(Mike Maharrey, Money Metals News Service) Central banks have gobbled up over 1,000 tonnes of gold for three straight years, and most central bankers think the buying trend will continue.

Last year was the third-largest expansion of central bank gold reserves on record, coming in just 6.2 tonnes lower than in 2023 and 91 tonnes lower than the all-time high set in 2022. (1,136 tonnes). 2022 was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

To put that into context, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

Looking at the broader perspective, the central bank gold buying trend is now entering its 16th year.

Based on the World Gold Council’s annual Central Bank Gold Survey, it appears the buying trend will continue.

Of the 73 central banks that responded to the survey, 95 percent said they believe central bank gold reserves will increase over the next 12 months. A record 43 percent of the respondents indicated they expect their own gold reserves to expand. That was up from 29 percent in 2024.

It was the largest number of central banks to ever respond to the World Gold Council survey. The WGC said the increase in participation isn’t just about a number.

“It is a powerful signal of engagement with gold amongst the central banking community.”

Seventy-six percent of the respondents said they think gold will hold a (moderately or significantly) higher share of total reserves five years from now, up from 69 percent last year.

“Expectations point to continued gold buying over the next 12 months, reflecting sustained confidence in gold’s strategic role amid evolving geopolitical and macroeconomic dynamics.”

What Is Gold Replacing?

Gold has already overtaken the euro as the world’s number two reserve. But it’s not so much that gold is replacing the euro. The EU currency’s share of global reserves has remained relatively steady.

Gold is usurping the dollar.

According to recently released IMF data, the dollar’s share of global reserve currencies slid further in 2024. As of the end of last year, dollars made up 57.8 percent of global reserves. That is the lowest level since 1994, representing a 7.3 percent decline in the last decade. In 2002, dollars accounted for about 72 percent of total reserves.

World Gold Council survey respondents think this trend will continue, with 73 percent saying they expect their dollar reserves to decline even more in the next five years.

CNBC recently pointed out that gold has been increasingly attractive to countries “concerned about sanctions and the potential erosion of the role of major currencies in the international monetary system.”

In other words, they are trying to shield themselves from the weaponization and depreciation of the dollar.

Survey respondents also indicated that the share of other currencies in the reserve mix, such as the euro and renminbi, would increase along with gold.

Why Gold?

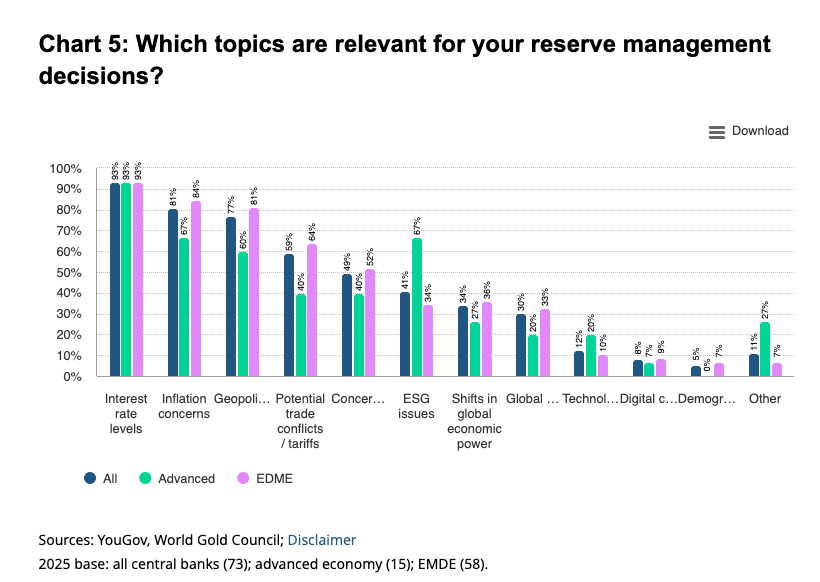

Central bankers who responded to the survey indicated that the level of interest rates was the most important factor dictating reserve management decisions. Inflation concerns came in as the second-most important driver.

Central banks in emerging markets and developing economies (EMDE) have driven the recent central bank gold rush. Of the EMDE banks that responded to the survey, the top two reasons for gold buying were inflation (84 percent) and geopolitical concerns (84 percent).

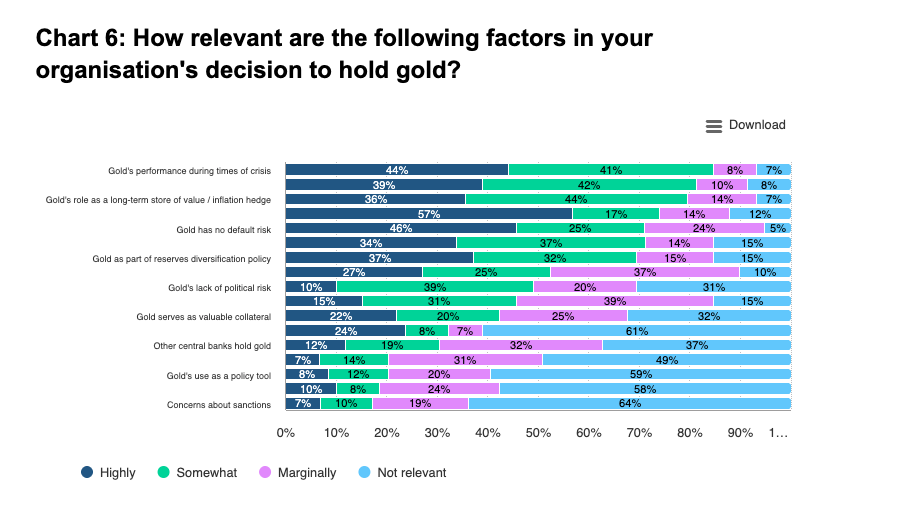

The survey also asked bankers to rank the relevance of various factors in their decision to hold gold. The yellow metal’s performance during times of crisis was the most relevant, along with its role as an inflation hedge.

As the World Gold Council summed it up, the world is becoming increasingly volatile and unpredictable, and “diversification and risk mitigation” have become key drivers of strategic reserve management decisions.

“Gold’s safety, liquidity and return characteristics – the three key investment objectives for central banks – have risen in importance. The trends uncovered in our survey suggest that central banks continue to recognize the benefits of an allocation to gold and indicate that their demand for gold will likely remain healthy for the foreseeable future.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.