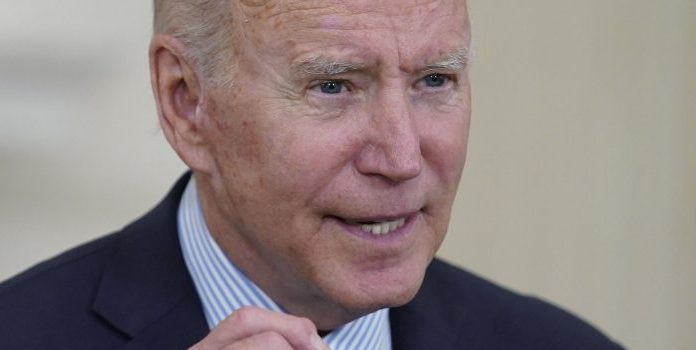

(Headline USA) President Joe Biden proposed a $6 trillion budget for next year on Friday that fails to slow spiking government debt, instead seeking tax hikes on corporations — which ultimately hit consumers — and on the “wealthy,” to pay for ambitious infrastructure and safety-net programs.

Biden has already announced major plans on infrastructure and won a major victory on COVID-19 relief earlier this year. But Friday’s rollout tallies up the cost and incorporates them into the government’s existing budget framework, including Social Security and Medicare. That provides a fuller view of the administration’s fiscal posture.

The unusual timing of the budget rollout — the Friday afternoon before Memorial Day weekend — indicates that the White House isn’t eager to trumpet the bad deficit news. Typically, lawmakers host an immediate round of hearings on the budget, but those will have to wait until Congress returns from a weeklong recess.

Democratic aides disclosed key elements of the Biden plan, speaking on condition of anonymity because the document is not yet public.

The whopping deficit projections reflect a government whose steadily accumulating debt has topped $28 trillion after well over $5 trillion in COVID-19 relief, driving the government to borrow almost 50 cents of every dollar it spends. With the government’s structural deficit remaining unchecked, Biden would use proposed tax hikes on businesses and high-earning people to power huge new social programs like universal pre-kindergarten, large subsidies for child care and guaranteed paid leave.

The budget incorporates the administration’s eight-year, $2.3 trillion infrastructure proposal and its $1.8 trillion American Families Plan and adds details on his $1.5 trillion request for annual operating expenditures for the Pentagon and domestic agencies.

Biden’s budget gives Republicans fresh ammunition for their criticisms of the new Democratic administration as bent on a “tax and spend” agenda that would damage the economy and impose a crushing debt burden on younger Americans.

“Now is the time to build (upon) the foundation that we’ve laid to make bold investments in our families and our communities and our nation,” Biden said Thursday in an appearance in Cleveland to tout his economic plans. “We know from history that these kinds of investments raise both the floor and the ceiling over the economy for everybody.”

Under Biden’s plan, the debt held by the public would exceed the size of the economy and soon eclipse record levels of debt relative to gross domestic product that have stood since World War II. That’s despite more than $3 trillion in proposed tax increases over the decade, including an increase in the corporate tax rate from 21% to 28%, increased capital gains rates on top earners and returning the top personal income tax bracket to 39.6%.

Like all presidential budgets, Biden’s plan is simply a proposal. It’s up to Congress to implement it through tax and spending legislation and annual agency budget bills. With Democrats in control of Capitol Hill, albeit barely, the president has the ability to implement many of his tax and spending plans, though his hopes for awarding greater increases to domestic agencies than to the Pentagon are sure to hit a roadblock with Republicans.

Some Democrats are already balking at Biden’s full menu of tax increases, imperiling his ability to pay for his ambitious social spending. And his plans to increase spending on domestic Cabinet agencies by 16% while limiting defense to a 1.7% increase is politically impossible in the 50-50 Senate.

The Biden plan comes as the White House is seeking an agreement with Senate Republicans over infrastructure spending. There are growing expectations that he may have to go it alone and pass his plans by relying on support from his narrow Democratic majorities in both the House and Senate.

The flood of Biden’s spending proposals includes $200 billion over 10 years to provide free preschool to all 3- and 4-year-olds and $109 billion to offer two years of free community college to all Americans. Also, $225 billion would subsidize child care to allow many to pay a maximum of 7% of their income for all children under age 5.

Another $225 billion over the next decade would create a national family and medical leave program, while $200 billion would make recently enacted subsidy increases under the Obama health care law permanent.

It also calls for $36.5 billion for schools with large concentrations of low-income students, a huge $20 billion increase over current levels. The new funding would be used to increase teacher pay, expand access to preschool and increase access to rigorous coursework, according to a congressional aide briefed on the budget who spoke on condition of anonymity ahead of the official release.

The increases would drive federal spending to about 25% of the entire economy, while the tax boosts would mean revenues approaching 20% of the size of the economy once implemented.

Last year’s $3.1 trillion budget deficit under President Donald Trump was more than double the previous record, as the coronavirus pandemic shrank revenues and sent spending soaring.

Republican concerns about the deficit are voiced chiefly when Democrats are in power, and the Biden budget gives them ammunition to attack.

“So far this administration has recommended we spend 7 trillion additional dollars this year. That would be more than we spent in adjusted inflation dollars to win World War II,” Senate Republican leader Mitch McConnell said Thursday on CNBC. “So they have huge spending desire” and “a great desire to add in $3.6 trillion in additional taxes on top of it.”

Biden’s budget assumes the economy will grow by 5.2% this year and 4.3% next year before settling to about 2% growth thereafter.

Adapted from reporting by Associated Press.