(Peter St. Onge, Money Metals News Service) Will we ever get durable deflation again? Or will grandma keep getting sucker punched at the check-out lane? Forever.

Last week, I joined Kevin Paffrath – MeetKevin on YouTube – for a wide-ranging interview about the economy and freedom.

During our chat, he asked about an ongoing beef between George Gammon and Cathie Wood about whether massive deflation is on the horizon.

The short answer is no: We will never again see durable deflation. Not until either the dollar dies or the Fed dies – whichever comes first.

The Tech-Led Deflation Debate

Now, if you don’t know George and Cathie, he makes financial videos on YouTube, and she’s the CEO of Ark Invest, which manages roughly $7 billion and focuses on disruptive high-tech plays like AI, robots, and biotech.

A couple of months ago Cathie gave a talk saying that investors were worried about the wrong thing. That we should actually be preparing for massive deflation.

Her reasoning is that technology is inherently deflationary, and we’re about to have an epic tech boom.

So is she right? Are we about to see plunging prices thanks to AI?

In short, no. Not because her reasoning is off – she’s 100% right that tech is deflationary because it lowers prices.

But the missing part is the central bank – the Federal Reserve. It soaks it all up.

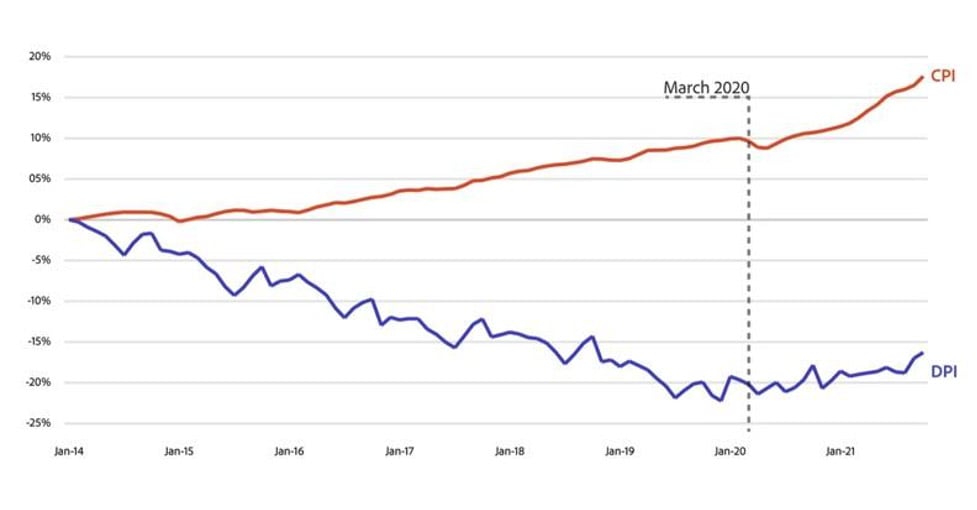

Digital Price Index vs Consumer Price Index | Digital Economy Index (U.S.)

Consumer Price Index is profiled against Adobe’s Data (cited as DPI for “Digital Price Index”)

To lay out the process, let’s say you make hand-made mugs – 10 a day. And you sell them for $20 to make ends meet. Now you install a machine and you can make 100 a day. Pay for the machine and you can charge, say, $10 and still turn a profit. Presto, a dollar buys more mugs.

Do that across an entire economy and you get generalized deflation – dollars buy more.

Indeed, before central banking this was the normal state of a healthy economy – technology advanced, capital – machines – were installed, and we got more stuff for the dollar.

The problem, of course, is that central banks are founded specifically to soak up all that deflationary goodness. In fact, they steal it and then some, turning deflation into inflation.

“Bad” Deflation — the Kind the Fed Makes

Now, there is a special type of deflation which is bad, which is when the dollar is getting stronger not because we make more stuff, but because a bunch of dollars suddenly disappeared. More specifically, they got pulled out of circulation and stored somewhere.

Why would that happen? It could happen because there’s World War 3 and everybody panicked. Or, more often, because the Fed crashed the banking system, a bunch of debt evaporated – it defaulted and got written off.

At which point everybody’s scrambling to save dollars to plug their balance sheets. They’re not spending the dollars, they’re storing them away. As if they buried them in the ground.

Meaning those non-circulating dollars are, at least temporarily, out of the inflation game.

That’s exactly what happened in 2008, it’s what happened in 1929, and it’s what happens in every financial panic.

In fact, that special case is precisely the excuse the Fed uses to steal the normal, good deflation. It’s pretty cute, really – using the special bank panic deflation the Fed itself causes to steal tens of trillions of healthy deflation year in, year out.

Sustained Deflation Is Not in the Cards

In short, there is zero chance we’ll have durable deflation. Because the Fed will soak it up and then some. In fact, China’s doing this as we speak, printing hand over fist to soak up its over-capacity-driven deflation.

That means whatever deflation windfall one expects from AI, robots, nanoassembly, or cold fusion will end up, like so much else, in the pockets of Congress. We will never again see durable deflation.