(Jesse Colombo, Money Metals News Service) Back in December, while much of the country was riding a wave of optimism over Donald Trump’s presidential victory, I warned that we were hurtling toward a recession—and saying that it may have already begun. I also noted that the increasing likelihood of a recession would drive up gold prices—and the recent surge is clear confirmation of that.

My prediction wasn’t driven by political bias but by hard data and reliable recession indicators, which had signaled economic trouble long before Trump’s win. And now, as expected, a growing body of evidence confirms that the odds of an imminent U.S. recession are surging.

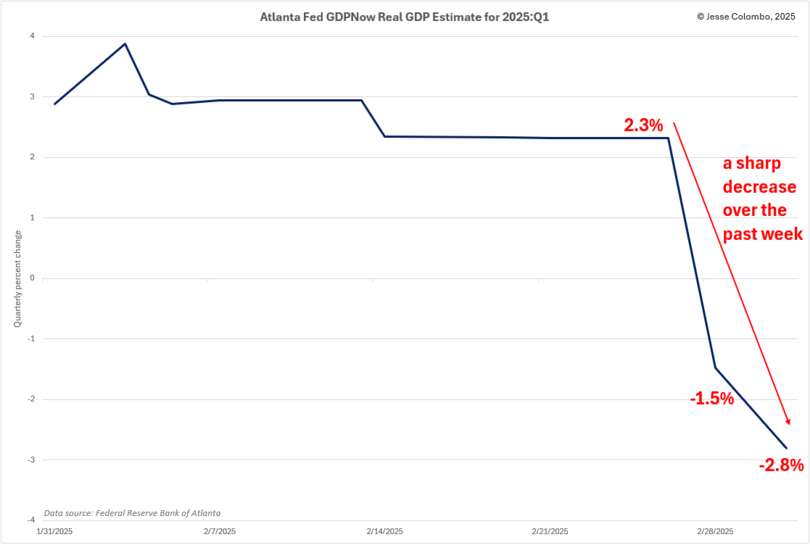

One key indicator signaling an imminent recession is the Atlanta Fed’s GDPNow forecasting model, which updates in real time as new economic data arrives. Just last Thursday, the model projected a 2.3% annual growth rate for the first quarter of 2025. However, after Friday’s economic data releases, that estimate plummeted to a recessionary -1.5%.

Then, on Monday, additional data sent the forecast tumbling even further to a staggering -2.8%, reinforcing the recession warning and silencing skeptics who doubted Friday’s sharp decline.

When the GDPNow estimate for first-quarter 2025 growth plunged to -1.5% on Friday, some skeptics argued that the drop was skewed by a temporary surge in imports. U.S. importers had been front-loading shipments ahead of impending tariffs, they claimed, creating an anomaly that would soon normalize.

While there is some truth to that, it’s only part of the story. A major contributing factor to the declining GDP estimate is weakening consumer spending, which drives more than two-thirds of U.S. economic activity.

In January, consumer spending contracted for the first time in nearly two years, as fears of rising inflation led many to pull back.

Additionally, Monday’s sharp drop in the GDPNow estimate for first-quarter 2025 growth was largely driven by a steep decline in residential investment—spending on new housing and home renovations.

Given that housing contributes between 15% and 18% of U.S. GDP, this downturn is a significant drag on economic growth.

What’s striking is that today’s plunge to a -2.8% GDP contraction marks the worst forecast since the COVID lockdowns in 2020.

