(Jesse Colombo, Money Metals News Service) Amid silver’s recent surge following a long period of stagnation, a wave of articles and commentaries has emerged calling its rise an unsustainable bubble that’s about to burst and burn investors.

It’s worth noting that nearly all of those now calling silver a bubble failed to foresee its bull market years ago, unlike myself. In my view, they’re now heckling from the cheap seats, which reeks of sour grapes.

I firmly disagree with their assessment, and in this report, I will prove that silver is not in a bubble by examining a wide range of valuation metrics.

Let’s start with a look at silver’s performance over the past few years. The current bullish cycle in silver began when it bottomed in September 2022, and it has since surged 379%.

While some argue for different starting points to silver’s bull market, I believe September 2022 is the most accurate. This view is supported not only by silver’s price in dollar terms, but also by other valuation metrics I use, as well as the timing of gold’s bottom. I explained my reasoning in this report.

While silver’s 379% gain over the past 40 months is impressive, it remains in the early stages when compared to previous secular silver bull markets.

For example, during the 1970s bull market, silver rose 3,631% over 98 months, and in the 2000s bull market, it gained 1,130% over 113 months. The current silver bull market’s relative youth is just one of many reasons I believe it is premature to call for its end.

Silver’s sharp nominal price increase is the main reason behind recent claims that it is in a bubble, but that is a highly inaccurate and intellectually dishonest approach. A far better method is to evaluate silver against a range of different yardsticks to determine whether it is undervalued, fairly valued, or overvalued, which is what we’ll examine next.

Let’s begin with the chart of silver’s real, or inflation-adjusted, price over the past six decades. At its 1980 peak, silver reached the equivalent of $200. In 2011, it climbed to an inflation-adjusted high of $72.24. At its recent peak last week, silver hit $84 before pulling back to its current level of $77.

This shows that the real price of silver is less than half of its 1980 peak and is currently roughly in line with its 2011 high. This indicates that silver has significant room to rise further over the course of its bull market.

I also want to point out that the current real price of silver matching its 2011 peak doesn’t concern me as much as it might seem, because at that time, gold, silver, and commodities in general were already more than nine years into a bull market that was clearly showing its age.

In contrast, the current precious metals bull market is only a few years old, and commodities overall have been stagnant for years, though I believe they are about to begin a supercycle of their own soon.

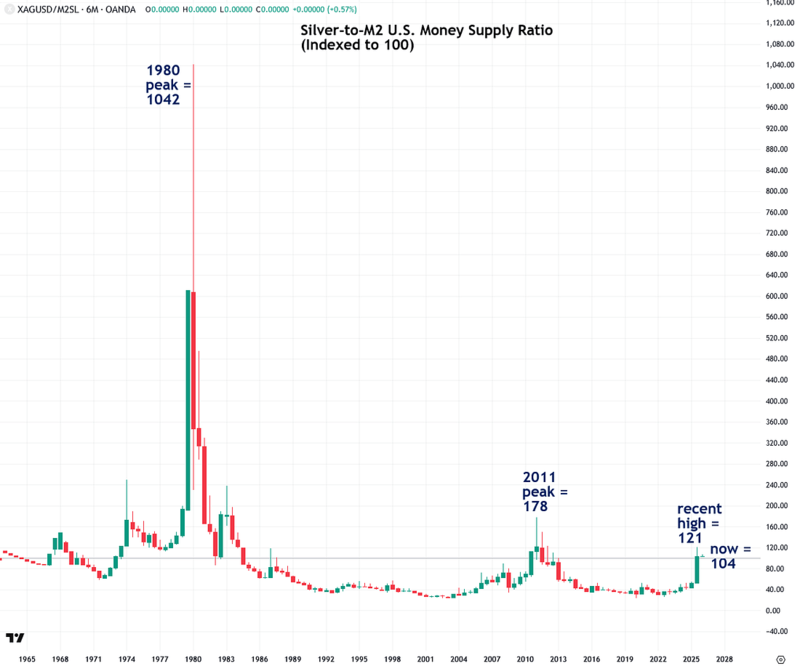

Now we will look at silver in relation to another measure of inflation: the U.S. M2 money supply. I believe that the money supply is an even better indicator of inflation than the Consumer Price Index (CPI) used in the prior chart, which is known to understate actual inflation (learn more).

Moreover, growth in the money supply is the underlying cause of inflation itself. As Milton Friedman, the Nobel Prize–winning economist, famously said, “Inflation is always and everywhere a monetary phenomenon.”

