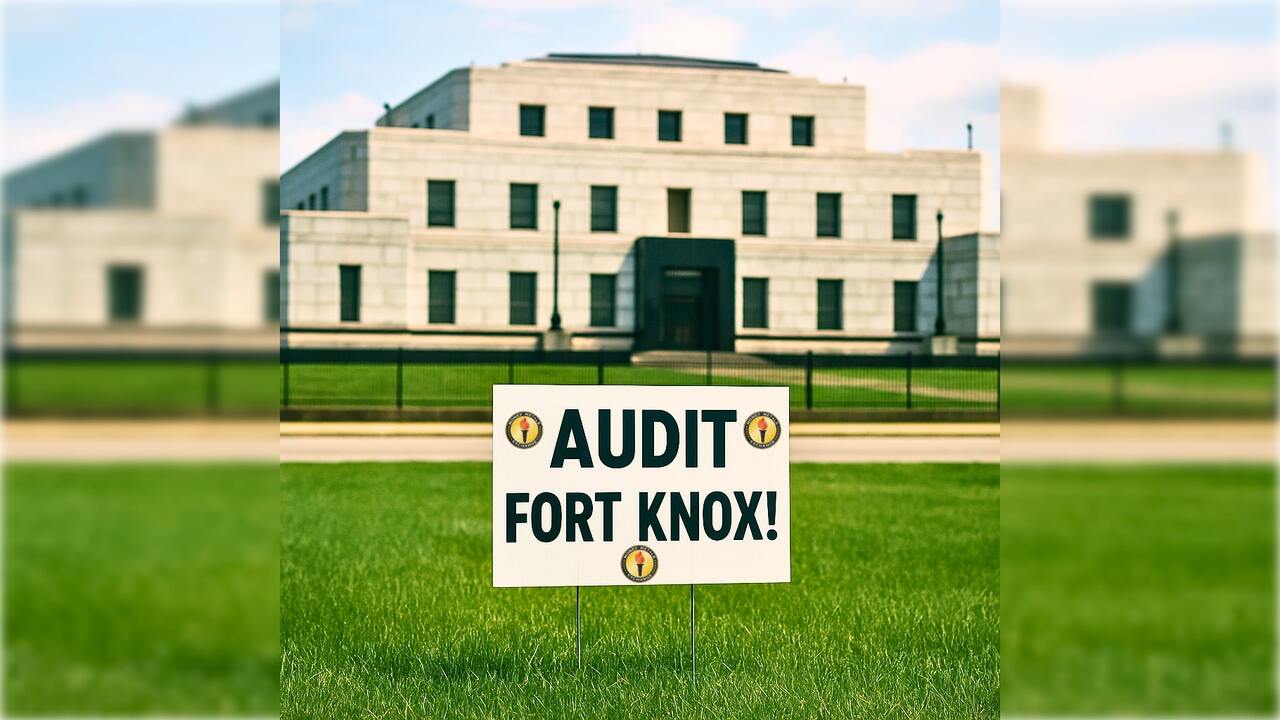

(Sound Money Defense League, Money Metals News Service) In a compelling interview with Investing News Network host Charlotte McLeod, Jp Cortez, Executive Director of the Sound Money Defense League, detailed a new legislative push to audit the United States’ gold reserves for the first time in decades.

The initiative, known as the Gold Reserve Transparency Act of 2025 (House Bill 3795), was introduced by Congressman Thomas Massie alongside three co-sponsors.

A Gold Audit—65 Years in the Making

The bill calls for a full, modern audit of America’s gold holdings—something that hasn’t occurred in over 65 years.

According to Cortez, prior “audits” were largely ceremonial, involving inspections of storage containers rather than the actual gold bars.

Past audits failed to meet basic transparency or accounting standards, with reports now missing and no comprehensive assaying, weighing, or transactional history available to the public.

