(Jesse Colombo, Money Metals News Service) Friday’s price action in precious metals and mining stocks was very encouraging and increases the probability of a bullish breakout that will lead to a powerful fall rally.

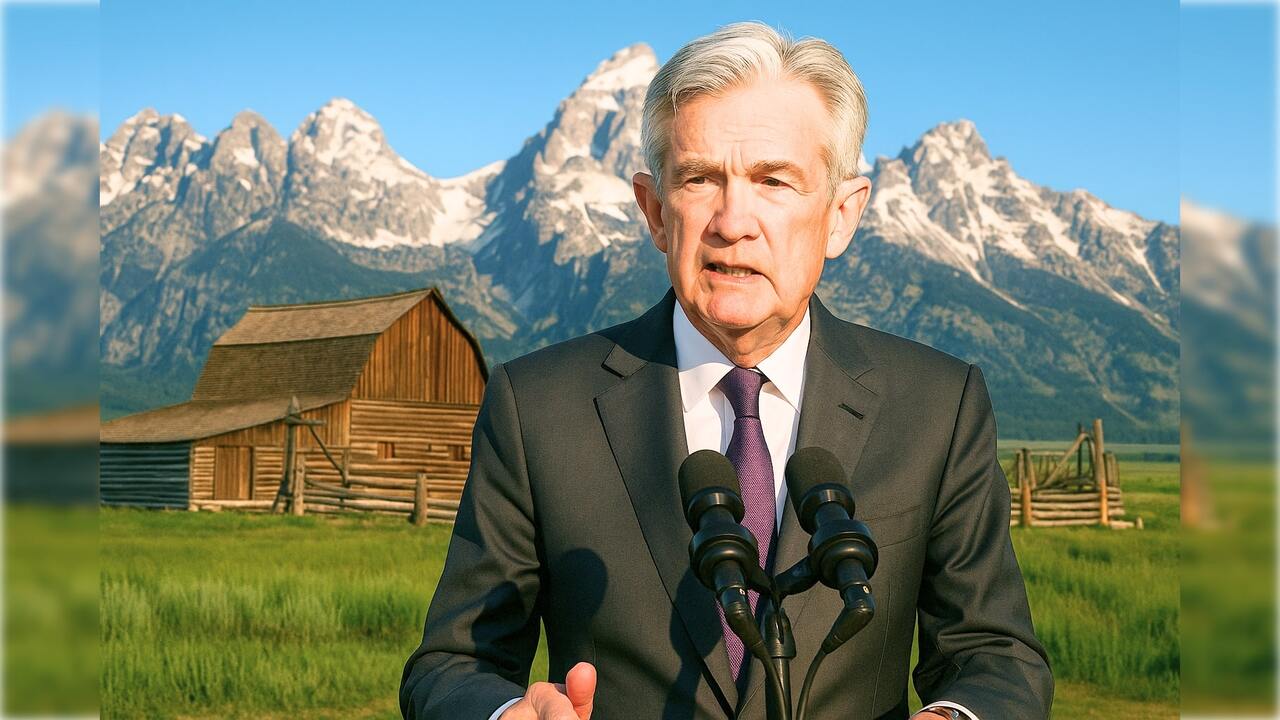

Gold, silver, and mining stocks rallied after Friday’s dovish Fed Jackson Hole speech, which lifted market sentiment and pushed spot gold up 0.97% and spot silver up 1.87%.

Ahead of the meeting, investors were on edge, worried that Fed Chair Jerome Powell might strike a hawkish tone on September’s potential rate cut amid rising stagflation fears.

Instead, Powell surprised markets by noting that “downside risks to employment are rising,” a comment widely interpreted as signaling that a September rate cut is essentially locked in.

In this update, I’ll break down where precious metals stand after this encouraging shift.

Gold reacted positively to the news, climbing about one percent, though it still hasn’t broken out of the triangle pattern I’ve been tracking. With the Jackson Hole speech now behind us, one major hurdle has been cleared, increasing the odds of a breakout in the days ahead.

The rally could very well continue into next week. To learn more, check out my recent articles on gold’s triangle pattern and volatility squeeze, which indicate the potential for significant gains this fall if a decisive breakout occurs.

Silver also reacted strongly to the Fed’s dovish comments, with spot prices jumping 1.87% and COMEX silver futures surging 2.56%. Friday’s bullish action triggered a breakout from the triangle pattern that had formed over the past few months—a clear bullish signal.

The next major hurdle is the $40 resistance level, a key psychological barrier that silver failed to clear in late July before retreating.

If silver can decisively break above $40, I expect the bull market to accelerate quickly, with $50, $60, and even higher levels coming into play in short order.

The Synthetic Silver Price Index (SSPI), a proprietary indicator I developed to confirm whether moves in silver are genuine or just noise or manipulation, climbed 0.87% on the Fed’s dovish comments, bringing it closer to breaking out of the ascending triangle pattern that has been forming over the past five months.

A decisive breakout from this pattern would be a strong signal that silver’s bull market is about to accelerate significantly. For a deeper understanding of this unique and powerful indicator, be sure to read my recent article on the SSPI.

Gold mining stocks, as measured by the VanEck Gold Miners ETF (GDX), continue to gain momentum after breaking out of their ascending triangle earlier this month.

With multiple factors now aligning in their favor, I believe we are still in the very early stages of the bull market for gold miners.

Junior gold miners, as represented by the VanEck Junior Gold Miners ETF (GDXJ), have also broken out of an ascending triangle pattern, adding further confirmation that a major bull market in gold mining stocks is just getting underway.

In addition to being bullish on gold mining stocks, I am also very optimistic about silver mining stocks and will be publishing a detailed report on them soon.

The monthly chart of the Global X Silver Miners ETF (SIL) shows a decisive breakout above the critical $48 to $52 resistance zone that has capped gains since 2016, which I view as a major bullish signal.

Junior silver mining stocks, which had been lagging until recently, are now waking up in a big way, and I am very bullish on their outlook.

The most popular junior silver mining ETF, trading under the symbol SILJ, is now on the verge of breaking out of a long-term triangle pattern that dates back to 2013.

Once a decisive breakout occurs, I expect explosive upside potential, particularly since junior mining stocks are highly leveraged to the price of the underlying metals and often outperform during broad precious metals bull markets.

Jerome Powell’s dovish remarks sent the U.S. Dollar Index down 0.93%, which strongly contributed to the bullish action in precious metals due to their well-established inverse relationship with the dollar.

I have been correctly bearish on the dollar since January and reiterated that view after the index broke below the key 100 level.

While the Dollar Index has been trading sideways for the past five months, I am watching the 96 support level closely. A decisive close below that level would signal that the dollar’s bear market is gaining momentum, which would create a powerful tailwind for precious metals and mining stocks.

To wrap things up, as a precious metals bull, I am both pleased and relieved after Jerome Powell’s dovish remarks on Friday, especially given the uncertainty leading into the meeting and the very real concern that he might spook the markets with hawkish comments, particularly given his ongoing public tensions with President Trump.

Friday’s price action in precious metals and mining stocks was very encouraging and increases the probability of a bullish breakout that will lead to a powerful fall rally.

That said, gold still hasn’t broken out of its triangle pattern yet, but I believe it is getting close. As always, I will keep you all updated.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.