(Mike Maharrey, Money Metals News Service) So, President Trump has announced his pick for Federal Reserve Chairman, and the markets are not pleased.

Everybody seems convinced that Kevin Warsh is a “hawkish” pick, and markets are throwing a temper tantrum because they think he might take the easy money punch bowl away.

They might be right.

But they probably aren’t.

Who Is Kevin Warsh?

Warsh, 55, is a former Federal Reserve governor, serving from 2006 to 2011. He was the youngest person ever to be nominated to serve on the central bank board at just 35.

Before joining the central bank, he worked in mergers and acquisitions for Morgan Stanley. Warsh also served as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council in the George W. Bush administration.

Warsh is widely viewed as an “inflation hawk,” and he has spoken out about the size of the Federal Reserve’s balance sheet. He also criticized the Fed’s decision to rapidly cut rates during the financial crisis, warning about inflation risk. He was the only Fed member to argue against QE 2 in 2011.

However, in recent months, Warsh has aligned himself with Trump and criticized the central bank for dropping rates too slowly.

Last year, Warsh called for “regime change” at the Fed, saying, “The credibility deficit lies with the incumbents that are at the Fed, in my view.”

He went on to argue for faster rate cuts.

“Their hesitancy to cut rates, I think, is actually … quite a mark against them. The specter of the miss they made on inflation, it has stuck with them. So, one of the reasons why the president, I think, is right to be pushing the Fed publicly is we need regime change in the conduct of policy.”

Warsh will take the helm at the Fed in May, pending Senate approval.

Market Reaction

When I woke up this morning, I saw that gold was down over $300 an ounce and barely holding onto $5,000. Silver was down some $17 and under $100.

The big selloff likely reflects the view that Warsh won’t be quite so prone to cutting interest rates. A higher rate environment is considered a headwind for gold, since it is a non-yielding asset. Coupled with algorithms set to sell at specific levels, and panic selling as the price dropped, it was a recipe for a big correction. (I think the correction itself is healthy, however misguided.)

Stocks were also down in early trading Friday, adding to the late Thursday selloff as rumors of Warsh’s appointment began to swirl.

Stocks and precious metals both got a boost in recent months as speculation around Trump’s Fed pick circulated through the news cycle. Trump has been highly critical of current Fed Chair Jerome Powell’s reluctance to drop interest rates as quickly as he’d like. Most observers assumed Trump would choose a “yes-man” predisposed to easy money. Warsh definitely isn’t viewed as that kind of pick, and his choice was something of a surprise.

“He’s a hawk,” CNBC commentator Joe Kernen proclaimed.

But Will Warsh Be a Hawk?

Despite the market perception that Warsh is going to be an inflation hawk and hold rates higher than other potential Fed chairs might have, I’m skeptical for two key reasons.

Trump Picked Him

President Trump has been highly critical of Jerome Powell and his unwillingness to cut rates more deeply than he has. The president has certainly had conversations with Warsh and is confident he will conduct monetary policy more to his liking.

As already noted, Warsh has been critical of the current Fed regime’s slowness to trim rates. That said, it’s certainly possible he’s simply saying what he knows Trump wants to hear to get the job. It’s also possible he will change his tune once he’s in the chair.

However, given his recent rhetoric and Trump’s willingness to give him the chair, it seems likely Warsh will tend to be more accommodating than Powell, at least initially. And Powell has been pretty darn accommodating.

It’s also important to note that Warsh will be just one voice among 12 voting members of the FOMC. He will certainly be a key voice in shaping policy and the face of the Fed, but one man’s hawkishness would not a hawkish Fed make.

The Debt Black Hole Demands Easy Money

More significantly, the central bank will likely be forced to cut more deeply because the Debt Black Hole demands it.

Quite simply, a new Fed chair isn’t going to suddenly erase the massive levels of debt in the global economy.

I’ve been arguing for months that the Federal Reserve is caught in a Catch-22. It simultaneously needs to raise rates to battle persistent inflation and cut rates because this debt-riddled bubble economy can’t function in a normal rate environment.

Warsh might be an inflation hawk, but when the rubber meets the road, he’ll do exactly what any central banker would do. He’ll almost certainly pick rescuing the economy over holding inflation at bay.

