(Mike Maharrey, Money Metals News Service) While accounting rules are intended to foster transparency and facilitate accurate financial reporting, they can also mask the true financial state of an organization.

Today, a commonly used accounting trick could be obscuring risks in the U.S. banking system by papering over the significant devaluation of commercial bank bond portfolios.

When a company buys bonds such as U.S. Treasuries, it has the option of classifying them as “hold to maturity” (HTM). In principle, this signals an intention to hold such bonds until they mature. They are recorded on the balance sheet at their original cost. If the market price for the bonds rises or falls, unrealized losses or gains are not recorded on income statements.

If the company wants to retain the option of selling the bonds before they mature, they’re supposed to categorize them as “available-for-sale” (AFS). These are recorded on the balance sheet at their current fair value, with unrealized gains and losses reflected in the income statement.

This accounting sleight of hand enables banks to mask massive potential losses that are lurking on their balance sheets.

I’ll use a $100 bond as an example.

If the bond is available for sale (AFS), it would be recorded on the balance sheet in year one as a $100 asset. If the market value of the bond fell to 90 dollars the following year, it would be recorded at that price on the balance sheet with a corresponding $10 unrealized loss on the income statement for that year.

But if the bond is marked HTM, it would remain a $100 asset on the balance sheet in year two despite the dip in market value. The company is only required to include information about the change in fair market value in the footnotes to their financial statements, and there would be no entry on the company’s income statement for that year.

The Fed’s Books Reflected Staggering Unrealized Losses

As Treasury prices dropped and yields rose (bond prices are inversely correlated with yields) after the Federal Reserve hiked rates to battle price inflation, many banks used HTM accounting to mask the significant devaluation of their bond portfolios.

For instance, the Fed recently reported $1 trillion in unrealized losses on its security holdings last year. That was an increase from the $948.4 billion in paper losses reported in 2023.

As an article published by Yahoo Finance pointed out, this doesn’t have any practical impact on the operation of the central bank, because it will almost certainly hold its securities until they mature, meaning it will never realize these significant losses.

“These paper losses do not affect monetary policy operations and are not an issue of note given that the Fed holds its bonds to maturity.”

However, many commercial banks are in the same position, and their declining bond values could potentially impact their operation.

Accounting Tricks and the Silicon Valley Bank Failure

While a bank may initially have every intention of holding certain bonds to maturity, they have no way of knowing whether or not it may need to liquidate some or all of its portfolio to cover unforeseen operating costs.

Companies are allowed to change the accounting basis from HTM to AFS to liquidate the securities. In other words, unlike the Fed, commercial banks could potentially realize their unrealized losses. Marking bonds “hold-to-maturity” on their balance sheets masks this potentially significant risk.

Unrealized losses turning into realized losses is exactly what did in Silicon Valley Bank (SVB) back in 2023.

Things started to unravel when Silicon Valley Bank sold a large portion of its bond portfolio to raise cash… at a $1.8 billion loss. At the time, SVB CEO Greg Becke said the bank made the sale “because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients.”

The bank bought the bonds when interest rates were low. As a result, the bank’s $21 billion available-for-sale bond portfolio was not yielding above cash burn. Meanwhile, rising interest rates caused the value of the portfolio to fall significantly. The plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet and caused worried depositors to pull funds out of the bank in what amounted to a good old-fashioned bank run.

Signature Bank and First Republic Bank failed for similar reasons. The Federal Reserve was forced to set up a bank bailout program in order to protect other banks from a similar fate.

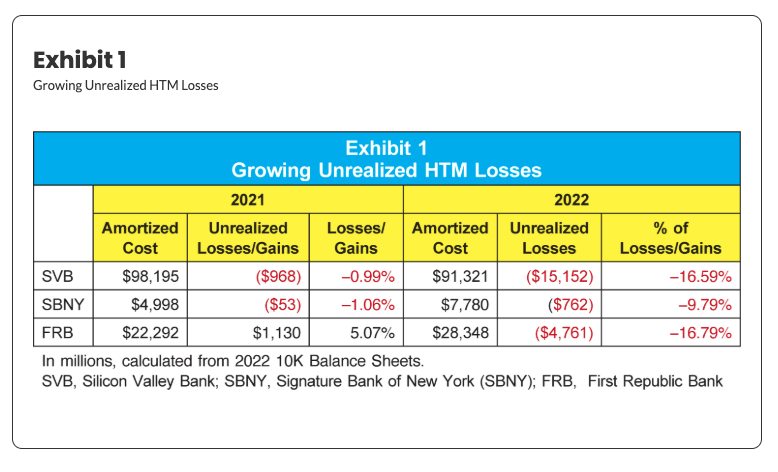

Before it decided to sell its devalued bonds, SVB had substantial unrealized losses on its HTM portfolio, as did Signature and First Republic. Had these unrealized losses been reported, observers might have realized the banks were in trouble earlier.

As the CPA Journal explained, “Factoring in the increases in unrealized losses from 2021 and 2022 into these entities’ income statements would have material negative effects on inferred earnings per share (EPS).”

The CPA Journal went on to assert that “shortcomings” in the HTM accounting method “may have, in hindsight, obscured the risks these banks faced in the prevailing interest rate environment.”

The Problem Hasn’t Gone Away

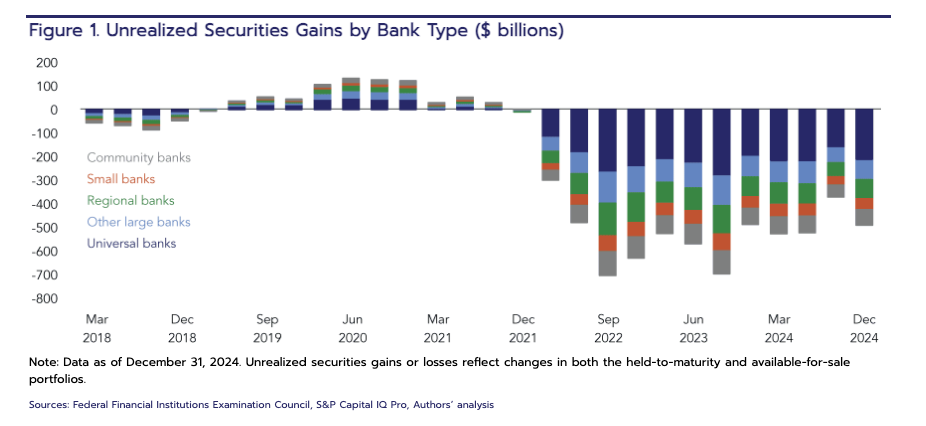

Fast-forward to today. Many banks remain burdened by significant unrealized losses. Whether they’re being accurately reflected in the accounting remains a significant question.

Unrealized losses are a ticking time bomb underneath U.S. commercial banks. As of December 31, 2024, there were roughly $482 billion in unrealized losses across both AFS and HTM bond portfolios. However, much of this is hidden on individual bank income statements because they have marked their bonds “hold-to-maturity.”

This isn’t really a problem – until it is. If banks face any kind of sudden stress, they could be forced to begin liquidating these undervalued bonds, sparking more bank failures. And as we saw in 2023, a banking crisis can happen suddenly and unexpectedly.

Florida Atlantic University finance professor Rebel Cole recently warned about this ticking time bomb.

“All it takes is one bad news story about any of these banks, and we could have another banking crisis like we had in March of 2023. I’m amazed we haven’t had one since then.”

To put it bluntly, HTM facilitates financial window dressing and deception. That means the U.S. banking system may be facing far more risk than most people realize.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.