(Mike Maharrey, Money Metals News Service) Investment demand for gold in China was robust last month, with monthly ETF gold inflows setting a record.

China ranks as the world’s number one gold market.

The Shanghai Benchmark Gold Price PM (SHAUPM) in yuan rose 4.3 percent last month. That was slightly higher than the 3.4 percent increase charted in dollar terms due to a weakening yuan.

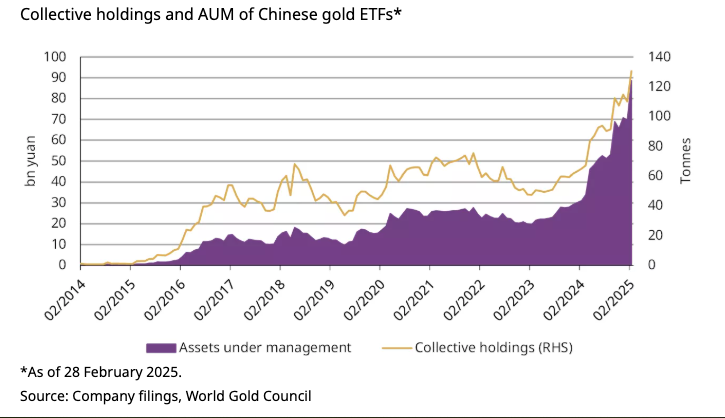

The rising gold price continues to draw Chinese investors. This is reflected by four straight months of positive gold flows into China-based ETFs.

Chinese gold ETFs added 21 tonnes of gold in February. That pushed total Chinese fund holdings to 131 tonnes, the highest level on record. The combination of new gold and the rising price pushed total assets under management (AUM) by China-based ETFs to a record ¥89 billion ($12 billion).

According to the World Gold Council gold investment demand continues to enjoy significant tailwinds.

“The strong local gold price performance in the month – especially the gapping up at opening on 5 February when investors came back from the Chinese New Year holiday – attracted attention. Meanwhile, concerns around the Trump administration’s trade policy may have sparked some safe-haven flows.”

World Gold Council analyst Ray Jia reported that anecdotal information indicates demand for physical gold remains robust as well.

He pointed out that in late January, online searches for gold topped their previous peak in 2013 when gold demand in China surged to the highest in history. Jia said he anticipates continued strength in bar and coin demand.

“Our conversations with market participants indicate that gold bar sales maintained their stunning pace seen in 2024, even leading to inventory shortages for some.”

Jia said he anticipates “continued strength in bar and coin demand while the soaring gold price may weigh on gold jewelry sales in tonnage terms – although consumer spending may not change much.”

A new policy allowing Chinese insurance companies to invest in gold for the first time could also give demand a significant boost in the coming months.

While higher prices have driven Chinese investment demand higher, they are dragging on jewelry sales. This was reflected by a 28 percent month-on-month decline in withdrawals from the Shanghai Gold Exchange to 90 tonnes.

Some of the decline was seasonal. Wholesalers and jewelry manufacturers typically buy less gold after the Chinese New Year holiday. According to the World Gold Council, every February on record – except 2023 when pent-up demand from COVID restrictions pushed up gold offtake – has charted a month-on-month decline, averaging 41 percent over the past 10 years.

Nevertheless, wholesale demand remains weak in historical terms. As already noted, the soaring local gold price has depressed jewelry sales, leading to weaker stocking activity by manufacturers. Jewelry producers account for the majority of SGE withdrawals.

Looking ahead, there are signs of improvement in the Chinese economy and consumer confidence has ticked up. New loans surged to a record high in January, signaling government stimulus policies have taken hold.

According to the World Gold Council, a resurgence of economic growth could stabilize the gold jewelry sector.

“We continue to believe that investment demand for gold could also remain generally robust as investors anticipate further price gains and concerns of the US trade policy uncertainties push up safe-haven buying.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.