In a victory for First Amendment and privacy rights, California Attorney General Rob Bonta quietly reversed a highly panned mandate from predecessor Kamala Harris that required charities to disclose the personal information of donors.

The Harris mandate was opposed by a diverse coalition of nonprofits from both sides of the political spectrum, including: the Thomas More Law Center, Americans for Prosperity Foundation, the Southern Poverty Law Center, American Civil Liberties Union and the Human Rights Campaign.

California Attorney General Quietly Submits to Supreme Court’s Landmark First Amendment Decision – https://t.co/hDqIM3KPAD pic.twitter.com/l8IJwSakw6

— Thomas More Law (@Thomas_More_Law) July 28, 2021

Some argued that the transparency afforded under the policy was a well-intended effort to prevent the influence of dark money from billionaire oligarchs and special interests.

However, conservatives feared the far-left state would use it selectively to target and dox their donors, creating a chilling effect as activists imposed boycotts and blacklists for what the US Supreme Court has deemed protected political speech.

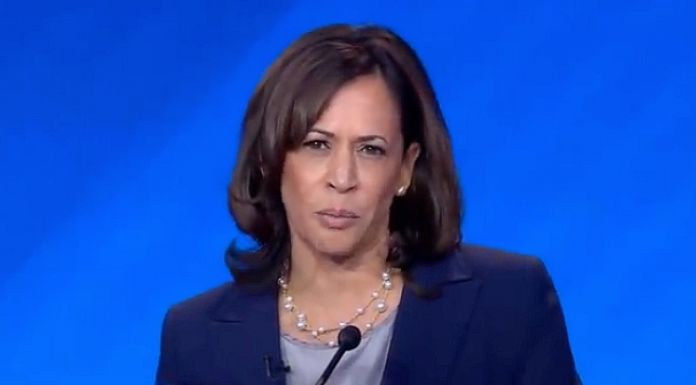

In its recent 6–3 decision, the Supreme Court sided with a charity that received a demand from then-California Attorney General Harris (now the US vice president) to turn over confidential, personal information of donors who gave more than $5,000 or be prevented from raising money in the state.

The Thomas More Law Center—a national public-interest law firm based in Ann Arbor, Michigan—instead challenged the requirement in California Federal District Court, which decided the case for the benefit of the charity.

However, the US 9th Circuit Court of Appeals reversed the lower court, which set up the SCOTUS decision in July after the law center appealed.

“When it comes to the freedom of association, the protections of the First Amendment are triggered not only by actual restrictions on an individual’s ability to join with others to further shared goals,” Chief Justice John Roberts wrote in the majority opinion.

“The risk of a chilling effect on association is enough, because First Amendment freedoms need breathing space to survive,” he continued.

The charities homepage for Bonta’s office now simply reads: “Effective July 1, 2021, the Registry of Charitable Trusts will no longer require the filing of Schedule B to the IRS Form 990 as part of the registration and annual reporting requirements.”

Schedule B of IRS Form 990 is a schedule of donors.

“In the Internet Age, where doxing one’s opponents has led to job loss, boycotts, ostracization, and violence, the fear of such repercussions should one’s charitable contributions become public could be enough to stymy giving, leaving the personal beliefs of many Americans to go unrepresented in the public square,” concluded the Thomas More Law Center in a press release celebrating the reversal.