At its peak in 1980, silver measured against the M2 money supply reached 1,042. In 2011, it was 178. At last week’s high, it stood at just 121, and after the recent pullback, it’s now at 104.

This indicates that silver still has significant room to rise relative to the money supply before it could be considered in bubble territory.

On that note, I also recommend reading my report on how the U.S. global money supply is growing at an alarming rate. I also suggest reading my other report, which explains how it is not so much that precious metals are rising in value, but rather that paper currencies are losing value.

Next, let’s move on to another metric that confirms that silver is still much cheaper today than it was at the peaks in 1980 and 2011, despite its recent gains. This time, we will look at the silver-to-gold ratio, which is a useful way to determine whether silver is undervalued or overvalued relative to gold, the leading benchmark in the precious metals market.

While gold has always been more expensive than silver throughout history, the gap between them has varied significantly. At both the 1968 and 1980 peaks, silver was 6.7% of the price of gold. At the 2011 peak, it was 3.3%. But now, silver is just 1.6% of gold’s price, which is far below historical levels.

This indicates that silver is extremely cheap by historical standards and still has substantial room for its bull market to continue.

Another novel yardstick I have been experimenting with lately for comparing precious metals and commodity prices is the U.S. national debt. The chart, indexed to 100, shows that this ratio was 1,377 at the 1980 peak, 87 at the 2011 peak, and it’s in the mid-50s now.

This confirms that silver has substantial room to catch up to the soaring national debt. In that context, $75 to $80 silver is not expensive at all, and a move to $100 and beyond is far from inconceivable.

One reason why this ratio is so important is that the higher the federal debt rises relative to GDP, the closer we move to the inevitable breaking point where the government and the Federal Reserve will be forced to support the U.S. Treasury market and fund government operations by running the printing presses on overdrive. This will send inflation through the roof and ultimately destroy the dollar, causing gold and silver to reach prices that are difficult to even comprehend.

This will not be ordinary inflation, but full-blown hyperinflation like what my great-grandparents suffered through in Weimar Germany during the 1920s. It devastated the wealth and economy of Germany and was the reason they emigrated to the United States. Unfortunately, it also led to mass radicalization, which directly paved the way for the rise of Hitler.

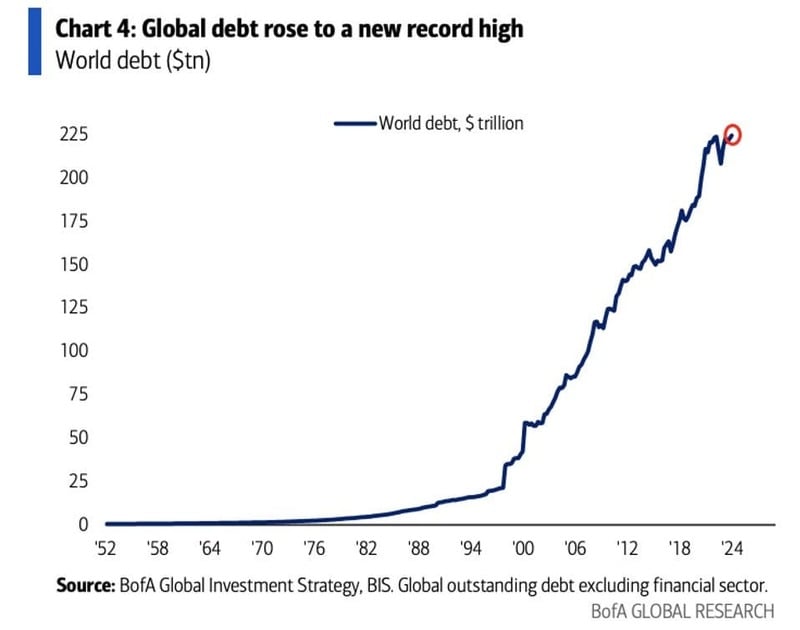

Unfortunately, this debt problem is truly a worldwide phenomenon, as global debt has surged more than tenfold since the mid-1990s, reaching an estimated $250 trillion. This towering debt burden is a ticking time bomb that will ultimately bring fiat currencies to their knees.

That is why it is of the utmost importance for everyone to acquire at least some physical gold and silver to protect themselves against what lies ahead. This fact alone guarantees that precious metals still have much further to rise.

Another useful way to determine whether silver is cheap or expensive compared to its past is to measure it against another yardstick: the Dow Jones Industrial Average.