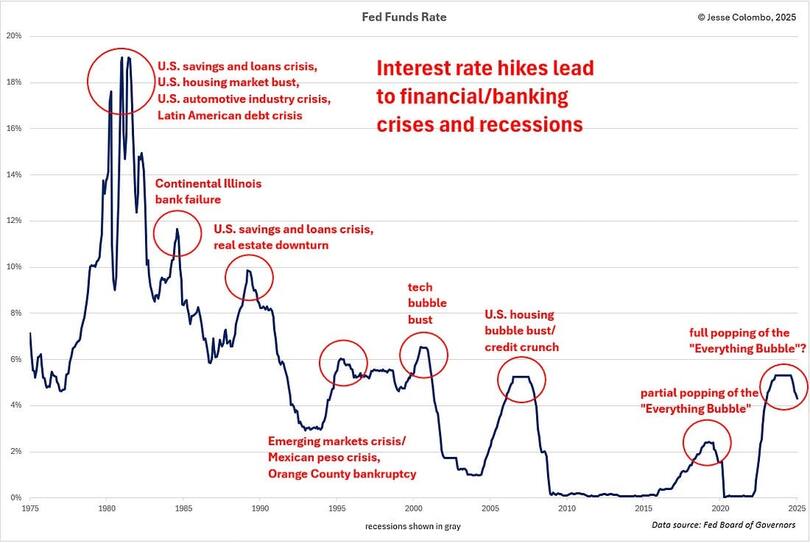

One of the key reasons I’ve been warning about a recession in recent months is that predicting one isn’t all that complicated—especially given historical patterns. The most significant factor is the near inevitability of recessions following rate-hiking cycles, as shown in the chart below.

In general, the Federal Reserve raises rates until “something breaks,” and that something is typically industries or speculative booms that flourished in the prior low-rate environment.

Over the past three years, the Federal Reserve has embarked on an aggressive rate-hiking cycle, pushing the fed funds rate from near zero to a peak of 5.3%—the fastest increase since the early 1980s.

Recently, they’ve cut rates to 4.3% amid growing signs of economic weakness. The tightening cycle had been even more extreme than the mid-2000s hikes that helped trigger the housing market downturn and the subsequent Great Recession.

While many economists and investors remain hopeful for a soft landing, history shows that such outcomes are rare—especially after rate hikes of this scale.

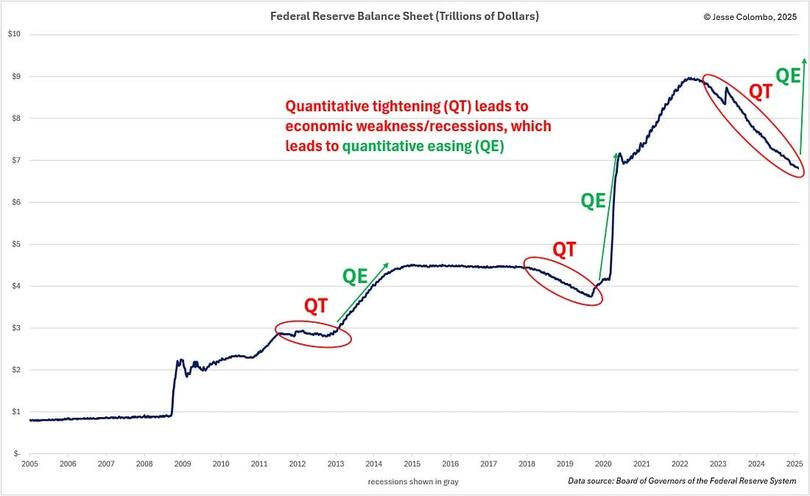

This time, I expect the U.S. economy to be dragged into a downturn by the bursting of what I call the “Everything Bubble”—a term I coined in 2014 to describe the multiple asset and financial bubbles inflated during the era of unprecedented quantitative easing (QE) and zero interest rate policy (ZIRP) after 2008.

In the U.S., this includes bubbles in housing, equities, tech startups, AI, much of the cryptocurrency space, healthcare, higher education, and auto loans. Beyond the U.S., similarly fragile housing bubbles in Australia, Canada, and Western Europe add to the global economic risks.

Make no mistake, there are many other risks likely lurking beneath the surface, waiting to be exposed in the coming downturn. As the billionaire investor Warren Buffett famously remarked, “Only when the tide goes out do you discover who’s been swimming naked.”

Several key indicators are flashing warnings of an imminent recession—or even suggesting that we may already be in one.

