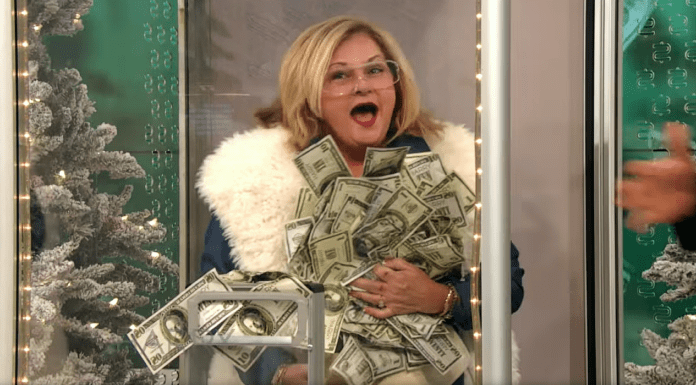

(Molly Bruns, Headline USA) A poll from Intelligent.com found that 73% of people applying for President Joe Biden’s student-loan amnesty will instead be spending their money on nonessential goods such as new smartphones, extravagant vacations and hitting the bar.

This plan, which was announced in late August, will transfer up to $20,000 for each individual debtor and cost taxpayers nearly $1 trillion in total, the Post Millennial reported.

“Nearly twice as many Democrats than Republicans feel spending on non-essentials is an acceptable thing to do (12 percent vs 7 percent),” the survey said.

The survey covered 1,250, all of whom were no longer college students.

A breakdown of the survey showed that 52% said their immediate plan was to shop for clothes; 46% said going out to a restaurant or going on vacation.

Of those surveyed, 44% said they would buy a new phone, 36% would spend their cash on a new video-game system, 28% on drugs and alcohol and 27% would hit the casino.

Moreover, 77% of the respondents admitted that they could probably spend their money more wisely if the program isn’t halted.

Six GOP states led the charge to stop the program, suing Biden and succeeding in the 8th US Circuit Court of Appeals.

“It’s patently unfair to saddle hard-working Americans with the loan debt of those who chose to go to college,” said Arkansas Attorney General Leslie Rutledge, who is acting as the primary proponent of this lawsuit.

“The Department of Education is required, under the law, to collect the balance due on loans,” she added. “And President Biden does not have the authority to override that.”

Low-end estimate payments per taxpayer land around $2,000 and nearly 45% of people who took out federal student loans would have all of their loans “canceled.”

Biden’s plan also extended the payment pause on federal loans until the end of 2022. He has ensured colleges and universities they will not face direct financial consequences.

The influx of “free money” is likely to continue driving the near double-digit inflation that has resulted from Biden’s earlier cash-grab free-for-alls, some of which were related to keeping people unemployed as the country continued to recover from the residual effects of the coronavirus pandemic.

Democrat-led economic stimulus packages and other unprecedented spending bills cost taxpayers added trillions in debt while minting extra money into the population, allowing people to live beyond their means and creating supply-chain shortages from the lack of productive, gainfully employed citizens.

Biden further bolstered the unemployment rate by forcing the firing of many in both the public and private sectors who refused to inject the experimental COVID vaxxines.

Although the rate of inflation has stubbornly refused to recede due to Biden’s ongoing spending policies, the Federal Reserve has raised interest rates in response, hoping to effect a two-headed monster of inflation and recession at the same time—sometimes referred to as “stagflation.”