This comparison is valuable because there is a long-established relationship between precious metals and stocks, with capital rotating back and forth between them in secular phases. In many ways, they act as counterbalances to each other.

The chart of the silver-to-Dow ratio, indexed to 100, shows that silver at its 1980 peak reached an astounding 2,814. At the 2011 peak, it was 204. Today, it is only 74. This confirms that silver remains very cheap, even at $77.

The reason for this extremely low ratio is twofold: the U.S. stock market is highly inflated and expensive right now, while silver remains undervalued according to numerous metrics.

I believe this situation will reverse, with silver far outperforming as stocks decline and their lofty valuations return to more realistic levels. That reversal will benefit precious metals enormously, as trillions of dollars flow out of a sinking stock market and into a booming silver and gold market, sending them dramatically higher.

Valuations aside, one of the many reasons I am so bullish on silver is that it recently broke out from a six-decade-old cup and handle pattern, and based on the sheer duration and magnitude of that pattern, it projects silver surging to hundreds of dollars an ounce.

After a breakout from such a significant historical pattern, calling silver a bubble or betting against it is both foolish and ignorant. The best investors and traders in the world understand that you should never fight the trend, even if you don’t agree with it or fully understand it, and silver’s trend is clearly upward.

Another point I want to make regarding the valuation metrics I showed earlier in this report is that their denominators, such as inflation as measured by the CPI, the money supply, gold, and debt, continue to increase over time along with the price of silver.

If silver merely keeps pace with them, that alone supports the continued increase in its price. Silver would have to dramatically outpace their growth for an extended period of time to be considered in bubble territory, and while that will probably happen someday as the bull market reaches maturity many years from now, that is certainly not the case right now with silver at $77.

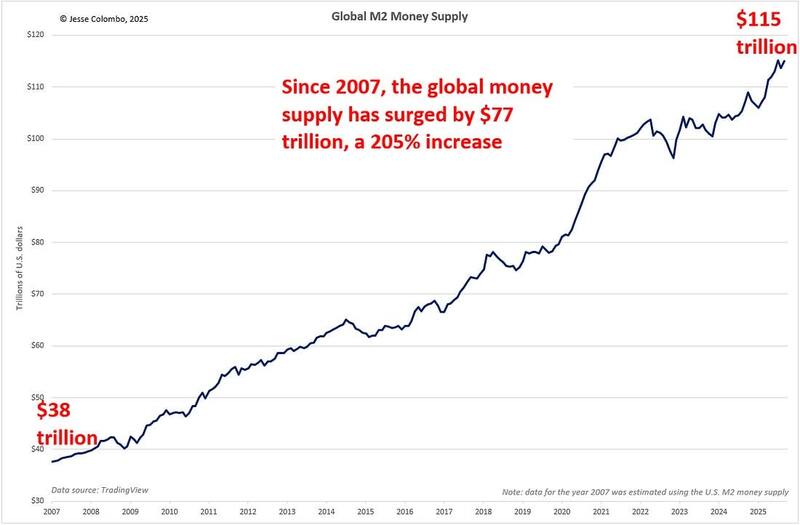

As you can see, the U.S. M2 money supply has surged an incredible fivefold since the year 2000, and that is the reason for our skyrocketing living costs and a major reason why precious metals have soared during that time period:

And it’s not just an American problem but a truly global one, as literally all fiat/paper currencies, including the euro, Canadian dollar, British pound, Australian dollar, and Japanese yen, race each other to the bottom.

This not only won’t stop anytime soon, but I anticipate it accelerating as we move toward the endgame of the fiat money regime that has been in place since 1971. That alone will ensure a continued tailwind for the precious metals bull market over the next decade.

In conclusion, I believe the many recent articles and commentaries claiming that silver is in a bubble are flat-out wrong. They are coming from people who did not foresee silver’s bull market in the first place, which indicates a lack of understanding of the dynamics driving it higher.

In addition, these shallow-thinking pundits are being misled by silver’s sharp nominal price increase, not realizing that silver has not actually risen anywhere near as much when compared to inflation, the money supply, debt, gold, and the stock market.

My advice is to tune out their negativity and not get spooked out of your wise investment in silver, which still has many years left to rise before its gains become excessive. And when that time comes, and silver does start to get too lofty and irrational, I will sound the alarm.

If you’ve enjoyed this report or have any questions, comments, or thoughts, please give this post a like and share your thoughts in the comments below—I’d love to start a conversation and hear your perspective.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.