(Mike Maharrey, Money Metals News Service) With all the attention focused on the wasteful spending being unearthed by DOGE and talk of “rebate” checks, you might think that the Trump administration is finally getting the federal government’s reckless borrowing and spending under control. But if we turn our attention to what’s going on over on Capitol Hill, the news isn’t nearly so good.

Under the Congressional Budget and Impoundment Control Act of 1974, Congress is required to develop annual budget resolutions that set overall spending and revenue targets. House Republicans are engaged in that process as we speak.

Former Reagan administration Office of Management and Budget Director David Stockman broke down the numbers. Far from addressing the massive budget deficits, Congress is on track to make them even bigger.

Stockman described it as “fiscal fraud.”

The pending resolution directs the four leading House committees to raise the deficit by $6 trillion over the next decade.

Here are the numbers:

- Ways and Means Committee for tax cuts: +$4,500 billion.

- Judiciary Committee for crime and border control: +$110 billion.

- Armed Services Committee for Pentagon increases: +$100 billion.

- Homeland Security Committee for border control: +$90 billion.

- Implied higher interest expense: +$1,200 billion.

- Total Deficit Increase: +$6.0 trillion.

There are spending cuts built into the budget resolution instructions as well, but they pale in comparison to the additional spending. Stockman describes them as “anemic.”

They total $1.502 trillion, which sounds impressive until you put them into context.

That amounts to 1.7 percent of CBO baseline outlays ($89.3 trillion) from fiscal 2026 to fiscal 2035 and 2 percent of total federal outlays even setting aside the $13.8 trillion of interest expense included in the CBO numbers.

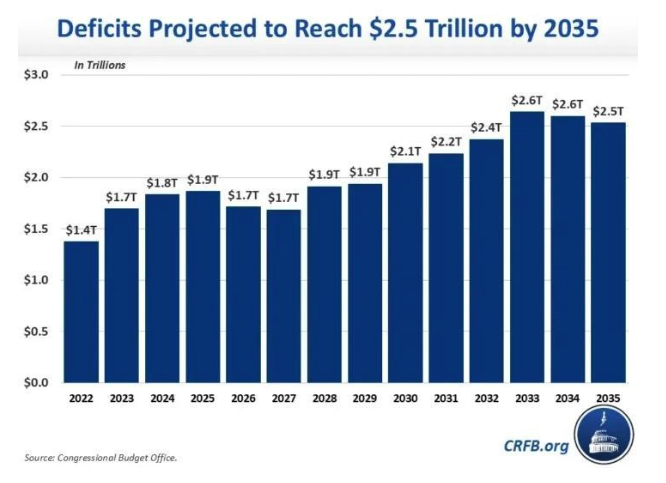

Stockman points out that this combination of new spending and tax cuts would be in addition to $22 trillion of cumulative deficits already built into the baseline budget over the next 10 years.

Based on the current Congressional Budget Office (CBO) projections (without any new spending or cuts), today’s $36 trillion national debt will balloon to $60 trillion by the end of the current 10-year budget window.

Keep in mind that the CBO always uses the best-case scenario. It is not projecting any recessions. It does not assume any wars or major disasters that inevitably pump up spending. As Stockman put it, the CBO bases its forecasts on a “performance-perfect” economy for the next 25 years.

Even with that rosy scenario, the public debt is on pace to hit $150 trillion by mid-century.

It’s important to remember that discretionary spending only accounts for 27 percent of total spending. The vast majority is for entitlements, and there is little political will to take the scissors to Social Security or Medicare.

Congressional Republicans are simply ignoring that elephant in the room.

Stockman summed it up this way:

“There is no instruction to cut Social Security, Medicare, Veterans Programs or Federal military and civilian retirement by a single dime—while, as shown above, defense is to be increased by $100 billion. But these five big budget functions add up to $55 trillion over the 10-year budget window or fully 73 percent of total baseline outlays excluding interest on the public debt. In a word, these once and former ‘watchdogs of the U.S. Treasury’ looked at the 10-year budget projections and waved the white flag of surrender on damn near three-fourths of the spending available to cut. Not a single dime of savings in this vast expanse of the budget is embedded in the GOP instructions.”

The Interest Problem

There are actually two elephants in the room. The second is the ballooning interest on the national debt.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and must be replaced by bonds yielding much higher rates. And even with the recent Federal Reserve rate cuts, Treasury yields have pushed upward as demand for U.S. debt sags.

