(Mike Maharrey, Money Metals News Service) Global gold demand topped 5,000 tonnes for the first time ever in 2025.

Factoring in the 65 percent price gain, the total value of gold demand increased 45 percent year-on-year to an unprecedented $555 billion.

Fourth quarter gold demand also set a record, coming in at 1,303 tonnes driven by hefty ETF inflows, coupled with coin and bar demand that hit a 12-year high.

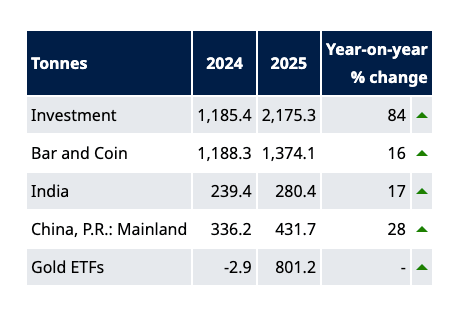

Gold Investment Demand

With gold hitting 53 record highs in 2025, investment demand surged to 2,175.3 tonnes, shattering the previous record of 1,805 tonnes set in 2020. Investment demand value more than doubled to $240 billion.

Investment buying manifested in strong demand for both ETFs and physical metals.

ETF gold holdings hit an all-time high of 4,025 tonnes. In dollar terms, inflows set a record of $89 billion.

As the World Gold Council framed it, the rising gold price was both a cause and an effect.

“Investors were attracted by the rising price, and the subsequent inflows helped to generate further price gains.”

North American-based ETFs contributed more than half of the increase, with gold holdings rising 446 tonnes.

Asian funds added 215 tonnes of gold. According to the WGC, the ETF investment base broadened across the region with a significant number of new investors tapping into the market.

Chinese funds more than doubled their gold holdings in 2025 (+133 tonnes). Meanwhile, Indian funds charted eight straight months of gold inflows to wrap up the year.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Physical gold investment also surged, with coin and bar demand hitting a 12-year high of 1,374.1 tonnes.

In value terms, global bar and coin demand was a record-breaking $154 billion.

More than half of the global coin and bar demand came from two countries – China and India.

According to the World Gold Council, “The rise in the gold price was overwhelmingly the most important factor driving stronger demand.”

However, bar and coin demand in the U.S. did not grow in volume despite a strong fourth quarter. In value terms, U.S. physical gold investment rose by a relatively modest 8 percent.

According to the World Gold Council, “Selling back remains notable as the price rise continues to attract profit-taking, making for an active two-way market.”

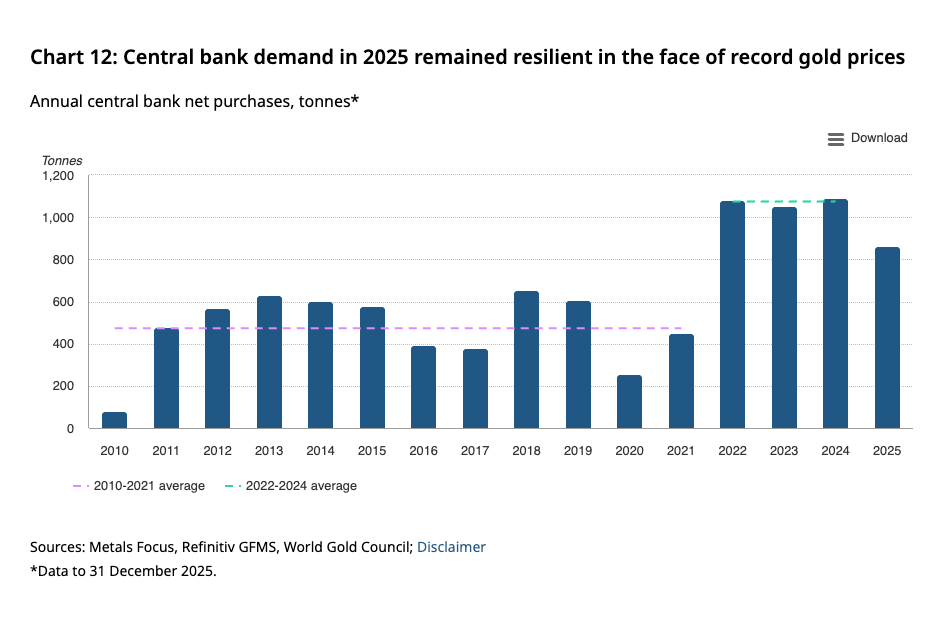

Central Bank Gold Buying

Official central bank gold buying globally fell below 1,000 tonnes for the first time in four years, coming in at 863 tonnes.

The World Gold Council said rapidly rising prices created a difficult climate for central bankers seeking to raise their gold reserves.

“Reported gold buying was somewhat modest through much of 2025 as central banks navigated a rapid rally in prices, which reached multiple record highs during the year. Elevated valuations of gold reserves appeared to prompt a more cautious approach. This highlights that central banks are not insensitive to price dynamics, even as their long-term strategic interest in gold remains firmly intact.”

While below the levels seen in the previous three years, it was still significantly above the 2010-2021 annual average of 473 tonnes.

Poland was the top buyer in 2025, adding 102 tonnes of gold to its official holdings. The National Bank of Poland recently announced plans to purchase up to 150 more tonnes of gold, raising its holdings to a maximum of 700 tonnes.

Gold Jewelry Demand

Unsurprisingly, gold jewelry demand fell, pressured by surging prices.

Total gold jewelry demand fell to a five-year low of 1,542 tonnes, an 18 percent decline.

However, demand value increased to a record $172 billion, an 18 percent increase. According to the World Gold Council, this indicates a steady appetite for gold jewelry.

“The remarkable gold price rise in 2025 inevitably imposed affordability constraints on jewelry consumers the world over. It did not, however, stifle consumer appetite for jewelry – as evidenced by the sharp jump in demand value during the year, with consumers spending a larger share of wallet on gold.”

Gold in Tech

Price pressure also created headwinds for gold demand for industrial and technical applications.

Overall, gold used in technology came in at 322.8 tonnes, down 1 percent from 326.2 tonnes in 2024.

Gold used in the electronics sector was flat at 270.4 tonnes.

Gold demand for other industrial applications dipped 5 percent to 44.2 tonnes.

According to the World Gold Council, the AI boom has disrupted the electronics sector.

“The AI boom continued to drive demand for gold in electronics (the dominant category of demand in this sector), with high-speed computing accelerating the use of bonding wire and contact and interconnect materials. However, this boom has created some tension and divergence with other parts of the electronics sector as manufacturing capacity has been redirected to meet AI-related demand, effectively crowding out production of some components and pushing up prices.”

I’ll be breaking down demand data for these various sectors in more detail in the weeks ahead.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.