(Mike Maharrey, Money Metals Exchange) Just one quarter into fiscal 2024, the federal government has already run a budget deficit of over half a trillion dollars.

The December budget shortfall came in at $129.37 billion, according to the latest Monthly Treasury Statement. That drove the 2024 deficit to $509.94 billion. That’s a 21 percent increase over the first quarter deficit in fiscal 2023.

This follows on the heels of the third-largest annual budget deficit in history (1.7 trillion).

These massive monthly budget shortfalls are pushing the national debt higher at a dizzying pace. On December 29, the national debt eclipsed $34 trillion for the first time. When Congress effectively eliminated the debt ceiling on June 5, the national debt stood at a “mere” $31.46 trillion.

TOO MUCH GOVERNMENT SPENDING

President Joe Biden blames Republican tax cuts under the Trump administration for the ever-widening budget deficit, but the numbers don’t bear this out. Federal receipts were just under $1.1 trillion in the first quarter. That’s 12 percent higher than through the first three months of fiscal 2023.

Federal revenue did decline in fiscal 2023 after a windfall in 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21 percent in fiscal ‘22. Tax collections also came in at a multi-decade high of 19.6 percent as a share of GDP. But at the time, CBO analysts warned the good times wouldn’t last. And they didn’t. Government receipts fell by 9.3 percent in fiscal 2023. Even so, receipts are up so far this year even as the deficit climbed.

The real problem is on the spending side of the ledger. Over the last two years, the Biden administration has blown through roughly half a trillion every single month.

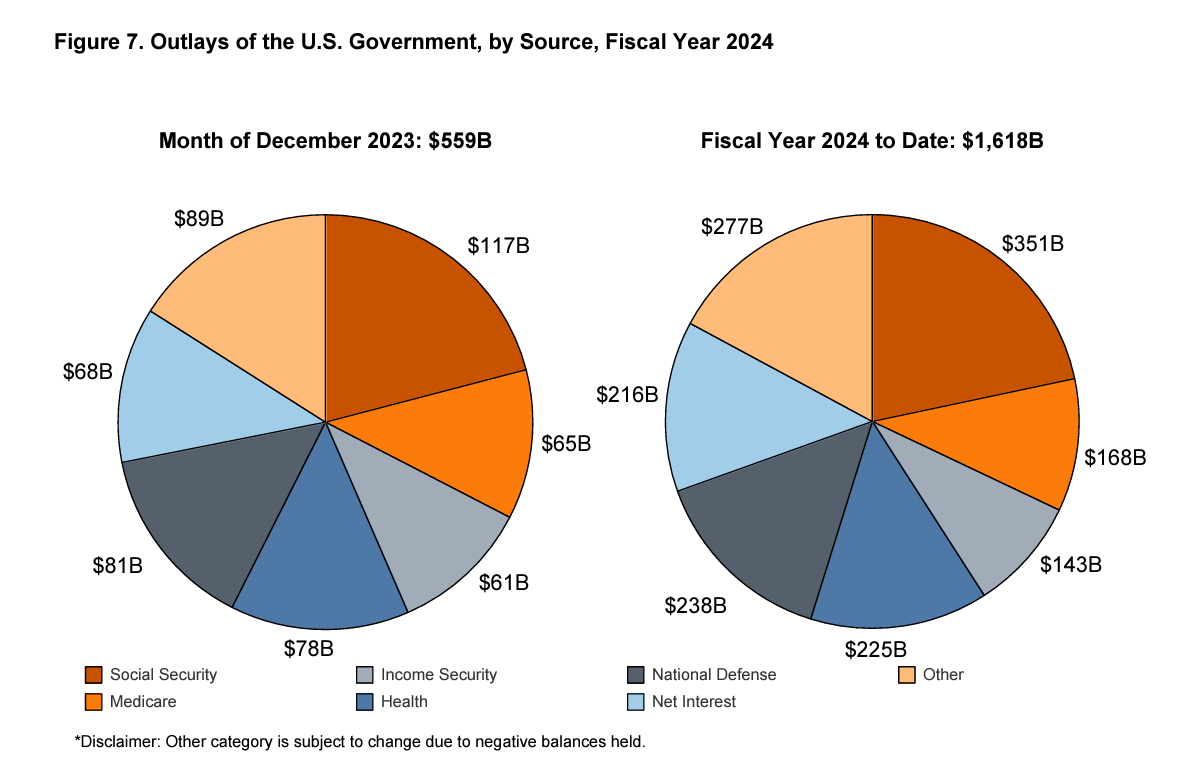

Through the first quarter of fiscal 2024, the federal government spent $1.62 trillion. That’s a 12 percent increase over the first three months of last year.

This isn’t to let Republicans off the hook. Spending under the Trump administration was generating a $1 trillion deficit even before the pandemic.

Excessive borrowing and spending is a bipartisan sport.

This underscores the fact that the fundamental issue isn’t that the U.S. government doesn’t have enough money. The fundamental problem is that the U.S. government spends too much money. Despite the pretend spending cuts, and promises from the Biden administration that it would save “hundreds of billions” the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act) didn’t address that problem. No matter what you hear about spending cuts, the federal government always finds new reasons to spend more money.

A DOUBLE-WHAMMY: EXCESSIVE SPENDING & HIGH INTEREST RATES

These big budget deficits are happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills, and it is likely one of the reasons that the Federal Reserve is talking about rate cuts even though the CPI remains well above the mythical 2 percent target. The borrow-and-spend U.S. government can’t function in a high interest rate environment.

Uncle Sam spent $288.01 billion in interest expense to finance the national debt in the first quarter of fiscal 2024. That was more than national defense ($238 billion) and more than Medicare ($168 billion). The only higher spending category was Social Security at $351 billion.

Net interest expense, excluding intragovernmental transfers to trust funds, was $216 billion in Q1, still nearly as much as the government spent on national defense.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. The weighted average interest rate on the government’s outstanding Treasury securities rose to 3.17 percent as of the end of December. That compares with a weighted average rate of 2.32 percent in December 2022.

Rising interest rates drove interest payments to over 35 percent as a percentage of total tax receipts in fiscal 2023. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

And it’s only going to get worse.

Interest expense will continue to rise at a rapid rate as more and more Treasuries mature and are replaced by higher-yielding bonds.

The only way out of this fiscal death spiral is significant spending cuts and/or major tax hikes. Congress doesn’t seem to have the political will for either.