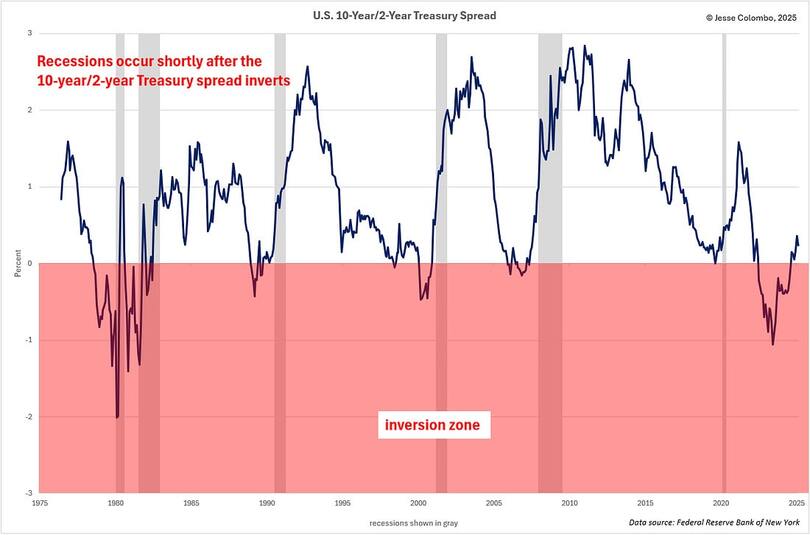

Among the most reliable is the 10-year/2-year yield spread, which is calculated by subtracting the yield of the 2-year Treasury note from the 10-year Treasury note. This measure has accurately predicted the last six recessions. When the spread falls below 0%, it signals an inverted yield curve—one of the strongest predictors of an impending recession.

As shown in the chart below, the shaded gray areas represent past recessions, clearly illustrating the historical correlation between yield curve inversions and economic downturns.

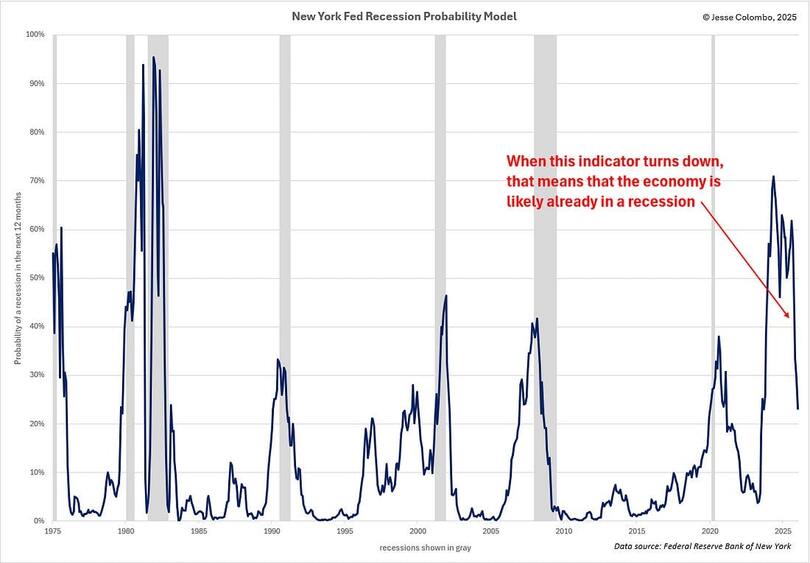

Another yield curve-based recession indicator is the New York Fed Recession Probability Model, which estimates the likelihood of a recession within the next 12 months. As this indicator rises, so does the probability of a recession.

However, when it starts to decline, it coincides with the yield curve’s uninversion—a signal that the economy is likely already in a recession.

Over the past year, this indicator has turned downward, suggesting that the U.S. economy is, unfortunately, already in a recession.

