(Jesse Colombo, Money Metals News Service) What to know about last week’s tariff-driven spike and drop in COMEX gold futures, and what it means for gold’s next move.

What began as a quiet week for gold took an unexpected turn on Thursday afternoon when speculation emerged that gold bullion imports into the United States would, in fact, be subject to tariffs—despite earlier assurances from the Trump administration that they would not.

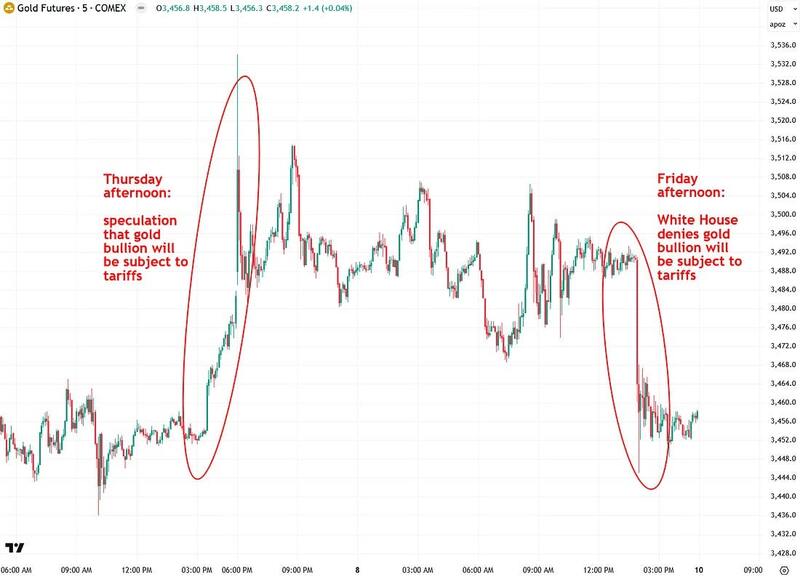

This news triggered a sharp spike in COMEX gold futures into Thursday night. However, with no follow-through, I was cautious and waited to see Friday’s close before drawing conclusions and publishing an update on the situation.

My skepticism proved warranted when, on Friday afternoon, the Trump administration announced it would issue a new policy clarifying that gold bar imports should not face tariffs.

The reversal sent COMEX gold futures tumbling in a sharp whipsaw that left many traders puzzled. In this update, I’ll break down what happened, share my assessment, and outline where I believe gold is headed next.

The intraday chart of COMEX gold futures on Thursday and Friday shows the complete round trip triggered by the bungled tariff announcement and its subsequent denial:

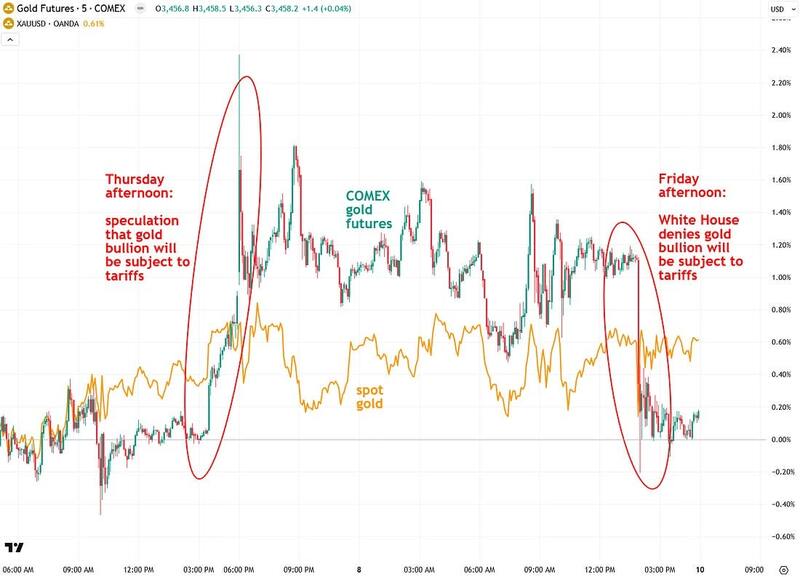

Notably, only COMEX gold futures, which reflect the U.S. domestic gold price, spiked and plunged on the tariff announcement and denial, while the global spot price of gold barely moved:

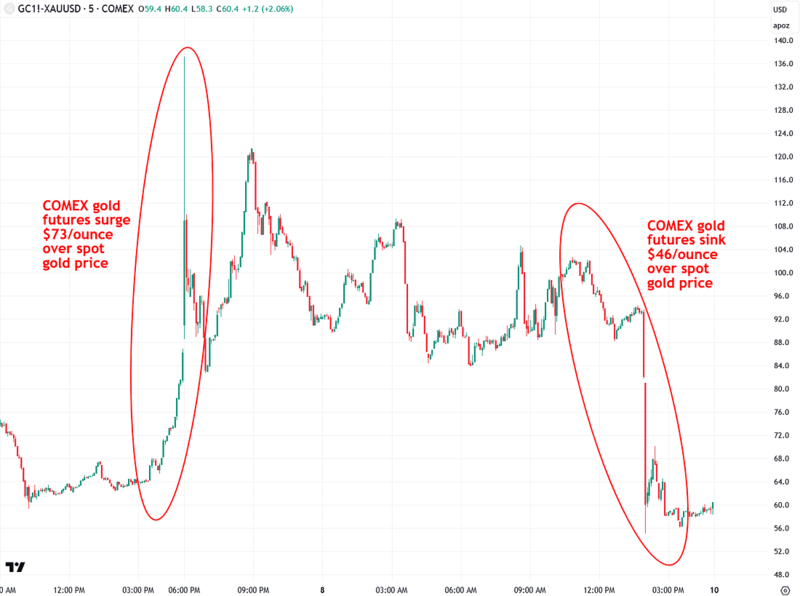

The intraday chart below shows the spread between COMEX gold futures and the spot price of gold. After Thursday’s announcement, futures surged by $73 an ounce over spot, climbing to as much as $137.20 above the spot price before sinking back to roughly where it started by Friday’s close.

This occurred because, had the bullion tariffs been real, the U.S. domestic gold price would have risen above the global price—at least until additional domestic supply entered the market, which could take some time.

By Friday’s close, the tariff saga still left COMEX gold futures at four-month highs and breaking out of the triangle pattern, with strong trading volume. Ordinarily, that would be a very bullish signal. However, the lack of confirmation from the spot price of gold makes me question its validity, as I will show next.

That said, this breakout may still prove valid, and I am now watching to see if COMEX gold futures can close above the $3,500 resistance level on strong volume, which would lend far more weight to the breakout since horizontal resistance levels are generally more significant than diagonal ones.

A quick look at the spot price of gold in U.S. dollars shows it is also trading within a triangle pattern.

Unlike COMEX futures, however, it has not yet broken out—and I want to see that before feeling confident that gold is experiencing a broad-based global breakout rather than a U.S.-only move driven by tariff-related price distortions.

A major driver of gold’s price is the U.S. dollar, with the two typically moving inversely—dollar weakness tends to boost gold, and vice versa.

As I’ve been pointing out, the U.S. Dollar Index has broken below the key 100 level, creating a downward bias as long as it stays beneath that now-resistance level.

The dollar also remains highly overvalued relative to other major currencies, increasing the likelihood of further weakness, which would be supportive for gold.

In recent months, the Dollar Index has been trading in a choppy manner amid tariff speculation and mixed economic data showing both strength and weakness. It recently tested the 100 resistance level again, underscoring its significance and why it should be watched closely.

I expect the Dollar Index will soon pick a direction and trend strongly, possibly when low-volume summer trading conditions come to an end in the coming weeks. Whatever direction the dollar takes from here will likely have a major influence on gold’s next move.

Politics aside, analyzing the markets under a Trump presidency is proving extremely challenging. I, along with many others, am growing increasingly frustrated with the constant tariff back-and-forth and other policy speculations—especially the repeated pattern of initial tariff announcements followed by predictable walkbacks. Copper was similarly hit by a tariff announcement and walkback.

Whether you agree with tariffs or not (I lean toward free markets and free trade), the way these announcements and negotiations are handled is chaotic, confusing, and nearly impossible to track. In my view, it’s also a waste of our collective time and energy.

The main question now is whether gold is about to break out from its summer consolidation phase and make a run toward $4,000+ this fall.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.