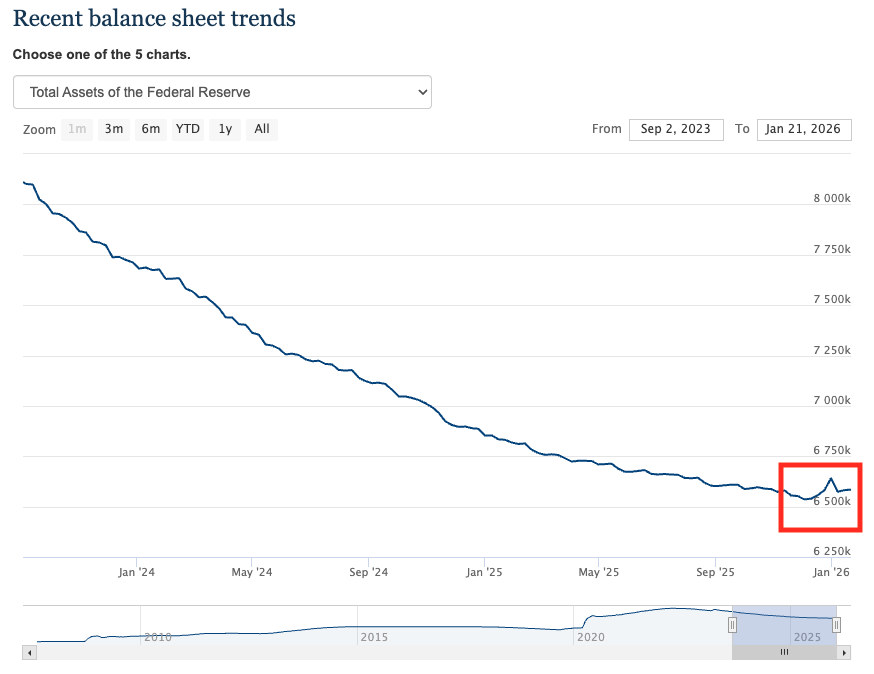

Warsh has argued that the Fed could set rates lower if it cut more from its balance sheet. That might be true in theory, but I don’t think the central bank can unwind its balance sheet any further. In fact, the Fed has increased the balance sheet modestly over the last month after announcing a return to quantitative easing (without using the term) at the December meeting.

On top of that, the Fed will likely have to engage in more aggressive QE in the coming months to support the federal government’s out of control borrow and spend habit. Demand for Treasuries is sagging in the global market as more and more players become wary of America’s fiscal malfeasance and the weaponization of the dollar.

We see the struggles in the bond market reflected by persistently high yields despite central bank efforts to push interest rates lower. This indicates a lack of demand for government debt.

This was overtly demonstrated by a Danish pension fund’s decision to divest Treasuries. Many made the decision out to be a political move over Greenland, but AkademikerPension said that wasn’t the case, citing concerns about the U.S. government’s fiscal malfeasance.

“The decision is rooted in the poor U.S. government finances.”

Warsh’s opinion on inflation and his hawkish reputation cannot change these underlying realities, and he will be forced to deal with them.

Finally, the economy still hasn’t reckoned with the bubbles and malinvestments created by nearly two decades of easy money. We are still due for a bust, and when that happens, all bets are off – as we saw during the pandemic.

In fact, the pandemic bailed the Fed out in 2020. The economy was cracking in late 2018 as the Fed finally attempted to normalize rates after the Great Recession. It was forced to abandon that effort in 2019, and it was already cutting rates and running QE before COVID reared its ugly head. The pandemic allowed the central bank to slash rates to zero and take QE to unprecedented levels. This kicked the can down the road, giving the easy-money-addicted economy a surge of its preferred drug, and keeping the inevitable crash at bay.

In other words, the economy never reckoned with the monetary malfeasance of the Great Recession era. Instead, the Federal Reserve and the government doubled down and added more fuel for the inevitable fire.

That fire will break out, and Warsh will have to deal with it.

The bottom line is that Warsh’s perceived policy views will matter little when they slam up against these ugly economic realities.

In my opinion, the big sell-off in gold and silver on the news of the Warsh nomination is an overreaction and doesn’t reflect any real change in the economic or financial landscape.