As President Joe Biden and his entourage prepare to hit the road promoting the recent $1.9 trillion coronavirus relief bill, they will have some serious explaining to do.

Amid a veritable smorgasbord of progressive pork, the so-called American Rescue Act, which Biden signed into law Thursday, stealthily slipped in $60 billion in tax hikes and a reported five-year ban on state-government tax cuts.

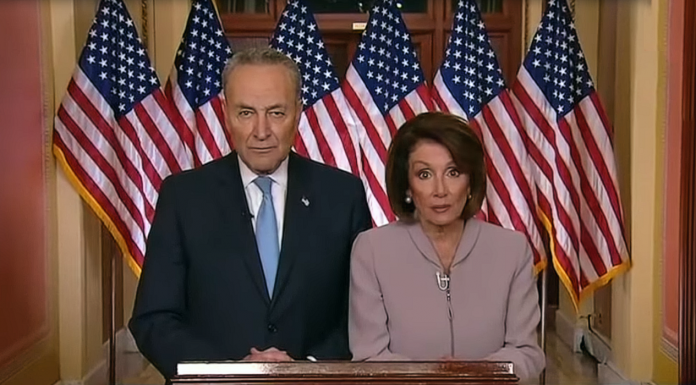

Unreal – Democrats are using the #PelosiPayoff to outlaw state tax cuts.

As painful as it may be to for @SpeakerPelosi & @SenSchumer to see Americans flee high-tax Blue states, they have no right to dictate policy for North Carolina & other responsible states. https://t.co/ZXoknrUwGP

— Rep. Dan Bishop (@RepDanBishop) March 10, 2021

Earlier this week, Senate Democrats passed the bill using a budget reconciliation process to avoid having to compromise with Republicans in the evenly-divided chamber.

Despite the widespread public support for additional $1,400 checks to eligible lower- and middle-income recipients, the shell-game ensures that all Americans will wind up paying later for the infusion of extra cash.

The Wall Street Journal‘s editorial board exposed congressional Democrats’ scheme, buried deep in the 800-page boondoggle of a bill.

It noted the likely unconstitutional stipulations placed on states’ $360 billion “windfall” in federal reimbursements.

“States can use the loot to provide government services, cover revenue losses during the pandemic and ‘respond to the public health emergency’ or ‘its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to impacted industries such as tourism, travel, and hospitality,'” the Journal reported.

As was widely expected, the new law funnels funds to insolvent blue states such as New York and California, which prioritized leftist agenda items including payouts to illegal immigrants.

It also adds to considerably to the coffers of labor unions through misdirection.

“States can pay out of their general funds for pensions and use the federal cash for something else,” said the Journal.

But while it offers states ample discretion for how to direct the funds, it states explicitly that they may not use it “to either directly or indirectly offset a reduction in the net tax revenue.”

It covers any state reductions resulting “from a change in law, regulation, or administrative interpretation during the covered period that reduces any tax (by providing for a reduction in a rate, a rebate, a deduction, a credit, or otherwise) or delays the imposition of any tax or tax increase.”

Already, that has forced some state legislatures to table legislation on measures entirely unrelated to the coronavirus, effectively giving Congress broad authority to regulate state law.

That potentially would conflict with the 10th Amendment of the Bill of Rights, which provides that “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

In addition to the federal overreach, the new “relief” package also tacks on an extra $60 billion in outright tax increases, Politico reported.

That includes:

- eliminating deductions from publicly traded companies that pay top employees more than $1 million

- controlling how multinational corporations do their taxes

- regulating how owners of unincorporated businesses account for their losses

The last-minute changes ensured that they received little attention from opponents in the Congress, while the convoluted nature of them meant they would garner little public notice.

“Everybody was caught by surprise,” a former Democratic aide told Politico. “They picked obscure items—things that were not on the radar.”

But some Democrats complained that the secretive tax hikes didn’t go far enough.

“While these modest Senate changes are welcome, they show the tremendous unutilized revenue potential that could be tapped,” said Rep. Lloyd Doggett, D-Texas, a top member of the House Ways and Means Committee.

The Biden administration is expected to hike federal taxes considerably after his campaign-trail pledges to repeal former president Donald Trump’s Tax Cuts and Jobs Act.

However, many believed that the Democrats would wait until the economy had fully recovered from recent COVID lockdowns before making the cash grab.