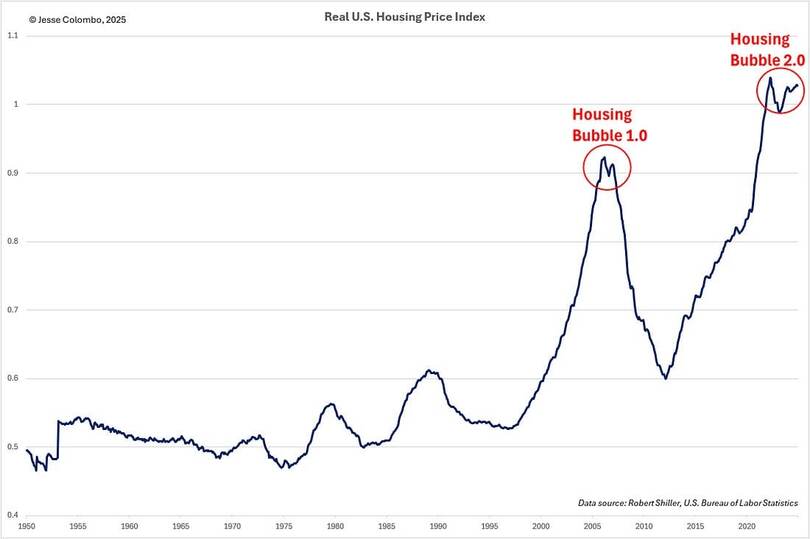

As discussed earlier, I believe the U.S. is in the midst of another housing bubble—what I call Housing Bubble 2.0—and I expect its collapse to be a major trigger for the coming recession.

Simply put, inflation-adjusted U.S. home prices have now surpassed the peak of the mid-2000s housing bubble that led to the 2008 crash. Remember The Big Short? We’ve made the same mistake all over again.

Housing has become so overpriced that, to afford the median-priced home of $433,100, Americans now need an annual income of $166,600—yet the median household income is just $78,538, as Fortune recently reported.

This level of imbalance is unsustainable, and history has shown us exactly how it ends: a housing market crash.

The severe unaffordability of housing in recent years has driven existing home sales to their lowest levels since 1995 despite the U.S. population growing by 80 million over that period.

This is a clear sign of a deeply dysfunctional market—one that cannot sustain itself indefinitely. Sooner or later, something has to give, and that something will be housing prices crashing back down to reality.

The Fed’s pandemic-era stimulus artificially inflated housing prices to irrational levels, fueling a surge in home construction.

Now, as those newly built homes hit the market, an oversupply is emerging—particularly in the Sun Belt region. This kind of excess inventory is a classic warning sign that often precedes a housing downturn.

As home sales stagnate due to unaffordability and inventory continues to build—with even more in the pipeline—housing starts, or the initiation of new residential construction, have entered a downturn. This decline is a classic recession indicator, signaling broader economic weakness ahead.

Another key indicator of the U.S. housing market’s health is homebuilder stocks, tracked by the SPDR Homebuilders ETF (XHB). Right now, these stocks are beginning to roll over—just as they did in 2005, ahead of the housing market downturn that followed a couple years later.

A decisive close below the $96 to $100 support zone would signal the onset of a deeper bear market in housing and homebuilder stocks—one that will ripple through the broader U.S. economy, accelerating the downturn.

