telling you as well.

It wasn’t until Q2 2022 that real wages started to play catch up with soaring costs. But even today, real wages have not recovered to pre-pandemic levels.

Pause and think about what that means for your family. You’re working just as hard as you were in 2019. You probably got “rewarded” with a pay raise. But you can’t afford as many goods or services today as you did then.

Gaslighting You on Inflation

This undercuts a popular narrative when it comes to price inflation.

The powers-that-be claim rising prices don’t actually hurt the average person because wages rise along with prices. Yes – you have to pay more for everything. But ostensibly you’re earning more, so it’s a wash. You’re no worse off.

Of course, you know you’re worse off because you’re living it.

And the data proves it.

The truth is earnings rarely rise at the same pace as prices. Wages almost always lag significantly. That means price inflation puts a significant squeeze on your pocketbook, at least in the short term until (if) your earnings catch up.

And if you happen to be somebody living on a fixed income or savings, you’re really screwed, as inflation rapidly eats away your purchasing power, and your income streams don’t increase at all. Price inflation always causes the most pain for the poor and elderly.

But the government people and their supporting cast in the media and academia need the inflation tax so, they try to tell you everything is fine.

You’ve probably noticed that the Federal Reserve operates with a stated policy to maintain price inflation at 2 percent. This is supposedly the Goldilocks CPI rate. By the way, nobody can tell you why 2 percent is the magic number. Just take their word for it.

Regardless, your purchasing power is supposed to decrease by 2 percent every year. That might not sound like a lot, but consider it becomes a 10 percent in purchasing power every decade.

And of course, it’s much worse than this during inflationary cycles like the one we just experienced.

But even though American wages continue to chase prices, economists keep telling us that American consumers are “healthy.” After all, they continue to spend. Retail sales have generally increased. How is this possible?

Credit cards.

Americans have turned to plastic to make ends meet as prices continue to skyrocket. Consumer debt topped $5 trillion for the first time ever in November.

As prices skyrocketed in 2021 and 2022, Americans blew through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. As of June, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans ran through $1.9 trillion in savings in just two years.

Then they turned to credit cards.

Credit card spending slowed through the fall, but Americans burned the plastic in November with a vengeance. Revolving credit, primarily made up of credit card debt, rose by $19.1 billion, a whopping 17.7 percent increase.

To put the percentage increase into perspective, the annual increase in 2019, before the pandemic, was 3.6 percent.

It doesn’t take a Ph.D. in economics to realize that this does not scream “healthy” consumers.

This Is What Government Has Done to Your Money

You hear a lot of economists and talking heads on financial news networks claiming that wages heating up could cause the economy to relapse into an inflationary period. This is just silly. You don’t cause price inflation by working. The Fed and the government cause price inflation by creating money out of thin air.

They did it with a vengeance while most of America was home playing video games during the pandemic. We felt the results in 2022. But it’s important to remember that the Fed and the government play the money creation game constantly. It just got away from there for a bit, and you noticed.

The reality is declining real wages are indicative of what the U.S. government and the Federal Reserve have done to your money. And it’s inevitable when you have a fiat currency detached from real money – gold and silver.

President Richard Nixon severed the dollar from its last connection to the gold standard in 1971 making it a pure fiat currency backed by nothing. When he announced the closing of the gold window, Nixon said, “Let me lay to rest the bugaboo of what is called devaluation,” and promised, “Your dollar will be worth just as much as it is today.”

He lied.

Based on the CPI calculator, the dollar has lost more than 85 percent of its value since that fateful day. The purchasing power of a 1971 dollar equals about 13 cents today.

Meanwhile, the dollar value of gold increased from $35 an ounce to over $2,000 an ounce today. In percentage terms, that’s a 5,614 percent increase.

This underscores the importance of preserving your wealth with real money. If you just put dollars in the bank, your purchasing power will continue to erode day after day.

Again – this is a matter of policy.

So, don’t let them fool you. This is not OK. You are not fine. Inflation is not good for you.

But you can protect yourself by holding real money.