Uncle Sam paid $1.13 trillion in interest expenses in fiscal 2023. It was the first time interest expense has ever eclipsed $1 trillion. Through the first four months of fiscal 2025, the federal government had already spent more on interest on the debt than it has on national defense or Medicare. The only higher spending category was Social Security.

This is a budget component that Congress has virtually no control over. And with price inflation stubbornly sticky, the Federal Reserve has put rate cuts that would provide some relief on hold.

According to Stockman, interest expense absorbs about 18 cents of every dollar of federal revenue. Based on current projections, that will grow to 22 cents by 2035 and 40 cents by 2052.

Again, this is based on the best-case scenario. Stockman notes that “once it is clear to the bond markets that the Fed can no longer monetize massive gobs of U.S. Treasury paper without re-accelerating inflation, bond yields will lurch skyward.”

If the average interest on the debt were to rise even 250 basis points from the current projection, it would nearly double the debt service to $3.3 trillion per year by 2035.

Stockman calls it a “fiscal doom loop.”

“In other words, we are not dealing with a tad too much borrowing or chronically lax fiscal discipline. What is built-in now is a veritable fiscal doom-loop under which soaring debt fuels an eruption of annual interest expense, which, in turn, drives the public debt and interest expense higher still.”

Smoke and Mirrors

According to Stockman, GOP policy wonks in Congress make the budget outlook seem better than it really is by including “fake deficit cuts.” He flat-out accuses them of “egregiously faking the budget numbers.” He points to $1.8 trillion in discretionary spending cuts “hidden in the fine print.”

“The GOP plan advertises that it is instructing seven committees to make savings of $1.5 trillion as explained above—offset by spending increases of $300 billion over the 10-year period for defense, law enforcement and border control. But if you look at the support document labeled ‘Table 1. Fiscal Year 2-25 Budget Resolution Total Spending and Revenue,’ for this net spending cut of $1.2 trillion, you won’t find it. Instead, the document actually contains a summary line called ‘Government-Wide Savings,’ which shows a figure of $2.99 trillion. That’s $1.8 trillion more than the reconciliation instructions actually provide for on a net basis. The latter amount, therefore, is lurking deep in the budgetary shadows as an unreconciled savings in discretionary spending. Since there is no enforcement mechanism or even annual tracking target by program and budget function, this figure is sure to be promptly forgotten even before the resolution makes its way across the Capitol Building to the U.S. Senate.”

Perhaps some of this will materialize in the DOGE savings, but how much gets cut from the budget when it’s all said and done remains to be seen. And of course, there is talk about some of that savings being distributed to taxpayers in the form of $5,000 checks.

On the other side of the coin, there is almost always additional unplanned spending coming down the pike, whether for disasters, crises, or wars. You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

Then there is $2.6 trillion in projected higher federal tax revenues due to economic growth.

In fact, politicians always use “economic growth” to close budget holes. The problem is that economic growth seldom materializes to the extent promised. And again, the projections always assume best-case scenarios with no recessions or economic crises. Given the massive debt bubble blown up by well over a decade of artificially low interest rates and the Fed’s inability to cut rates due to sticky inflation, a major economic meltdown in the next decade seems more likely than not. The economy is addicted to easy money and its drug has been taken away.

When federal revenues do increase, whether through tax hikes or economic growth, Congress always manages to find more ways to spend – as already noted.

Stockman offers a pretty dismal summary of the situation.

“Talk about the elephant in the elephant’s caucus room! In order to justify massive tax cuts that it’s unwilling to back up with politically difficult spending cuts the GOP is just making up the numbers—sweeping under the rug four times more red ink than the entire $930 billion Federal debt at the time that Ronald Reagan became president.”

DOGE is a great start, and President Trump should be lauded for exposing all this wasteful spending. But don’t be fooled. Uncle Sam is not getting his borrowing and spending problem under control.

This is precisely why despite periodic jawboning about cutting spending and getting America’s fiscal house in order, every president since Calvin Coolidge has left the U.S. with a bigger national debt than when he took office.

Stockman pulls no punches.

“In short, the GOP budget resolution is a complete betrayal of any even minimal notion of fiscal sanity. Upon a fresh CBO report (January 2025) showing massive Federal deficits rising skyward as far as the eye can see, these cats in the GOP caucus have proposed— apparently with a straight face—to add a net of $3.3 trillion ($4.8 trillion of tax cuts less $1.5 trillion of spending reductions) of new deficits on top of the $28 trillion of baseline deficits. The very notion is absurd. This plan needs to be subject to a mercy killing on the U.S. House floor and sent back to committee for a long overdue reckoning with reality.”

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.