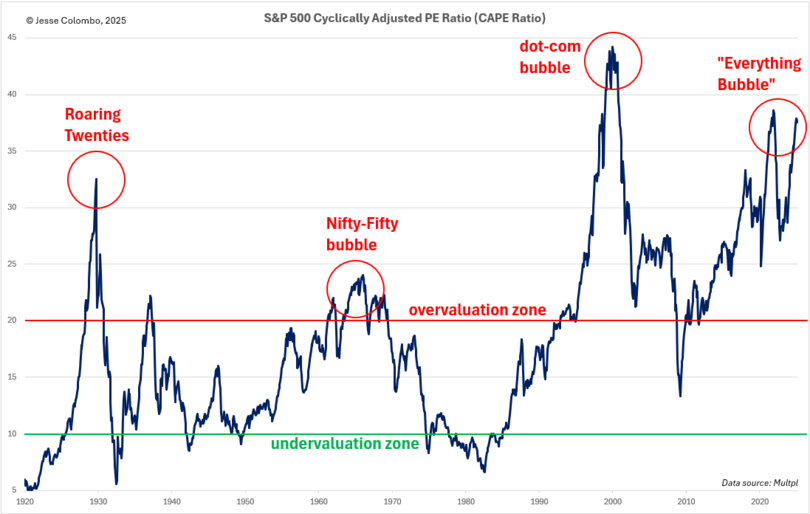

Beyond housing, another major bubble I expect to burst is the one in U.S. stocks. Numerous indicators confirm that the stock market is dangerously overvalued and primed for a mean reversion—a correction that will drag down inflated stock prices and serve as both a symptom and a catalyst of the coming recession.

One of the clearest signs of this excessive valuation is the S&P 500’s cyclically adjusted price-to-earnings (CAPE) ratio, which compares the current price of the S&P 500 to its average earnings over the past 10 years.

Historically, when this metric reaches extreme levels (20 and higher), sharp market declines tend to follow.

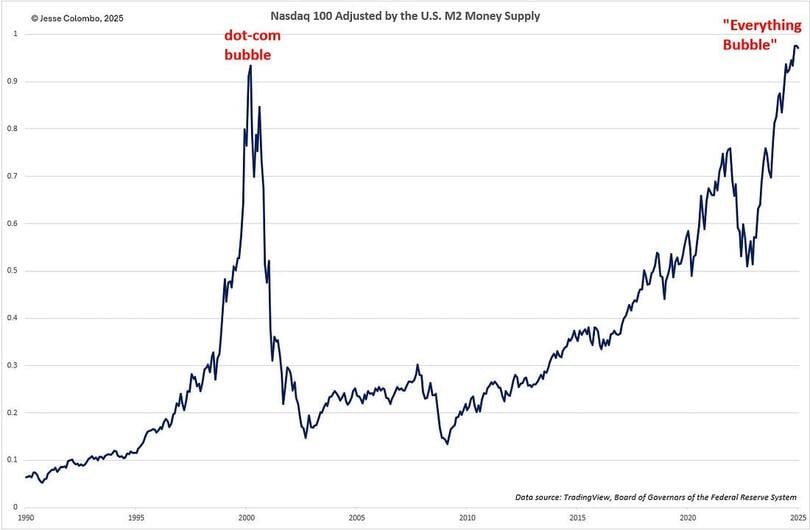

Tech stocks, in particular, are wildly inflated, as evidenced by the Nasdaq 100 adjusted by the U.S. M2 money supply, which represents the total amount of dollars in circulation. This metric reveals that the Nasdaq 100—and tech stocks as a whole—are now even more overvalued than they were during the late-1990s dot-com bubble, which ended in a spectacular crash.

When the “Everything Bubble” bursts, triggering a severe recession (or more realistically, a depression), the U.S. Federal Reserve and government will pull out all the stops to prop up the economy.

This will include slashing interest rates back to zero—and even into negative territory—while abruptly ending the current quantitative tightening (QT) policy and reviving quantitative easing (QE).

In doing so, they will digitally create hundreds of billions—eventually trillions—of new dollars in a desperate attempt to stabilize financial markets and the broader economy.

Gold has a remarkable ability to anticipate recession risks and the monetary stimulus that typically follows—both of which are highly favorable for its price. This is one of the key reasons gold has surged over the past year, leaving many puzzled.

As the coming recession unfolds, I expect gold to continue its upward trajectory, with silver eventually catching up as it historically tends to lag before making its move.

In summary, the risk of a U.S. recession is rising rapidly, and I expect it to involve the bursting of several bubbles within the “Everything Bubble”—most notably in housing and stocks.

Unfortunately, this economic downturn was already set in motion long before Trump won the election, leaving him with little ability to prevent it.

This looming recession will result in serious pain for mainstream investors heavily exposed to overcrowded trades like housing, stocks, and cryptocurrencies.

However, for those positioned in precious metals—a small but savvy minority—it will be highly profitable and beneficial.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.