(Peter St Onge, Money Metals News Service) During last month’s tariff war, a big driver of stock-market declines was foreigners selling.

Foreigners have stockpiled over $60 trillion in US assets — much of it in stocks. Which puts America at the mercy of those foreigners whenever foreigners get nervous.

Part of this is terrible trade deals, but the biggest driver is that Americans stopped saving money, instead spending their way into debt slavery.

Why Americans Stopped Saving

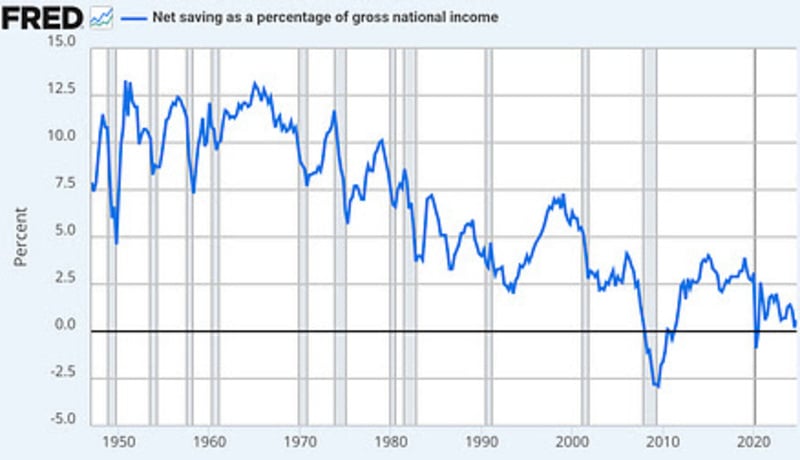

According to the BEA, Americans currently save just 0.6% of gross national income. In the 90’s it was 7 and a half percent. In the 1960’s it was 12.6%.

So what happened?

Mainstream focuses on consumer culture — immediate gratification, advertising, credit cards.

But of course, we had all this in the 1990s and 1960s. The 90s were the me decade, and the 1969 Summer of Love is the definition of immediate gratification.

Ads in the 60s were on everything, and by 1969, over half of Americans had a credit card. By the90ss credit cards were as ubiquitous as today.

The “Poverty Trap”

In reality, we can trace the low savings rate to 3 things: stagnant wages, generous welfare, and, above all, artificially manipulated interest rates by the Federal Reserve.

The wages and welfare combination actually has a name: the Poverty Trap. As in the more generous welfare gets the less people work — may as well relax on the couch. In fact, if you work, you lose the benefits.

When illegals push back-breaking jobs to minimum wage, all the more reason.

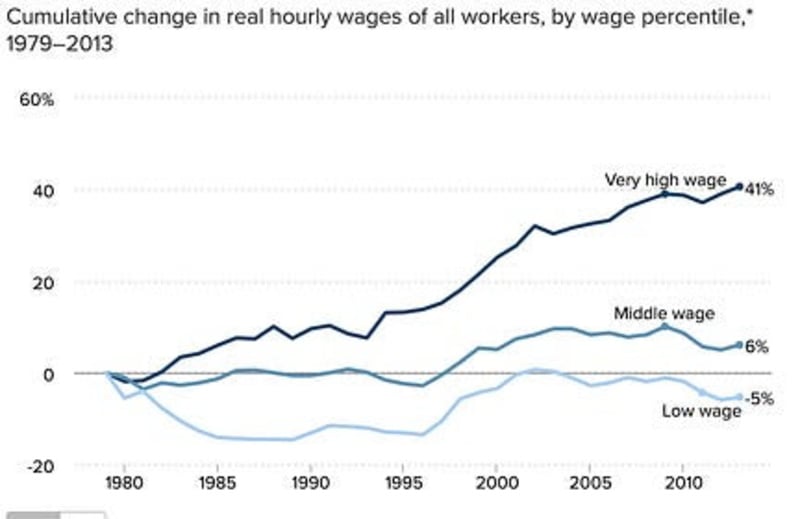

I’ve talked about how wages stagnated for the young blue-collar starting in the 2000s, to the point they’re the first generation in 250 years that doesn’t out-earn their parents.

Part of this is mass migration competing for jobs. Part is trade deals that opened markets but didn’t open theirs. Part is the relentless march of regulations that wipe out small businesses. And part is the relentless march of benefits that by votes by paying people not to work.

Put them together, and the net worth for the bottom half of Americans has been stagnant since 1989.

Enter The Federal Reserve

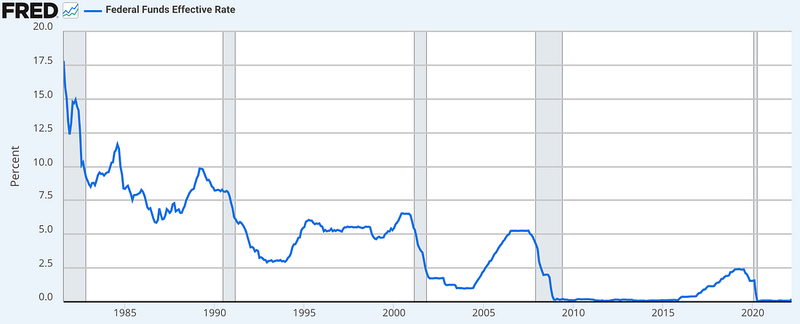

While the poverty trap went to work on the poor and young, the middle class got run through the interest rate woodchipper by the Federal Reserve.

Between the 1950s and 2000, the average Fed fund rate was 6.6%. Since 2000, it’s 2.3%. Adjusted for inflation, it’s actually been negative since 2000.

In other words, banks were paid to borrow money.

This did 3 things:

It gutted the return on savings — for most of the period since 2000, banks have paid fractions of a percent on deposits. After all, why pay when they’re getting it free from the Fed?

It drove inflation, most spectacularly under Joe Biden. This turned those fractions of a percent negative, actually draining your money. The amazing thing is that people saved at all.

It drove income inequality by driving up the price of assets from stocks to housing. This slammed the door on the biggest traditional savings pool, your house.

Low rates rained trillions on boomers — trillions they never earned. And it destroyed the young, who are currently doom-spending their way to debt slavery.

What’s Next

It’ll take 3 things to get Americans back to saving: Jobs that pay more than welfare. Interest rates that reward savings. And controlling federal spending so the Fed doesn’t need to force rates down.

Trump’s doing his best. Congress is not.

But if we can get there, we start the long road back to a creditor nation that owns more of the world than they own of us.

Peter St. Onge writes articles about Economics and Freedom. He’s an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University.