(Brien Lundin, Money Metals News Service) Gold continues to explode higher as fractures spread in the global gold market.

I’ve been reporting on the extraordinary gold flows of recent weeks, which have been driving the price of gold to record levels.

Those mysterious flows, generally blamed on concerns over potential U.S. tariffs on gold and silver, have combined with other factors to indicate that something much deeper and more compelling is happening.

In short, it appears that cracks are now spreading in the global gold market infrastructure, with tremendous implications for the price of the metal.

A Stunning Picture Emerges

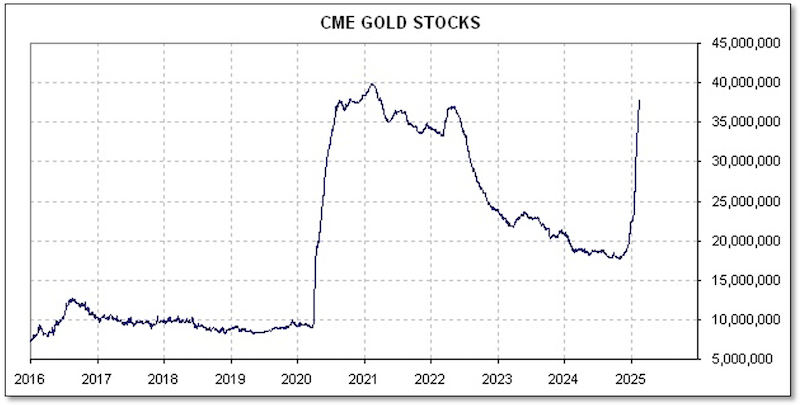

The following two charts, courtesy of our friend Nick Laird at his highly recommended GoldChartsRUs site, paint a remarkable picture. The first chart shows how gold from around the world, and primarily from London, is flooding into the New York vaults of Comex:

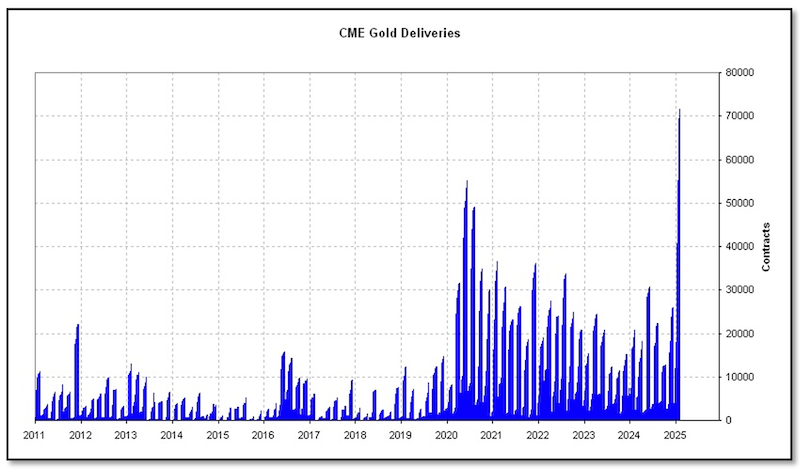

The second chart shows that this gold is immediately being pulled out of those vaults through a stunning surge in physical deliveries:

Now, the flow of gold from the London Bullion Market Association vaults into Comex could be explained away by the threat of tariffs… but that doesn’t explain the coincident surge of deliveries — physical demand — from Comex.

Or the tremendous levels of gold demand now being seen from central banks, institutions, and individuals around the world.

Again, these moves smell of desperation… and they have helped propel gold to record price levels in a historic new bull market.

That leaves us to wonder whether these developments are a sign that the huge central bank gold sales of the 1990s, which resulted in thousands of tonnes of official reserves being sold and replaced by IOUs, are now being desperately reversed.

Or is it an indication that the fragile paper gold and paper silver fractional reserve schemes are finally cratering under the weight of massive physical demand?

Or both?

More generally, is the shadowy global gold market, long hidden from prying eyes and accountability, now rushing to cover its tracks as the “new sheriff in town” yanks one curtain after another open?

Consider that, if the JFK, UFOs, and likely Epstein files will soon be exposed to the glare of public view, how long could the status of global official gold reserves and the officially sanctioned trading schemes remain hidden?

And all this comes amid growing calls for a long-awaited audit of the U.S. official gold in Fort Knox and elsewhere (and its ownership).

The bottom line is that President Trump and his team have become veritable bulls, rampaging through the establishment’s china shop.

It’s been exciting, entertaining, and occasionally scary. And this is only the beginning.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.