(Jacob Bruns, Headline USA) President Joe Biden’s newly militarized Internal Revenue Service plans to target restaurant tips as it seeks new revenue streams to fund Democrats’ out-of-control spending, Fox News reported.

Despite repeated assurances that their new 87,000 armed agents would only crack down on the ultra-wealthy, the tax bureaucracy has instead decided to harass everyday middle-class taxpayers, invasively poring over every detail of their finances in the process.

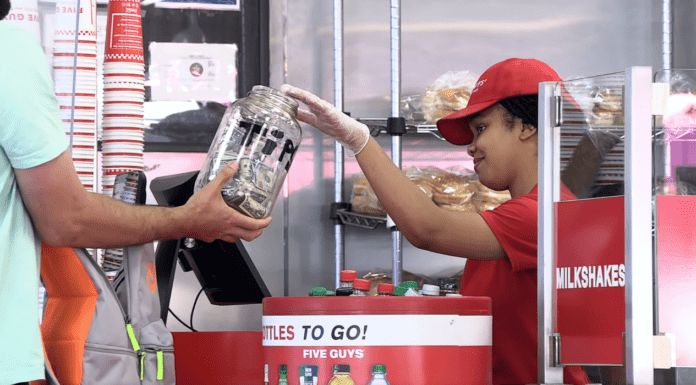

The IRS recently announced the roll-out of its Service Industry Tip Compliance Agreement, which will oversee how much waiters and waitresses make in tips across America.

The policy must first undergo an obligatory period of “public input” before the agency is able to implement it on a wide scale this summer.

In the name of “transparency,” the IRS wrote that it is seeking to “improve tip reporting compliance.”

Fox News contacted an IRS official regarding the proposal, who claimed businesses actually want the increased bureaucratic oversight.

“This is not a proposal for the auditing of servers,” the official noted.

“Yesterday’s action was a proposal for comment—not a rule—based on over a decade of feedback from restaurants and other businesses seeking the increased flexibility for their overall tax compliance on tips.”

The official also added that the agency will seek more input before they implement the rule.

“This proposal is not in effect and is intended to welcome further conversation from all interested parties before any rule is put into place,” the official said.

Of course, a closer look at the proposal suggests that the IRS plans to involve itself deeply in the regulation of minutiae.

The proposal’s features include “monitoring of employer compliance based on actual annual tip revenue and charge tip data from an employer’s point-of-sale system, and allowance for adjustments in tipping practices from year to year.”

Though the program is allegedly “voluntary,” those who comply would not be held liable to “rules that define tips as part of an employee’s pay” and would be permitted to implement policies “in accordance with the section of the tax law that requires employees to report tips to their employers.”