(Money Metals News Service) In an era marked by fiscal uncertainty, JP Cortez, the Executive Director of the Sound Money Defense League, sits down with Lynette Zang of Zang Enterprises to discuss the urgent need for sound money principles in the United States.

Cortez’s passion for the principles of Austrian Economics and his dedication to preserving individual liberty through sound money guide his advocacy, resonating in legislative wins across over a dozen states since 2018.

Why Sound Money Matters

Cortez emphasizes that the drive for sound money goes beyond price speculation; it is a safeguard for a free society. Historically, sound money has constrained government overreach, avoiding unnecessary wars and bureaucratic inflation.

The essence of sound money, particularly gold and silver, is its proven ability to retain value, providing an economic foundation for societies worldwide.

Global Case Studies: Zimbabwe and the BRICS Alliance

Zimbabwe offers a cautionary example, says Cortez. In its attempt to stabilize its economy through a gold-backed currency, Zimbabwe fell short due to poor fiscal discipline. Despite creating a gold-pegged currency, the government’s inability to maintain its value resulted in further devaluation.

This scenario is a stark reminder that establishing a gold-backed currency is only half the battle; maintaining it is even harder. Similar moves by countries like Russia, India, and members of the BRICS alliance reflect a growing global inclination toward alternatives to the U.S. dollar, with gold and silver as the favored standards.

The Role of Convertibility and Accountability

For a currency to be truly sound, convertibility is crucial. Zang points out that without the ability to exchange currency for physical gold, a currency is only pegged and not genuinely backed. This lack of convertibility enables governments to manipulate currency values unchecked, diminishing public trust.

Cortez echoes this sentiment, noting that true reform would mean stepping away from simply creating gold-backed currencies and, instead, allowing people to use physical gold and silver as legal tender.

Empowering Citizens Through Legislation

Cortez believes in grassroots legislative efforts to reintroduce sound money at the state level. The Sound Money Defense League has collaborated on legislation that has seen success in states like Wisconsin, Alabama, Nebraska, and Kentucky.

Cortez argues that citizen involvement in state legislation is vital. Unlike federal systems, state legislatures are more responsive to public opinion, and citizen engagement could tilt the scales in favor of sound money policies.

The Sound Money Index: A Pathway for Involvement

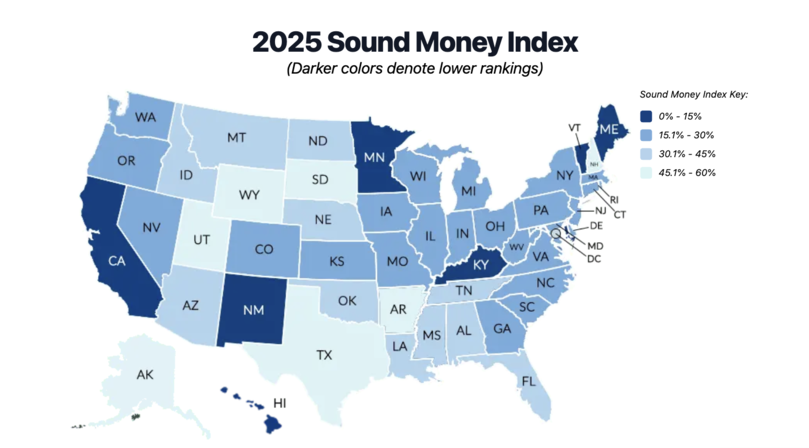

The Sound Money Defense League’s Sound Money Index, in exclusive partnership with Money Metals Exchange, serves as a guide for citizens eager to advocate for sound money. Updated annually, this index ranks each U.S. state based on its pro- or anti-sound money policies.

Metrics include sales and income taxes on gold, the establishment of bullion depositories, and the integration of gold in state pension funds. This index enables citizens to hold their states accountable and participate in pushing for sound money legislation.

Education as a Catalyst for Change

Cortez stresses that education is pivotal in achieving lasting reform. With over 7,400 state legislators in the U.S., many of whom have little understanding of sound money, public education and engagement are essential.

Notably, the League offers paid scholarships and fellowships to students interested in researching sound money principles, encouraging academic contributions that deepen public understanding.

Moving Toward a Resilient Future

Cortez and Zang agree that America’s monetary system faces significant challenges, from a growing national debt to increasing inflation. The Sound Money Defense League’s mission to empower citizens and promote legislation aims to create a more resilient monetary system for future generations. As Cortez emphasizes, this movement is not merely about economic reform but a stand for individual liberty and fiscal responsibility.

Through community engagement, grassroots advocacy, and educational initiatives, Cortez calls for a national and even global sound money movement, inspiring citizens to take control of their economic futures and protect their freedom.

Key Questions & Answers

Here’s a breakdown of the key questions and answers covered in the interview between Lynette Zang of Zang Enterprises and JP Cortez of Money Metals’ Sound Money Defense League:

Why is sound money important?

JP Cortez explains that sound money is essential for a prosperous society as it helps prevent excessive government growth, unnecessary wars, and fiscal irresponsibility. Gold and silver, in particular, are reliable stores of value, helping to protect individual freedoms and promote economic stability.

What lessons can we learn from Zimbabwe’s attempt at a gold-backed currency?

Cortez points to Zimbabwe as an example of the challenges in maintaining a gold-backed currency. He notes that while establishing one is important, maintaining it requires significant fiscal discipline, which Zimbabwe lacked. This demonstrates the importance of long-term political commitment and economic stability to avoid currency devaluation.

Why is convertibility essential in a gold-backed currency?

Zang highlights that for a currency to be truly backed by gold, it must be convertible, allowing people to exchange currency for physical gold. Cortez agrees, adding that without convertibility, a currency is only pegged to gold, leaving it vulnerable to manipulation and reducing public trust.

How can citizens contribute to the sound money movement?

Cortez encourages citizens to get involved at the state level by supporting sound money legislation. He notes that state legislatures are more responsive to public input than federal bodies and that citizen advocacy has already led to legislative victories in multiple states.

What is the Sound Money Index, and how can it help citizens?

The Sound Money Index, created by the Sound Money Defense League and Money Metals Exchange, ranks U.S. states on their sound money policies. It provides citizens with insights into their state’s stance on sound money, empowering them to advocate for reforms such as eliminating taxes on gold and silver.

What are the risks of a fiat currency system?

Cortez argues that fiat currency is vulnerable to inflation and government manipulation. He explains that fiat money enables the government to devalue currency over time, eroding purchasing power, creating inflation, and funding debt-driven government policies.

How does grassroots legislative work impact sound money policy?

Cortez notes that grassroots legislative efforts are crucial, as local and state advocacy has the power to influence policy changes directly. He emphasizes that citizen engagement can lead to the reduction of taxes and regulatory barriers on gold and silver, thus promoting sound money practices.

Is hyperinflation a possibility in the United States?

While Cortez does not predict an immediate hyperinflationary event, he acknowledges the risk due to rising national debt and relentless government spending. He emphasizes that this scenario could severely undermine the dollar’s value if government policies continue without reform.

What role does education play in the sound money movement?

Education is essential, according to Cortez, as most state legislators and the public are unaware of the benefits of sound money. The Sound Money Defense League offers scholarships and fellowships to educate young people about sound money and monetary history, fostering a more informed base of advocates.

What do you see as America’s monetary future if changes aren’t made?

Cortez and Zang agree that without a shift to sound money practices, America’s monetary system is at risk of continued devaluation and loss of purchasing power. This scenario would harm individuals’ savings, lead to more economic inequality, and eventually destabilize the economy.