Cortez emphasized that private depositories, such as the one operated by Money Metals Depository in Idaho—the largest in North America—would face criminal charges for such loose practices.

The bill would apply not only to Fort Knox, but also to vaults in Denver, West Point, and other storage sites. It requires:

- Physical inventory and verification through assaying

- Accounting of all transactions over the last 50 years

- Review of ownership status (whether gold is leased, swapped, or encumbered)

According to Cortez, this is essential because the U.S. Treasury claims to hold 261 million troy ounces of gold, much of it in impure, 90% fine “coin melt” bars that are no longer considered market-tradable. That means, even if the gold is there, it may not be liquid—a critical issue if the U.S. ever needs to sell or use it as a monetary reserve.

Trump, Musk, and Massie: Bipartisan and Popular Support Builds

While not yet formally endorsing the bill, former President Donald Trump has voiced support for an audit of Fort Knox. Likewise, Elon Musk stirred social media interest earlier in the year by suggesting a livestream of the U.S. gold reserves, though Cortez warns against repeating the superficial “dog-and-pony show” audits of the past.

The Sound Money Defense League has worked on this issue since its founding in 2014, with earlier versions introduced by Congressman Alex Mooney in 2019 and 2021 failing to even receive a hearing. But Cortez is optimistic that conditions have changed.

He points to rising grassroots support, social media momentum, and a growing concern over inflation, monetary debasement, and the status of the U.S. dollar. These concerns coincide with global calls for de-dollarization, and moves by countries like Germany to repatriate gold stored in the U.S.

Cortez believes support from Senators like Rand Paul (KY) and Mike Lee (UT) could pave the way for a companion bill in the Senate.

Congressman Thomas Massie, known for his principled stance on transparency and fiscal responsibility, is well-positioned to lead this initiative. Alongside the bill’s co-sponsors (Warren Davidson, Addison McDowell, and Troy E. Nehls), he brings a consistent record of challenging federal overreach and advocating for accountability—making them a strong team to push for a meaningful and credible audit of America’s gold reserves.

Federal Sound Money Reform: Capital Gains Tax Elimination

Beyond the audit bill, Cortez also highlighted another key federal initiative: the Monetary Metals Tax Neutrality Act, reintroduced in 2024 by Rep. Alex Mooney. The bill seeks to eliminate federal capital gains taxes on gold and silver—one of the biggest legal and financial barriers to treating bullion as money.

Since most states base their tax policy on federal returns, the bill would have the knock-on effect of removing capital gains taxes in most of the country, restoring gold and silver’s monetary utility.

“The biggest impediment to people using gold and silver as money today is the friction of taxes,” Cortez said. “Removing that friction allows individuals to reestablish their own gold standard.”

State-Level Victories and Momentum in 2025

While federal reform has been slow, 2025 has been the most successful legislative year yet for sound money at the state level, according to Cortez.

- Over 35 states introduced sound money legislation in 2025

- Nearly a dozen states passed bills into law

- Reforms include tax exemptions, legal tender recognition, and state gold reserves

Just a year ago, only 7 states had enacted similar reforms.

This surge, Cortez said, reflects growing public concern about inflation and the long-term viability of fiat currency. States are increasingly choosing to protect their citizens and treasuries by embracing gold and silver as honest money.

A Global Trend: Gold in a De-Dollarizing World

Cortez linked the legislative momentum to the surging gold price, which has reached new all-time highs multiple times in recent months. As both U.S. states and foreign governments look for alternatives to fiat currency, gold is regaining its role as a neutral, superior monetary asset.

“More and more countries—adversaries and allies alike—are rediscovering gold as a hedge against inflation and monetary instability,” he noted.

With ongoing global inflation, rising debt, and eroding confidence in central banks, Cortez predicted the trend would continue. As long as paper currencies remain prone to manipulation, he said, sound money will remain a smart long-term bet.

For more information on sound money reform and gold markets, visit the Sound Money Defense League or Money Metals Exchange.