(Mike Maharrey, Money Metals News Service) Government regulators in India are considering easing restrictions on the inclusion of gold ETFs in the country’s pension funds. This could supercharge India’s already surging gold investment market.

India ranks as the world’s second-largest gold market behind China.

Gold-backed ETFs are currently treated as “alternative assets” in Indian pension funds. Alternative assets can’t make up more than 5 percent of the fund’s total value. The proposed rule change would eliminate that limit.

Indian pension funds collectively manage around $177 billion, and they are seeking new ways to drive returns as the pool of retirement savings expands. The total value of assets in the country’s pension system has more than tripled since the pandemic.

According to a Bloomberg report, retirement fund managers met multiple times with officials from the Pension Fund Regulatory and Development Authority. In addition to the request to lift limits on gold ETFs, managers also requested changes to rules governing real estate investment trusts and infrastructure trusts, also considered alternative assets.

According to the report, “In the last few months, managers have asked through an industry group for easier rules on the tenor and rating of securities they can buy, though the regulator hasn’t yet decided on the changes the pensions are seeking.”

Officials are reportedly considering the changes and have drafted language for the new rules.

Indians have traditionally held physical gold. They valued the yellow metal as a store of wealth, especially in poorer rural regions. Many Indians use gold jewelry not only as an adornment but to preserve their wealth.

Over the last several years, there has been a growing interest in ETF investment as the economy has grown and more people have access to investment platforms.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

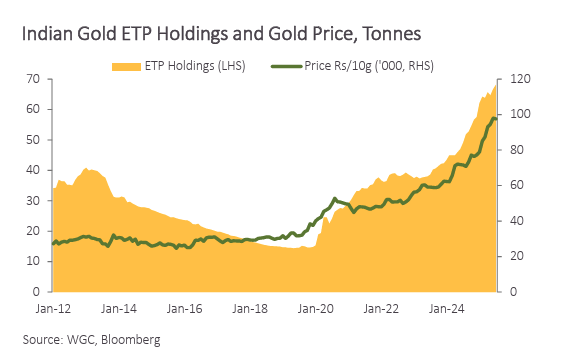

Indian ETF gold holdings have nearly doubled since 2021. As of the end of July, Indian gold ETFs reported assets under management (AUM) of ₹676 billion ($7.85 billion), a 96 percent year-on-year increase.

According to Bloomberg, the appeal of gold investment in pensions is clear.

“This year – some of India’s largest gold ETFs – such as Nippon India ETF Gold, SBI ETF Gold, and HDFC Gold ETF have logged price increases of close to 30 percent so far in 2025.”

If the new rules are approved, it will likely drive a further surge of gold into Indian gold-backed funds.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.